A group of researchers from Germany’s Forschungszentrum Jülich and U.S. thin-film solar module manufacturer First Solar has developed an economic model to operate a PV installation as a permanent asset with maintenance being performed at regular intervals.

The model was presented in the paper The value of stability in photovoltaics, which was recently published in Joule, where the research group stressed that the renewable energy industry is currently considering a 25-year lifetime as a benchmark for solar power plant operation, noting this parameter is strictly related to performance warranties set by manufactures and political decisions that have supported these claims.

“I wouldn’t say that solar module stability is more important than efficiency, as you need both,” the research corresponding author, Ian Marius Peters, told pv magazine. “In research, however, I see a much stronger focus on efficiency and, by now, journals also ask for [the] proven stability of these cells, but I still don’t see record stabilities being highlighted in the same way.” According to him, the emphasis that is today being given only to panel efficiencies should raise concerns in the industry, as the importance of stability for the commercial success of a solar product is not yet fully appreciated, especially the implications for the sustainability of the devices.

The scientists cited the U.S. solar company SunPower as a provider that currently offers a 40-year performance warranty for some of its products, based on low degradation rates that make them suitable for achieving over 70% of the initial yield after four decades. “A PV system owner has no reason to retire a PV system while it operates safely and generates a profit,” the scientists stated. “From this perspective, there is no reason why a PV power plant should be retired at all.”

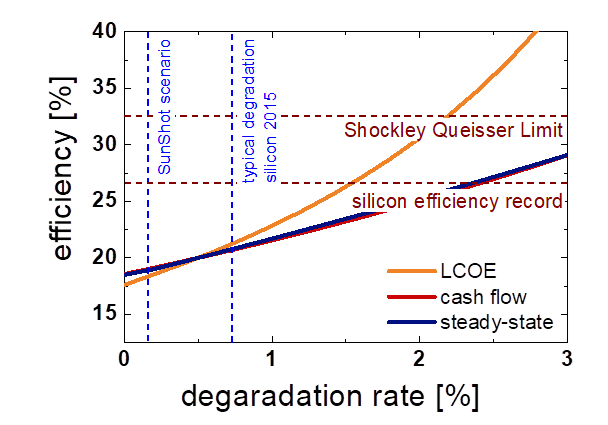

Three economic models were initially considered by the research team: the levelized cost of energy (LCOE), which balances yield and cost of a PV system over its lifetime; the discounted cash flow analysis, which estimates the value of an investment based on its expected future cash flows; and the steady-state model, which considers that an energy asset is run indefinitely and comprises all income and expenses. “The change in mindset that continuous operation requires is a transition from focusing on recovering an initial investment, to maximizing profit by managing degrading components,” the researchers said, referring to the third approach.

The trade-off between degradation rate and efficiency was analyzed through techno-economic calculations in a utility scale PV project located in Arizona and a rooftop installation in Germany in which all modules are replaced by more efficient panels, a move that, due to the increased capacity, imposes an increase in the number of inverters and cables. “Considering these effects, we numerically adjust efficiency until the economic performance is the same as that of the initial installation,” the academics specified. “Results depend on the choice of system cost parameters but are independent of specific yield.”

The U.S.-German team found that the LCOE approach is the most sensitive to trade-offs between degradation rate and efficiency, while the cash flow and steady-state models were shown to be slightly less sensitive. Those two methods, on the other hand, treated power maintenance in the same way. “In the spirit of transitioning to a long-term perspective, power maintenance is now not considered as a single event any more but as a repeating event with a fixed maintenance period,” it further explained, noting that the steady-state model allows, in principle, that more money can be spent on power maintenance compared to the other two approaches. “In steady-state thinking, there is no particular optimum maintenance time, as there is when the system lifetime is fixed.”

With the proposed steady-state mindset, the power maintenance of a solar facility should be implemented each time damage or technical issues arise. In order to help PV asset owners decide when to perform maintenance activities, the scientists introduced the concept of the minimum economically useful lifetime (MEL), which defines when replacing the solar panels becomes more profitable than not replacing them, specifying that higher degradation rates reduce MEL values and higher discount rates increase the value. “Price reductions of PV modules reduce the MEL,” they added. “If modules get cheaper, replacing old modules becomes economically attractive earlier.”

The academics assumed a learning rate for solar module prices of only 2.5% for the next three decades and found that the ideal lifetime of a PV asset may increase to 35 years by 2050. “When estimating the economically ideal lifetime, we find that a module with 0.5% annual degradation should be operated for 35 years and a module with 0.2% degradation for 50 years.”

It is important to note that one of the paper's authors is a researcher who works for First Solar, which in April announced its cadmium telluride thin-film modules reached what the company claims to be the lowest module degradation rate in the industry. “Realizing the SunShot target of 0.2% annual degradation further increases the ideal lifetime to 50 years,” the scientists said, referring to the target set for solar module degradation yield by the U.S. government through the Sunshot initiative.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I this a topic of scientific research or more an engineering topic? This kind of reminds me the Economics of Industrial Engineering classes…

What factors determine whether a P/V Plant should be used after 25 years of installation?

1. Module suppliers give a warranty that the modules will have 80% of the starting efficiency after 25 years of service.

2. Thus, a 500 MWp installation will still generate 400 MWp after 25 years of installation. This is of course for modules made with p-type wafers with B doping which have been showing a degradation of about 0.4% per year due to the B-O complexes formed slowly acting as traps. However, what is the degradation for modules made with n-type wafers or Ga doped p- type wafers? Obviously, absence of B means that there is no degradation. Also, n-type modules have better efficiencies to start with.

3. What is the warranty given by suppliers of n-type modules? It would be more than 25 years. What then is the life expectancy of such PV plants?

4. Why a 400 MWp PV plant should be retired when it is of nil cost because of depreciation?

5. If there is alternate space for a new 500 MWp plant after 25 years, then there is no sense in retiring the old plant. Only if the land is of premium value and no alternate site is available, then the question of retiring the old unit and replacing it with a new module based plant can be considered.

6. In such a case, the new investment has to be justified for an incremental capacity addition of 100 MWp.

7. This has to be determined based on the cost per W of module and the unit cost of electricity at that time.

8. This means a justification has to be made for an investment of 500 MWp plant but generating an incremental 100 MWp. This may be difficult.

9. If at that time, the efficiency of the modules used is drastically higher than the present value, then for the same area, more energy can be generated. In such a situation, the cost of land also will come to picture. It is difficult to predict these at present.

10. Overall, the life expectancy for a PV Plant can be much more than 25 years and need not be retired.