There was a slight distortion in the module market in early 2023 because of a recent patent infringement lawsuit in the Regional Court of Düsseldorf, brought by Hanwha Q Cells against Trina Solar. Hanwha and Trina announced, on Friday, Feb. 17, 2023, they had reached a settlement in the dispute enabling “both parties to use each other’s solar patents and respectively drop all pending cases between the two companies,” as reported by pv magazine.

With this settlement, the disruption has been resolved and Trina continues to pull out all the stops to ramp up its production of TOPCon [tunnel-oxide passivated contact] products.

[Editor's note: This article has been amended to reflect the Feb 17. settlement of the case between Hanwha Q Cells and Trina Solar and the resolution to any supply implications.]New year expectations

Stefan Kutscher, managing director of the wholesaler and installation company SK Solar, believes that recent amendments to Germany’s Renewable Energy Act do not go far enough to resolve challenges present in the German PV market. He still views the time-consuming procedure for getting required plant permits as a major obstacle, although the time pressure has been eased somewhat. Instead of radically simplifying overly complex regulations, the authorities have in some cases introduced new ambiguity and formulations that leave a great deal of room for interpretation. The best example of this is the sales tax adjustment for small private systems. For months, the industry has been puzzling over how the new regulation in the annual tax law is meant to be implemented. At least there has now been an initial attempt at clarification from Germany’s finance ministry.

Efforts to find real solutions to problems of grid access, connection conditions, and certification of medium-to-large systems have been in vain so far, says Michael Reck, project developer at GME clean power AG. Developers still face major hurdles that can hinder the rapid implementation of planned projects and call into question their economic viability. Nevertheless, he thinks that improved availability of the required components, and falling module prices, will leave enough profitable projects in the pipeline for the next few years. Expected average construction costs would, he believes, ensure remuneration rates between €0.08 ($0.09**)/kWh and €0.10/kWh in most cases – sufficient to give investors an adequate return over the calculated 20- to 25-year plant service life. A moderate cap on remuneration, even for unsubsidized plants, or the threat of the government skimming additional revenues, should therefore do little to diminish the attractiveness of larger solar projects.

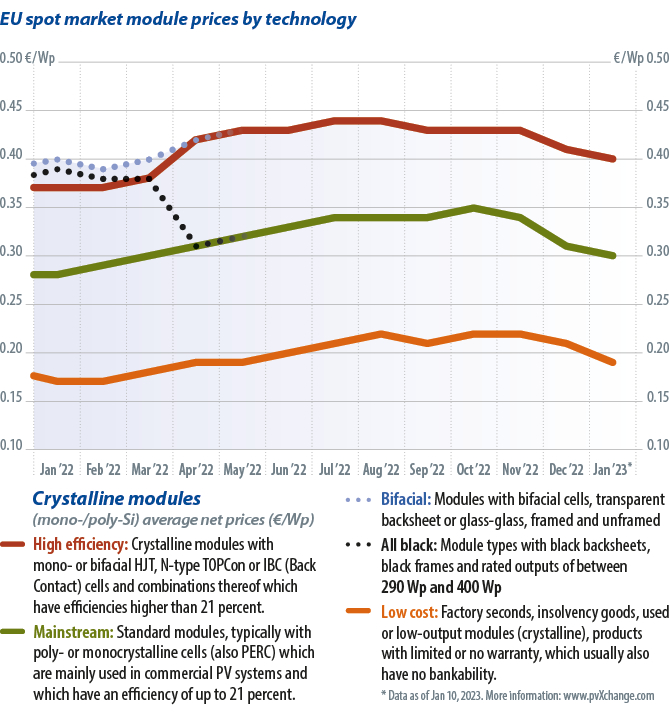

Overview of price points by technology in January 2023, as of Jan. 10, with changes over the previous month.

| Crystalline module type | €/Wp | Trend since Dec. 2022 | Trend since Jan. 2022 | Description |

| High efficiency | 0.40 | -2.4% | 0% | 340 Wp+ PERC, HJT, n-type, back-contact, or combinations thereof |

| Mainstream | 0.30 | -3.2% | +3.4% | 275-335 Wp, typically 60-cell, standard aluminum frame, white backsheet |

| Low cost | 0.19 | -9.5% | +11.8% | Factory seconds, insolvency goods, used or low-output modules, and products with limited or no warranty |

Reck’s colleague Gerald Wotruba, Chief Sales Officer at GME clean power, speculates that the elimination of a verification requirement at the module level will increase the potential for re-powering existing projects with below-average energy yields. As a result, sites that are already developed could be better utilized and the output of existing plants could be increased within certain limits. He sees an ongoing string-inverter shortage, which will probably only slowly resolve itself in the second half of the year. In addition, there is a shortage of skilled workers, particularly evident among nationally active engineering, procurement, and construction services companies.

Installation crews traveling all over Germany, or even Europe, are now hard to find. What little installation-team capacity is available has to be locked in early and for an extended period.

Florian Meyer-Delpho, CEO of Installion GmbH, agrees that there is an urgent need to remedy the labor situation. Meyer-Delpho is part of a delegation of energy industry representatives that recently informed German Chancellor Olaf Scholz of the acute need for skilled workers as part of the national, pan-industrial Alliance for Transformation consultative group established by the government. The group, in cooperation with ministries and business associations, aims to develop solutions to the acute shortage of skilled workers, among other issues.

The problem has at least been recognized. The next step is to provide sufficient budget and suitable infrastructure and find training providers. What worked well in Germany recently, in the acute emergency situation with vaccination centers or refugee reception centers, could certainly also be organized to tackle the shortage of installers if the political will is there.

Overall, the market outlook is positive. Demand for small systems in particular will continue for quite some time and will offer work for installers. The days of panic buying and consumers blindly accepting quotations, as we saw last year, are probably over.

As far as installers are concerned, more competition will revive business and make it more transparent, and system prices will stabilize. But industry representatives also see growth in medium-to-large PV projects, especially in non-subsidized systems. With forward-looking component purchasing, sound costing, and quality-conscious implementation, investors can look forward to rising returns and commercial businesses to a lasting reduction in energy costs.

**Currency translation correct on 17/02/23.

About the author: Martin Schachinger has a degree in electrical engineering and has been active in the field of photovoltaics and renewables for more than 20 years. In 2004, he started his own business and founded the internationally known online trading platform pvXchange.com, where wholesalers, installers and service companies can purchase solar panels, standard components and inverters that are no longer manufactured but are urgently needed to repair defective PV plants.

About the author: Martin Schachinger has a degree in electrical engineering and has been active in the field of photovoltaics and renewables for more than 20 years. In 2004, he started his own business and founded the internationally known online trading platform pvXchange.com, where wholesalers, installers and service companies can purchase solar panels, standard components and inverters that are no longer manufactured but are urgently needed to repair defective PV plants.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.