In California, which represents half of the United States residential solar market, the third iteration of net energy metering (NEM) rules has reduced the payments made for electricity fed into the grid from new residential solar arrays by 75%, drastically changing return-on-investment calculations. The “NEM 3.0” rules took effect on April 15, 2023, for new solar customers, with existing solar arrays grandfathered into previous regimes.

While NEM 3.0 boosted the proposition for pairing batteries with solar, entry-level capital costs remain high. With interest rates rising over the past year, due to the U.S. Federal Reserve raising its target range for the federal funds rate, loans to help purchase and install solar panels have risen from historic lows to more than 5.5% in official rates – and to 8% and beyond from finance companies.

With loans expensive and incentives removed, Californian residential PV has been devastated. By late 2023, rooftop solar installations had fallen 80%, driving more than 17,000 layoffs – 22% of the industry. In February 2024, publicly traded installer Sunworks filed for bankruptcy following a 29.5% decline in quarterly revenues, year over year, for the third quarter of 2023, led by a 44.5% decline in residential PV. Sunrun posted a loss of more than $1 billion in its most recent quarter.

With loans expensive and incentives removed, Californian residential PV has been devastated. By late 2023, rooftop solar installations had fallen 80%, driving more than 17,000 layoffs – 22% of the industry. In February 2024, publicly traded installer Sunworks filed for bankruptcy following a 29.5% decline in quarterly revenues, year over year, for the third quarter of 2023, led by a 44.5% decline in residential PV. Sunrun posted a loss of more than $1 billion in its most recent quarter.

Deep Patel, founder and chief executive officer of California-based Go Green Solar, is chapter leader for the California Solar & Storage Association (CALSSA) in Los Angeles. He said NEM 3.0’s overnight change hasn’t just hurt solar uptake, it has damaged wider interest in PV, with online forums such as social media platform Reddit’s solar subreddit seeing plenty of complaints and questions.

“First of all, just on Reddit, a lot of people are confused [about whether solar] now makes sense or not,” said Patel. “There’s a whole consumer perception thing going on. Those people say, ‘If I didn’t get NEM 2.0, I’m not even going to look at NEM 3.0 rules.’ Or they say, ‘Hey, a battery can help me,’ but then they get sticker shock: A typical [solar] system runs you $20,000, but adding a battery on top runs you $40,000.”

“The American consumer finances everything and they just don’t have the capital to make big purchases. So even when those battery systems make sense, it might’ve been fine if interest rates were still at 2% but borrowing costs have risen. So they’re punting the decision down to when financing rates are lower. That’s causing stress with distributors and installers and so on.”

While the solar industry can somewhat cheerfully dub the dizzying highs and terrifying lows of the cyclical industry as all part of the “solar coaster,” the reality is grim when it comes to establishing a straightforward industry where people can rely on long-term warranties and support after a five-figure outlay that affects the value and appearance of their home.

Silver lining

The NEM 3.0 rules may eventually benefit key suppliers of residential power electronics – and also module-level power electronics (MLPE). The new rules in California incentivize both home storage and more advanced systems beyond earning feed-in tariffs, including solar self-consumption, energy storage, electric vehicle charging, and more. Achieving those features requires more advanced MLPE products from makers such as Enphase, SolarEdge, and others. The short-term downturn is particularly tough, though, given the state’s oversized contribution to the United States residential market.

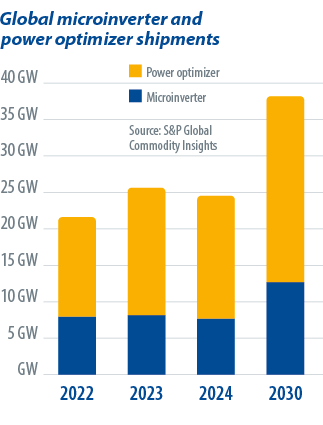

Liam Coman, solar analyst at S&P Global Commodity Insights, told pv magazine that the situation is tough but not a disaster. “S&P Global predicts MLPE shipments to be down by 4% in 2024 but to grow long-term, out to 2030,” he said.

Data from the company show that global microinverter and power optimizer shipments grew 19% in 2023, to a record high of 26 GW, as non-United States geographies held up well.

While a drop from record highs isn’t inherently disastrous, the industry’s growth-dependent model is the problem for companies heavily invested in United States residential solar. Companies rely on increasing quarterly sales, leaving them vulnerable to overstaffing and excess inventory during downturns.

“High inventory levels and a slowdown in residential demand, particularly in California following the introduction of NEM 3.0, has had a twin negative impact on MLPE suppliers in the US since the second half of 2023,” said Coman.

MLPE woes

Two of the United States’ largest solar MLPE suppliers, Enphase Energy – based in Fremont, California, and SolarEdge, headquartered in Herzliya, Israel – heavily target the residential market with advanced inverter and optimizer solutions. Both supply installers and companies, including Sunrun, leaving them exposed to the current United States residential downturn.

Although other markets show better results, SolarEdge said it would cut 900 jobs – 16% of its workforce – while Enphase cut 350 roles, or 10% of its staff and said it would cease operations at its contract manufacturing locations in Timisoara, Romania, and in Wisconsin, in a blow to manufacturing.

Financing woes

Sophie Karp, senior analyst for electric utilities, power, and renewable energy at KeyBanc Capital Markets, agreed with that assessment. “We believe that once channel inventory levels normalize, Enphase and SolarEdge should both grow at a rate similar to the overall growth rate in mature markets,” Karp said. “However, we do not expect this normalization to become apparent until mid-2024 at the earliest.”

Karp also pointed out that the issues being experienced by the segment are not indicative of wider problems in solar.

“I don’t believe the issue with Enphase and SolarEdge is indicative of the performance of the solar industry as a whole,” she said. “Both cater heavily to the residential solar market, a niche subset of the solar industry which experienced a “perfect storm” of adverse regulatory outcome and rapidly rising interest rates in a relatively short period of time. I believe that in the medium- to long-run, residential solar with storage will continue to present an attractive value proposition for homeowners in the US.”

Biju Perincheril, an analyst at trading firm Susquehanna, agreed, noting that issues are improving outside California to an extent.

“Recent permit data appear to show non-California markets are stabilizing,” said Perincheril. “This is consistent with recent commentary from Enphase. Of course, the California recovery is still a wildcard.” The analyst said the latter half of 2024 should see a recovery but it may not be equally weighted. “We think the recovery for SolarEdge could be slightly behind Enphase and, therefore, [we are] modelling a larger year-on-year revenue decline for SolarEdge this year.”

Supplies squeezed

SolarEdge appears to be facing more consistent pressure than Enphase, from analysts such as Perincheril and on the stock market itself.

A November 2023 industry note from Phil Shen, managing director of Roth Capital Partners, said that an installer in the United States was shifting from serving 50% Enphase inverters and 50% SolarEdge inverters, to an 80% Enphase, 10% SolarEdge, 10% Tesla split. The quoted reason: “When we asked about why the move away from SEDG [SolarEdge], he shared that the higher failure rates have been a challenge.”

A November 2023 industry note from Phil Shen, managing director of Roth Capital Partners, said that an installer in the United States was shifting from serving 50% Enphase inverters and 50% SolarEdge inverters, to an 80% Enphase, 10% SolarEdge, 10% Tesla split. The quoted reason: “When we asked about why the move away from SEDG [SolarEdge], he shared that the higher failure rates have been a challenge.”

Those reliability concerns continue to pop up in reports and online. On forums including Reddit, Go Green Solar’s Patel is one of many active participants, with the company founder freely providing advice for interested people and answering questions on topics such as “Need advice on batteries?” or “Best value inverter?” as well as about panel and inverter makers, including SolarEdge.

Patel, when asked about his experience with the Israeli company, said his business, which has been active in the industry since 2006, had gradually transitioned away from SolarEdge, starting around four to five years ago.

“We used to sell a lot of SolarEdge … but SolarEdge for us started slipping in terms of customer support, quality, and turnaround times,” said Patel. “Lead times got very long at one point during the pandemic. The downside with SolarEdge is that when the inverter doesn’t work, the whole system is down, so that wasn’t good for customers and we haven’t really been back to SolarEdge again.

“The value proposition SolarEdge offers [via attractive pricing] isn’t there for us. You also have other inverter guys nipping at the heels – you have Sol-Ark now, and GoodWe now has a residential string inverter with four MPPT [maximum power point tracking] trackers in the US, which is great. Even Tesla is coming on strong, no longer just going direct to customers but letting installers sell it for them.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.