From pv magazine Brazil

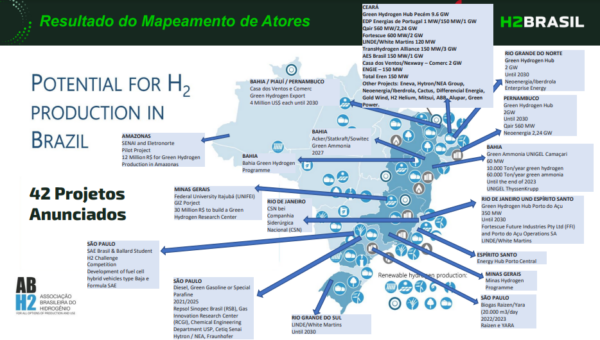

A mapping conducted by H2 Brazil, a project resulting from a partnership between the German Agency for International Cooperation (GIZ) and the Brazilian Ministry of Mines and Energy, has identified at least 42 green hydrogen production projects in the country of different sizes and stages of development.

H2 Brazil, which started in 2021 and will run until the end of 2023, mapped more than 800 companies and institutions in 12 sectors of the green hydrogen value chain in five Brazilian regions.

According to H2 Brazil coordinator José Zloccowick, an interactive tool will be made available for a detailed consultation of the projects and players in each state. The results of the mapping were presented at the Intersolar Summit Nordeste last week, where green hydrogen was one of the main topics.

The study identified green hydrogen hubs in port regions as one of the main business models for developing green hydrogen in Brazil. These hubs concentrate all the demand from the port industrial complexes in one place and can also meet the export demand. For transportation, the production of green ammonia is one of the main options.

Most green hydrogen hubs are located in ports in the northeast of the country, where most of the country’s solar capacity is also installed.

Popular content

The production of green hydrogen is seen as a way to tap Brazil's enormous potential for renewable generation. Just from projects under development, there are 99 GW of solar energy and 25 GW of wind energy capacity. Electricity corresponds to 73% of the production cost of green hydrogen.

In the last federal government auction in which the sources were contracted, held in October 2022, with supply starting in 2027, wind and solar were negotiated for BRL 175 ($34.72)/MWh and BRL 171/MWh, respectively. In the wholesale market, which serves PPAs and self-production for large consumers, the incentivized energy (which also includes small hydroelectric plants) is being negotiated at BRL 113/MWh for contracts with supply starting in 2024.

For the green hydrogen produced in Brazil to become competitive, the price level for renewable energy in the country should decrease to between $10/MWh and $30/MWh (BRL 149/MWh), according to estimates presented at the Intersolar Summit Nordeste.

Although the level of competitiveness is still far from the auction prices — and even more so from the price considered adequate to remunerate the investment of solar energy generators — the cost of transportation and storage will also be a differential for the production and commercialization of green hydrogen.

Moreover, the geographical location of the ports in the northeast of the country and the presence of industrial consumers, which could make joint investments in infrastructure, can be important in giving Brazil the edge in the global green hydrogen race.

Image: H2 Brasil

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.