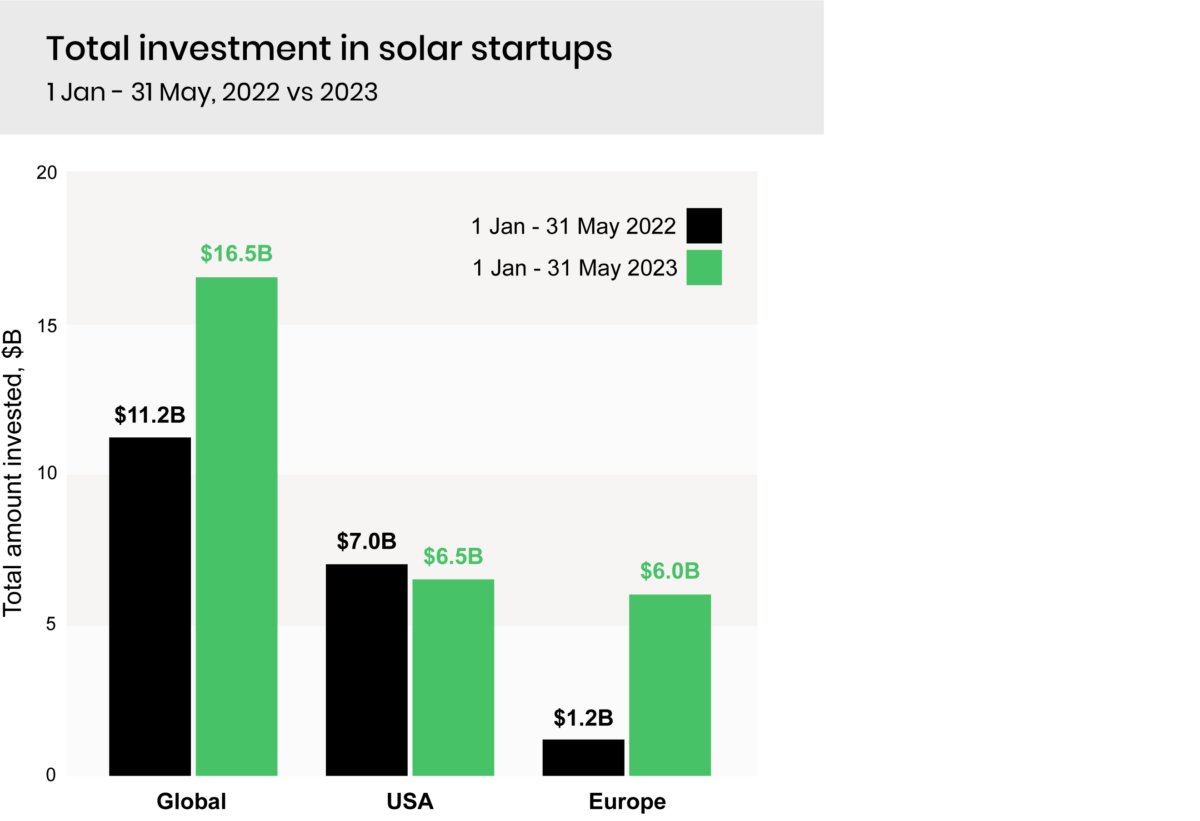

Innovation in European solar tech is booming, with $6 billion raised in just the first five months of 2023. According to data compiled by electronics distributor Avent Abacus, total investment in European solar startups is up 398%, from just $1.2 billion raised in the same period a year earlier.

Avnet Abacus, which acts as a consultant to engineers when designing new products, analyzed Crunchbase data for companies listed under solar and other renewable energy categories to provide insight on the level of funding going into those sectors. It found that investment is up 47% globally, with funding of the sector down 7% in the United States so far this year.

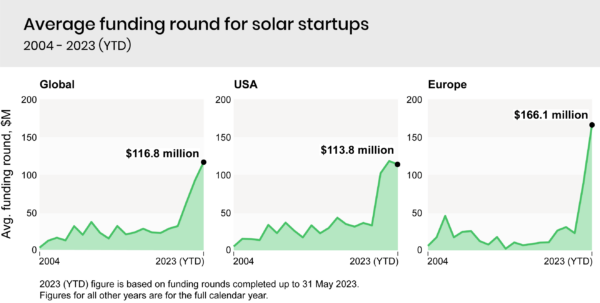

Despite continued uncertainty in the venture capital market, average investment in European solar is at an all-time high at $166.1 million, compared with an average of $88.3 million in 2022 and $22.9 million in 2021. The average amount of venture capital flowing into European solar so far this year eclipses the sector’s global average of $116.8 million and the US average of $113.8 million.

“Even though solar technology is relatively mature, there is still a lot of room for growth and innovation. There is growing demand around the world, and government policies and incentives continue to support investment in this area, with engineers continually seeking new ways to make solar more efficient,” said Sara Ghaemi, Avnet Abacus’s technical director.

Popular content

According to Avnet Abacus, there are almost six times more startups focused on solar than wind energy in Europe, and it’s the consumer market that’s driving the expansion. Indeed, rooftop installations accounted for 66% of the EU’s solar capacity at the end of 2022, according to SolarPower Europe. Amid a slower-than-expected increase in large-scale solar, the total share for rooftop PV is expected to decrease only slightly to 59% by 2026.

Driven by rising electricity prices, interest in solar has grown exponentially. In Europe, specifically, a growing number of companies serving the residential sector and, in some cases, the commercial solar segment, have raised capital from a mix of investor types, particularly for lighter, more aesthetically pleasing, or easier-to-install rooftop PV designs.

In addition, the complexity of solutions has increased over the years, with startups now offering services and a software layer on top of that. One such example is Hamburg-based 1Komma5°, which last week raised €430 million in a Series B round, helping it to become Germany's latest unicorn, with a value of more than €1 billion ($1.09 billion) in just 23 months of existence.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.