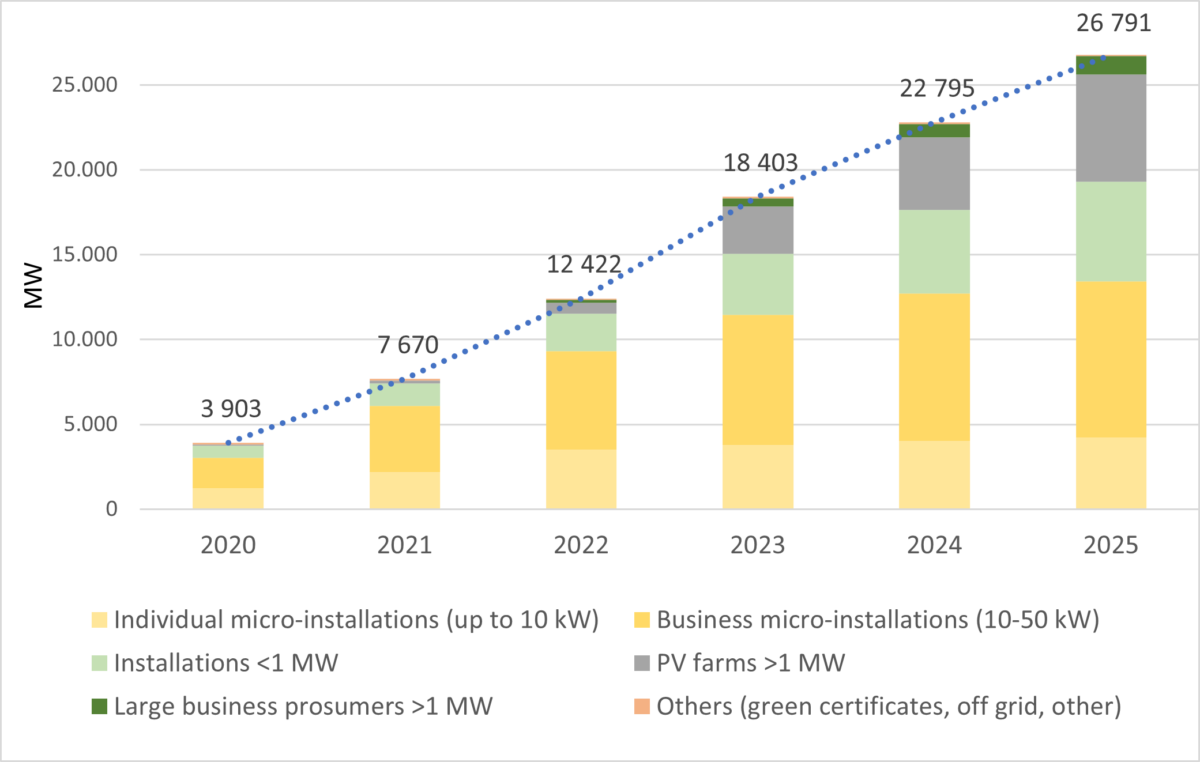

Poland's installed PV capacity could more than double to 26,791 MW by the end of 2025, based on data from the Polish research institute IEO. Its latest report suggests that this year, the nation will add approximately 5,981 MW, followed by 4,392 MW in 2024 and 3,996 MW in 2025.

“The most remarkable change and growth are expected in the segment of large-scale farms and among commercial prosumers,” IEO researcher Agata Krzyżanowska told pv magazine. “Temporarily problems with full access to the grid and very high electricity prices for commercial consumers will facilitate faster development of business prosumers' investments in small installations up to 50 kW or bigger under the net billing scheme, focusing on green power auto consumption.”

The IEO said renewable energy auctions in the 2016-21 period were a success and a stimulus for the development of mostly large PV projects. They provided support for 6.8 GW of solar power and 5.3 GW for wind power.

“However, in the years 2021-22, a decreased interest in the auction support instrument could be observed, since the PV technology is considered as matured and energy prices grew during Russia’s gas blackmail and the power crisis,” Krzyżanowska said. “Investors decided to build farms on fully commercial principles, through the energy sale on the market, including [power purchase agreements].”

In the last auction of 2021, investors offered only a portion of the capacity, leaving a significant portion for PPA contracts. With the introduction of a price cap for PV and wind in 2022 and the decline in power prices in 2023, the upcoming autumn auction is expected to be more attractive. However, it is expected that the auction volume will be diversified in the future.

During the 2016-22 period, energy prices contracted in the auction system for PV farms decreased by 18%, while average selling prices of electric power on the competitive market in Poland increased by 68%. In contrast, solar module prices experienced a significant increase in 2021 and 2022.

“According to surveys conducted by IEO among PV market participants, in 2021, PV module prices in Poland increased by 7%, and in 2022 – by 12% and the inflation is still over 10%,” said Krzyżanowska.

Krzyżanowska said that developers of PV projects are also dealing with serious grid connection issues in Poland. However, these constraints do not represent a true barrier to solar deployment.

“The constraints caused by more often rejections since 2022 of applications for grid connection are expected not to slow down the PV industry's development pace until at least 2025,” she said. “There is still a 6 GW pipeline of projects with grid connection permits, and grid operators plan to expand grid connection capacities for hosting PV in the coming years.”

Krzyżanowska mentioned that the Polish government will offer financial incentives for grid modernization through the National Reconstruction Plan and the EU Cohesion Fund. System operators are also expected to adopt a new approach that considers economic needs and embraces technical solutions like cable pooling, hybrid installations, direct lines, and the use of batteries and other energy storage methods.

“Such measures were approved in June by Polish Parliament,” she explained. “Also, the ongoing RES auction system will remain open until 2027, which will undoubtedly contribute to the mobilization of financial institutions and further growth of large-scale PV investments in the Vistula River country.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

A big problem is the infrastructure in Poland, which is not adapted to such a rapidly growing number of solar energy producers.