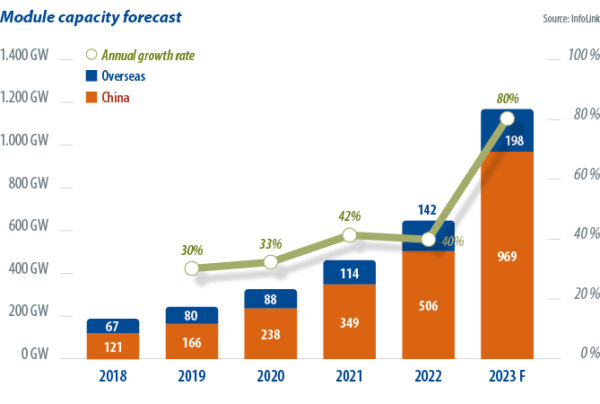

This year, solar manufacturers have increased vertical integration and production capacity, and the global industry has attracted new entrants, buoyed by the market outlook and advancing technology. Infolink data shows annual module production capacity grew at an average of 30% to 40% from 2018 to 2022. That rate is expected to double this year, to an unprecedented 80%.

Module oversupply

Technology and competition are driving expansion, prompting legacy manufacturers to modify production lines. For instance, passivated emitter rear contact (PERC) lines must have nine-busbar (BB) to 11 BB stringer machines upgraded to 16 BB devices, and have laminating temperatures controlled, to produce tunnel oxide passivated contact (TOPCon) modules. For heterojunction (HJT) production, busbarless cell interconnection requires dispenser equipment.

InfoLink expects that more than a terawatt of annual module production capacity will be reached this year. Inventory has already started stockpiling, driving buyers to wait. Quarterly module prices have fallen below manufacturer quotes and some solar companies have clawed back their overseas stock at the end of June, as underselling continued into early August.

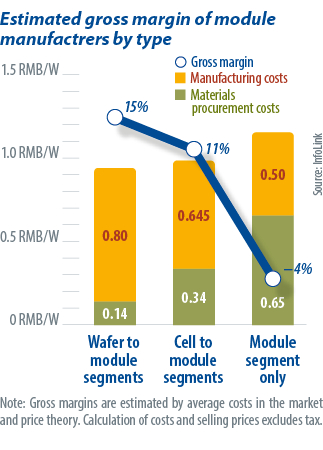

Module-only manufacturers are thought to have experienced negative gross margins thanks to solar cell costs, and risk management strategy will be critical to survive in a competitive market.

Module-only manufacturers are thought to have experienced negative gross margins thanks to solar cell costs, and risk management strategy will be critical to survive in a competitive market.

Solar manufacturers with just a single business model will need a risk strategy as competition increases. SMEs could take advantage of flat organizational structures to show flexibility in equipment use and at a managerial decision-making level.

Standing out

Manufacturers can utilize the production of medium and low-efficiency products to control costs while also accepting special-specification or, unbranded, original equipment manufacturer (OEM) orders to manage monthly output. This allows for efficient capacity utilization and the maintenance of a stable utilization rate, which can be lowered to regulate inventory level. Based on historical expense data, the average gross margin level for OEM and dual-channel distribution may be lower than for direct sales. During periods of high market volatility, however, maintaining conservative gross margins can provide flexibility in continuing minimum operational conditions.

As the industry moves toward competitive convergence on identical or similar module technology, product differentiation strategies will help SMEs by increasing module diversity and market opportunities to create demand. Using differentiated products, such as flexible thin-film and small-format specialty modules – to expand product ranges and cater to different applications based on customer need – can foster the development of potential markets.

In addition, diversification of suppliers and customers can reduce reliance on certain clients, suppliers, and markets. As regional risks have been steadily increasing in recent years, particularly within the volatile environment of the solar industry, SMEs could become vulnerable to market fluctuation. Expansion overseas and developing diversified products will help spread risk and build solid customer relationships to ensure long-term business cooperation.

Vertical expansion

Manufacturers can also adopt supply chain integration strategies to manage the manufacturing capability of their upstream and downstream segments. Such vertical integration enhances cost management capability and retains transaction space by having in-house production capacity of other segments, thereby maintaining flexibility and mitigating risk during periods of greater volatility. Taking the example of cell manufacturers expanding into module production, if the cell inventory cycle extends, in-house module capacity can consume a portion of the cell output, ensuring better risk control.

The significance of vertical integration is growing for manufacturers. This involves expanding into project development, system design, integrated products, and after-sales operation and maintenance services. Such an approach can effectively address product usage and consumption issues. Moreover, manufacturers can gain a better grasp of real-time market information downstream through collaboration with clients.

The S word

With sustainability requirements tightening – in the form of environmental, social, and corporate governance (ESG) reporting guidelines set to become obligatory in the European Union and with new standards planned in the United States and internationally – PV manufacturers powered by non-renewable energy, for example, will face greater risk. At the same time, this will provide all players with more opportunities for differentiation. Manufacturers can seize this chance.

Long-term oversupply has become a key issue in the PV industry. Given the resource and financial constraints faced by SMEs, companies should deploy a combination of strategies to establish presence in a market that is marked by a convergence of competition. This includes exploring potential markets via differentiated products and adopting strategies such as OEM and dual-channel distribution to mitigate operational risk. With sustainability becoming a corporate imperative, manufacturers should also be prepared for future policy dynamics in regional markets, thereby seizing businesses opportunities. Adapting risk strategies will be a crucial factor for the survival of manufacturers with a single business model.

About the author: Amy Fang is an InfoLink analyst who focuses on the solar cell and module segment of the PV supply chain, working across price trend forecasting and production data.

About the author: Amy Fang is an InfoLink analyst who focuses on the solar cell and module segment of the PV supply chain, working across price trend forecasting and production data.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.