Two academics from the Swiss university ETH Zurich – Bjarne Steffen and Florian Egli – have told pv magazine that after conducting research with a consortium of other solar PV experts, their data shows India’s risk premiums for solar PV projects remains “stubbornly high.”

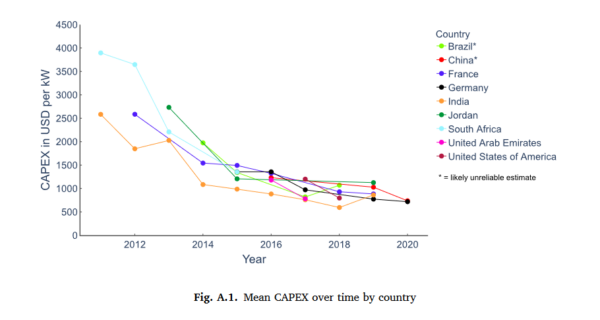

Steffen, an assistant professor of climate finance and policy, said that through the course of the study, published recently in the academic journal Energy Policy, their analysis reveals that for almost all the nine countries analyzed the cost of capital (CoC) has decreased over the last decade.

Risk premiums that investors demand on top of baseline interest rates were “significantly reduced,” he said, but there there are exceptions to this trend. “Stubbornly high CoC rates” remain in India, Steffen said, as shown in their analysis. Asked what impact this would have on the South Asian country, and why the risk premiums are elevated, Egli said the researchers did not investigate these issues for the study. “[We] can only say that the solar PV risk premium stayed relatively high in India contrary to other markets [and] this has a negative effect on the cost competitiveness of solar PV,” he said.

According to the study, there were a total of 573 solar PV projects completed in India from 2011-2020, amounting to 30.4 GW. “The results show that the CoC declines are mainly due to lower solar PV risk premiums whereas base rates have stayed roughly constant,” the paper stated. “Risk premiums have declined substantially in all countries but India.”

Florian Egli, Nikolai Orgland, Michael Taylor, Tobias Schmidt, Bjarne Steffen. Energy Policy.

India is the third biggest solar PV market in the world. It recorded 62 MW of solar PV installed capacity at the end of 2022, according to the most recent data published by the International Renewable Energy Agency (IRENA), and is increasingly ambitious with its renewable energy goals. The country’s most recent National Electricity Plan stated it wanted to reach 185.6 GW solar PV installed capacity by fiscal 2026-27, reaching 364.6 GW by fiscal 2031-32. But according to a recently published report by think tank Ember Climate, India needs to increase its current annual solar capacity by 36% each year to achieve these aims.

Popular content

The researchers came to this conclusion by analyzing the realized prices of almost 4,000 solar PV auctions in a spate of countries across an almost decade-long period. The academics used the auction results to “re-engineer” the underlying CoC in projects, Steffen said. The countries selected for analysis vary in geography, investment environment and institutional setup. They are Brazil, China, France, Germany, India, Jordan, South Africa, United Arab Emirates and the US. Getting a complete picture of the CoC in China was limited due to a “lack of data”, the researchers concede in the paper. “Data is scarce because [it is] often treated as trade secret,” Steffen said.

Egli, a senior researcher and lecturer, said that as interest rates rise, the cost of capital, as a key determinant for renewable energy cost competitiveness, is becoming “more important”. What he found “surprising” through the research, though, was that financing premiums of solar PV projects over a base rate – for example returns of government bonds – has decreased to approximately 100 basis points “or less” in several countries. “There is even a possibility of a negative premium, particularly in developing and emerging economies, which may be a silver lining for the transition,” Eglis said.

The aim of the work is to provide transparency around the financial machinations of solar PV projects. “More transparency can help governments to see CoC as a policy lever and motivate them to think about what could be done to reduce CoC,” Steffen said. Egli believes that policy remains “crucial” for the determination of financing premiums, and a way for this to be achieved is to ramp up the “demand” for the publication of financing costs after the realization of auctioned projects. This would, “enhance transparency and facilitate energy system planning worldwide,” he said.

The research paper, titled “Estimating the cost of capital for solar PV projects using auctions results”, was published in Energy Policy this month. It was penned by researchers from ETH Zurich, Princeton University in New Jersey and IRENA in Germany.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.