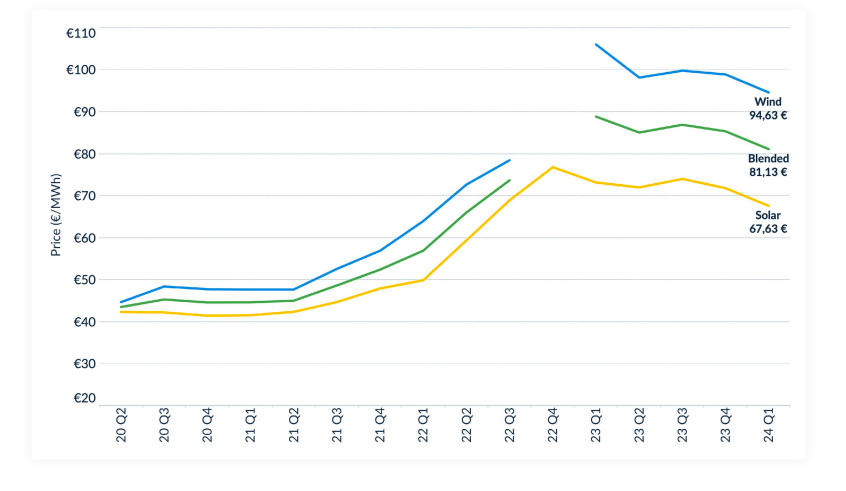

PPA prices declined 5% across Europe in the first quarter of 2024, according to a new report from LevelTen Energy. Solar PPA prices dropped 5.9%, while wind fell 4.3%.

LevelTen recorded decreases in solar PPA prices in most European countries it analyzed. It said there was a 13.2% drop in Sweden, a 12.7% decrease in Germany, and a 10.5% fall in Spain.

Plácido Ostos, director of European energy analytics at LevelTen Energy, said that lower wholesale electricity prices from Europe’s mild winter have put pressure on PPA prices to become more competitive, while a continuous decline in solar module prices due to China-based PV components also played a role.

“However, the PV supply chain situation has caused Europe’s domestic PV manufacturing industry to call for government intervention – which, if taken, could restrict the supply of cheap components and push solar PPA prices back up,” added Ostos.

Romania bucked the trend of falling PPA prices, recording an 8.6% increase in the first quarter of the year, after experiencing an 11% decrease at the end of last year.

“As an emerging PPA market, Romania is more prone to pricing turbulence,” Ostos said. “Developers and buyers there continue to calibrate what transactable PPA prices in the market look like, which brings the potential for larger quarterly pricing swings.”

Overall, Ostos said the first-quarter results suggest that Europe’s energy market “seems to finally be reaching a period of relative stability, with even a light downward trend.” But he added that the trend could reverse.

“Electricity demand will grow, and certain regulatory uncertainty remains,” Ostos explained. “For instance, we’re seeing the potential for increased government oversight on PV component supply. These factors could all impact PPA prices in the near future. The relative stability of the current moment makes now an opportune time for buyers to go to market.”

LevelTen said that it is encouraging buyers to understand their options, leverage new innovations, and act quickly.

The consultancy said it expects more corporate buyers to invest in PPAs as end-of-decade sustainability goals approach, explaining that “this growing demand, plus rising electricity demand from factors like AI usage, electrification, and green hydrogen, will collectively push up the cost of PPAs, meaning corporate buyers who move soon can avoid the impending rush for capacity.”

Earlier this week, LevelTen reported stable solar PPA prices in the US market, which it said indicates greater stability after a period of market volatility.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.