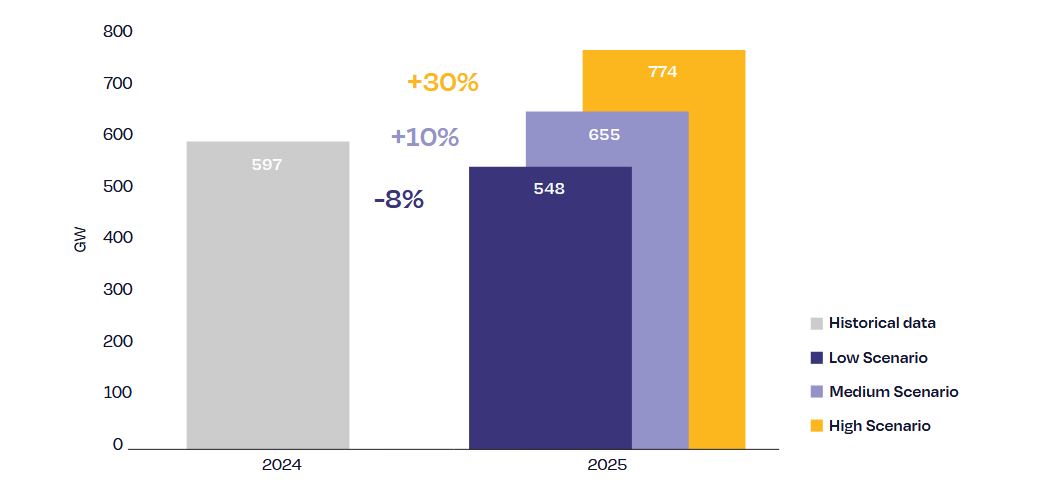

The world could install up to 655 GW of new PV capacity this year, according to the “Global Market Outlook for Solar Power 2025-2029” report, which was recently published by the SolarPower Europe industry association.

If confirmed, the result would mark 10% growth from 2024, when developers installed about 597 GW of new PV systems worldwide and global cumulative PV capacity reached 2.2 TW by the end of December.

The association outlined three scenarios for 2025: a “High Scenario” with up to 774 GW of new additions; a “Mid Scenario” with 655 GW, which the report’s authors called the most likely; and a “Low Scenario” projecting just 548 GW.

“This scenario underscores the risks posed by escalating trade conflicts, which could increase PV system costs, delay project pipelines, and deter investments in particular among more price-sensitive markets,” the report noted. “In the EU-27, the solar market could rapidly shift from stagnation to contraction in 2025, primarily if framework conditions are not swiftly and correctly implemented in the member states.”

SolarPower Europe said the “High Scenario” could materialize if low module prices persist, installation rates remain high, and the Chinese government ramps up PV deployment.

It said China will account for about 53% of new global installations in 2025, followed by the Asia-Pacific region excluding China at 16%, the Americas at 14%, Europe at 13%, and the Middle East and Africa at 4%.

The association also forecast 2.27 TW of new PV capacity could be installed between 2026 and 2028, down from its previous estimate of 2.34 TW.

“Our updated forecast still anticipates solid annual growth in the range of 10% to 14%, broadly in line with last year’s estimate of 12% to 13%,” the report stated. “However, 2026 stands out as a clear exception, with growth expected to slow to just 1%.”

The 2026 performance is predicted to be impacted by the transition from feed-in tariffs to feed-in premium tariffs in China, which should be felt from the second half of 2025, with project developers delaying investment decisions and revising their business models.

“Overall, our ‘Medium Scenario' projects the global PV market to reach 665 GW in 2026, up from 655 GW in 2025,” the report stated. “Looking further ahead, we expect annual additions to reach 755 GW in 2027, 847 GW in 2028, and 930 GW in 2029.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The latest forecast from SolarPower Europe provides a nuanced and forward-looking perspective on the trajectory of global photovoltaic (PV) deployment. The projection of 655 GW in new PV installations for 2025, reflecting a 10% increase over the 597 GW added in 2024, confirms that solar power continues to assert itself as the cornerstone of the global energy transition. With cumulative capacity reaching 2.2 TW by the close of 2024, the pace of growth underscores both the urgency of decarbonisation efforts and the maturing confidence in solar technology as a commercially viable solution.

The scenario-based approach adopted in the report is particularly instructive. The central or ‘Mid Scenario’—deemed the most likely—presents a balanced outlook, assuming stable module prices and robust installation activity. Yet the divergence between the High (774 GW) and Low (548 GW) scenarios illustrates the sector’s continued sensitivity to geopolitical and regulatory dynamics. The identified risks, particularly those associated with trade disputes and policy misalignment within the EU, are well-founded. Market contraction remains a real possibility if regulatory frameworks fail to evolve in pace with market needs.

The regional breakdown of expected installations is also telling. China remains the undisputed leader, expected to contribute over half of new global capacity in 2025. This dominance not only reflects domestic policy prioritisation but also signals a wider structural shift in global manufacturing and energy policy alignment. Meanwhile, the Asia-Pacific region, the Americas, and Europe account for smaller shares, with the Middle East and Africa remaining nascent markets in global terms. This distribution highlights the need for greater policy support and investment flows into underrepresented regions to ensure a more balanced and resilient global energy transition.

Looking beyond 2025, the forecast suggests sustained growth in global PV deployment, albeit with a temporary deceleration in 2026. The anticipated impact of China’s policy shift from feed-in tariffs to feed-in premiums is expected to dampen short-term momentum, with developers likely to adopt a more cautious stance. Nevertheless, the outlook remains broadly positive, with annual additions projected to approach the 1 TW mark by 2029.

Overall, this report reinforces the dual message that while solar power is on a promising trajectory, the sector’s continued expansion is contingent upon stable policy environments, the resolution of international trade tensions, and a concerted global effort to extend market access and grid integration capabilities.