From ESS News

While the case for batteries as enablers of flexibility is widely accepted, the path to profitability remains far from settled. As more projects enter the pipeline, competition is intensifying, placing growing pressure on operators to extract value from volatile market conditions. In this increasingly more complex market landscape, the ability to generate stable returns is no longer a given, but the product of strategic precision and operational excellence.

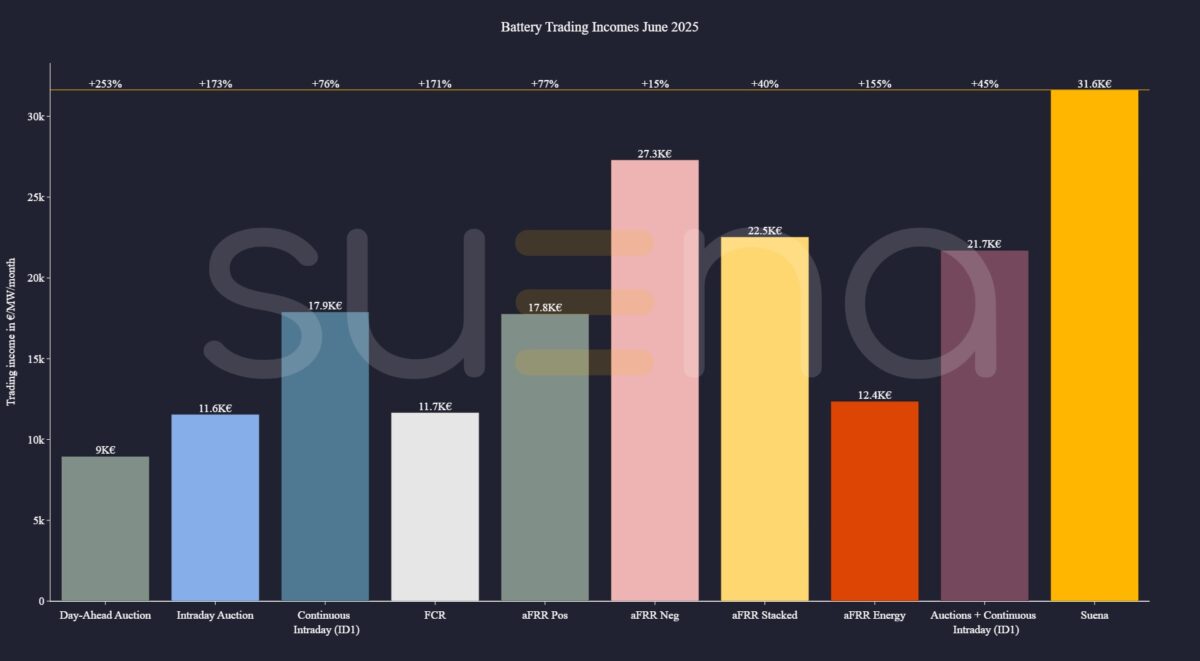

This is especially true for standalone battery storage systems. Like fully merchant colocated assets, they are fully exposed to market prices and system signals. What distinguishes standalone systems, however, is their operational autonomy: they are grid-connected but not dependent on wind or solar plants. This allows them to participate freely across energy and ancillary service markets.

In theory, this autonomy allows for maximum flexibility. In practice, it demands constant re-evaluation of trading priorities, regulatory rules, and asset constraint, such as degradation, state of charge (SoC) limits, and ramping profiles. Each day presents a different set of variables: auction timings, capacity pricing, intraday spreads, and redispatch signals all evolve dynamically, and frequently in conflict with one another.

To continue reading, please visit our ESS News website.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.