Renewable hydrogen remains four times more expensive than conventional hydrogen produced from natural gas, according to a report from the EU Agency for the Cooperation of Energy Regulators (ACER).

The intergovernmental organization’s European hydrogen market 2025 monitoring report says that a decrease in natural gas prices has further lowered the cost of producing hydrogen from steam methane reforming (SMR) since the agency’s 2024 report, increasing the price gap with renewable hydrogen.

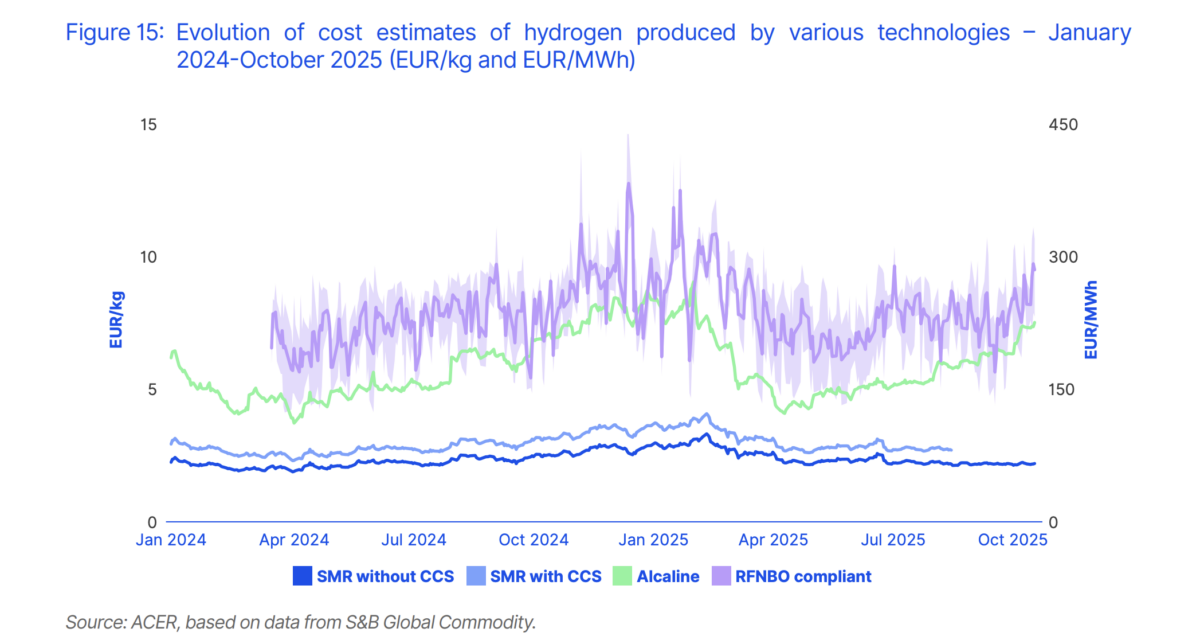

The average price of conventional hydrogen produced via SMR was a little over €2.00 ($2.33)/kg between January and October this year, while carbon capture brought the average cost of abated hydrogen over the same period to €2.80/kg, excluding CO2 transportation and storage costs.

The average cost of renewable fuels of non-biological origin-compliant (RFNBO) hydrogen, depending on country of origin, ranged between €7.00/kg and €10.00/kg. The market-based HYDRIX index issued by the European Energy Exchange for renewable energy has seen a slight increase in 2025, averaging approximately €8.20/kg.

ACER's report explains that the main cost components of producing renewable hydrogen can be split into capital expenditure costs, including eletrolyzer stacks, balance-of-plants and other upfront costs, and operating expenditures, encompassing the cost of electricity supply, network tariffs, maintenance and labour. The weight of these components varies heavily project-to-project, with capital expenditure the dominant cost component for hydrogen produced from solar due to the relatively lower cost of electricity when compared to other sources and the lower capacity factor.

The report adds that prospects for cost reductions of renewable hydrogen seem “uncertain” in the short-term. Expectations for liquified natural gas (LNG) and CO2 emission allowance price levels currently favour fossil-fuel hydrogen, the report highlights, while slower deployment of electrolyzers is limiting economies of scale, delaying anticipated reductions in related capital costs.

In order for Europe’s renewable hydrogen market to scale-up and mature, the report recommends facilitating the technology through faster permitting and grid connection. It also calls on EU member states to accelerate the transposition of renewable hydrogen elements of the renewable energy directive (RED) III into national law, establish clear demand targets for RFNBO hydrogen and combine them with incentive policies.

Elsewhere in the report, ACER adds that low-carbon hydrogen produced from natural gas with CCS could support market development and accelerate decarbonization in some sectors, with some current production costs estimate at just below €3.00/kg. While the report acknowledges low-carbon hydrogen seems more cost-competitive than renewable hydrogen, it warns current cost estimates are largely dependent on assumptions around CO2 transport and storage costs and highlights that the build-out of CO2 poses additional challenges.

“Assessing these cost uncertainties is essential for plotting the path towards the most appropriate hydrogen production options,” the report recommends. “It is therefore important to maintain the sector’s momentum by targeting support for demand creation in sectors with the highest willingness to pay for renewable and low-carbon hydrogen.”

Headline figures from the report add that the EU’s electrolyzer capacity increased by 51% year-on-year in 2024 to stand at an installed capacity of 308 MW, with a further 1.8 GW under construction. However, it adds this is “well short” of a realistic trajectory toward the 2030 EU target of 40 GW.

“A substantially faster expansion is needed to reach the necessary scale, gain operational experience, and eventually drive innovation to reduce costs,” the report says. “To achieve this, early movers need adequate support and regulatory certainty.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.