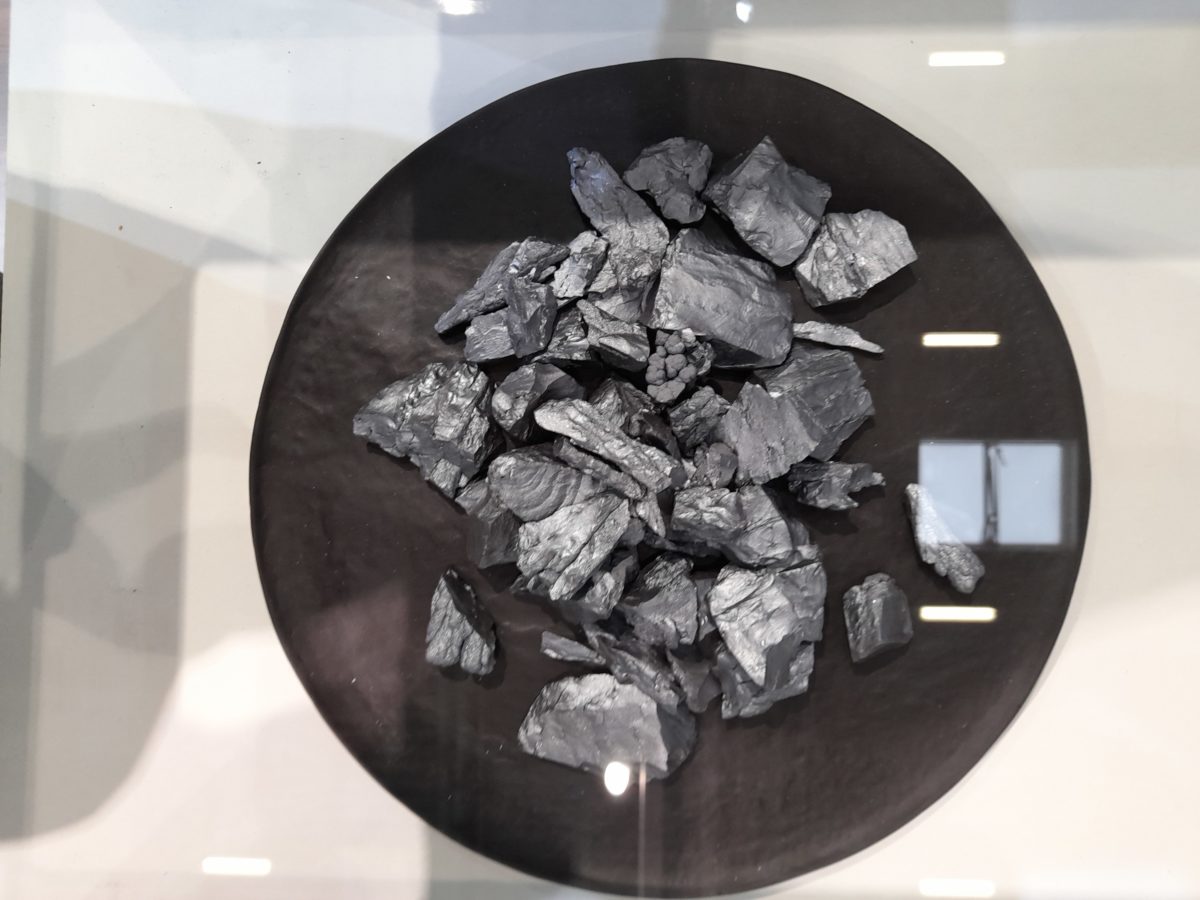

The China Nonferrous Metals Industry Association (CNMIA) has reported a sharp increase in polysilicon prices, driven by lower operating rates at production facilities and stronger procurement from downstream manufacturers. Average prices for n-type re-charge polysilicon rose to CNY 59,200/MT, up 9.83% week on week, while n-type granular silicon increased 10.5% to CNY 55,800/MT. The CNMIA said many new orders were concluded above CNY 60,000/MT, reflecting tightening supply conditions. The association attributed the price increase to reduced polysilicon output, higher production costs, rising wafer and cell prices, and strong demand supported by steady module orders. Wafer prices continued to climb, with average prices for n-type G10L, G12R, and G12 wafers reaching CNY 1.31, CNY 1.42, and CNY 1.66 per piece, respectively, representing increases of between 8.40% and 9.21% compared with pre-holiday levels. Cell prices also moved higher, rising to CNY 0.37/W to CNY 0.39/W, an increase of 18.75%, while module prices remained stable at CNY 0.66/W to CNY 0.68/W. The CNMIA said stable module pricing reflects strong stocking demand from manufacturers and tight wafer supply, despite upstream cost pressures.

Join us on Jan. 28 for pv magazine Webinar+ | The Solar Module Market Playbook: Managing pricing, risks, and other procurement challenges. We combine real-time market data, case studies, and an interactive Q&A to help EPCs, developers, investors, and distributors secure high-quality PV modules at competitive prices, thereby safeguarding project bankability. Separately, deliveries have begun for the Shanghai Lingang No. 1 offshore solar project, where Aiko Solar is supplying modules. The first batch of ABC 655 W and 660 W high-efficiency modules has arrived on site. The project, located in the Lingang offshore area of Pudong, is designed for 500 MW, with total module procurement of about 650 MWp. Aiko secured the contract in August 2025 at a bid price of CNY 0.72/W, with full grid connection scheduled by July 2026. A subsidiary of Jolywood has secured a CNY 537 million contract to supply modules for the Gulang Longdian-to-Zhejiang Huanghuatan 2 GW solar project in Gansu province. The award covers the 800 MW western section of the project and implies a module price of about CNY 0.67/W. The project is expected to be completed in the fourth quarter of 2026. JA Solar has signed an exclusive supply agreement with partner JB for what it has described as South Korea’s largest ground-mounted solar project, with a combined capacity of 410 MW across eight sub-projects. The array will feature JA Solar’s DeepBlue 5.0 modules, offering output of up to 670 W and conversion efficiency of 24.8%. All permits have been secured. Shanghai-listed Chint Electrics said it is planning a potential H-share issuance in Hong Kong to support its international strategy and diversify financing channels. The company said the proposal would not change its controlling shareholder and remains subject to board, shareholder, and regulatory approval. Shenzhen-listed LEAD Intelligent Equipment said it has secured record-filing approval from the China Securities Regulatory Commission (CSRC) to issue overseas-listed H shares. The company plans to issue up to 200.12 million ordinary shares on the Hong Kong Stock Exchange, subject to final regulatory approval. It wants to use the proceeds to support global expansion and R&D activities. This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Worthy update