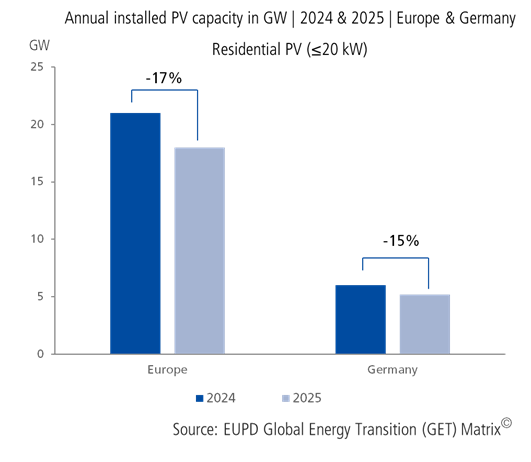

In recent years, residential solar PV has acted as one of the most important anchors of growth in Europe’s solar market. Rooftop installations across key markets helped absorb manufacturing capacity, accelerated consumer adoption, and normalized solar as a mainstream household investment. In periods of market uncertainty, residential demand repeatedly provided stability and momentum for the broader PV sector.

That role, however, is now evolving. As European solar markets are tilting towards larger scale C&I and utility projects, residential PV installations recorded a year-on-year decline in 2025, reflecting a combination of market saturation, reduced support incentives, grid export limitations, and increasingly selective consumer behaviour, a dynamic explored in greater detail in our recent analyses of broader market adjustment.

This shift does not signal a loss of relevance for the residential segment. The momentum generated by residential solar following the Ukraine-war, energy insecurity and elevated electricity prices is now branching into adjacent technologies and upgrades such as digitally enhanced energy management solutions that improve flexibility, self-consumption, and control at household level. Energy storage, balcony systems, smart energy management platforms, and AI-driven optimization solutions are increasingly defining where residential solar growth is now occurring.

What Are Prosumers and Installers Asking For?

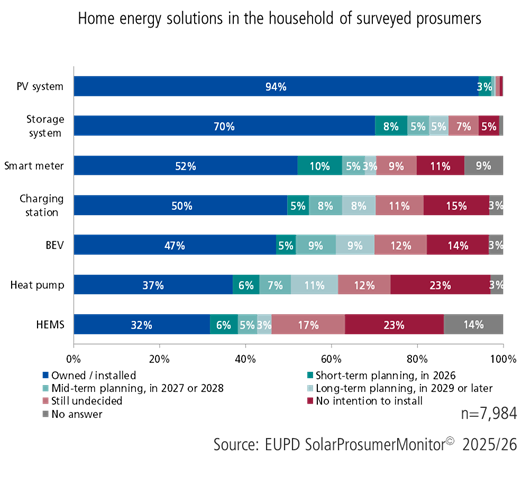

Insights from EUPD SolarProsumerMonitor© 2025/26, based on surveys and interviews with over 7,900 solar prosumers in Germany, point to a clear shift in expectations within the residential segment. Survey results show that residential demand is increasingly driven by system upgrades and complementary technologies, rather than first-time PV adoption, with many existing PV owners prioritizing energy storage, smart control, and system optimization. Prosumers consistently emphasize the importance of further advancements in decentralized storage to better manage self-consumption and local overcapacity under constrained grid conditions. Many respondents also explicitly highlight bidirectional charging and vehicle-to-grid (V2G) capabilities as a key next step, linking electric vehicles and home storage more closely within the household energy system.

At the same time, prosumers report growing challenges in purchasing decisions. Responses indicate that price comparisons alone are no longer viewed as reliable indicators of product quality, while the lack of widely trusted, unbiased benchmarks makes it difficult to assess long-term reliability and performance. Battery lifespan and reliability consistently rank among the most important decision criteria, often outweighing upfront price considerations, reflecting prosumers’ increasing focus on system durability and total cost of ownership.

These expectations are closely mirrored on the installer side too. According to feedback captured in EUPD’s PV & EES InstallerMonitor©, installers increasingly expect residential systems and ancillary technologies to integrate seamlessly into home automation environments. Intelligent tools that transparently track energy savings and performance, along with system-level integration of AI-controlled storage, charging infrastructure, and load management, are increasingly viewed as baseline requirements rather than optional add-ons.

Why Do Residential Customers Remain Relevant Beyond Solar PV?

Prosumer responses show that they increasingly prioritize improving system performance and control, as well as enhancing long-term economic value. For residential suppliers, this signals a shift away from one-off hardware sales toward longer-term engagement models, as value creation increasingly follows households through subsequent system expansions and retrofits.

In mature rooftop markets, this evolution is already visible in how demand priorities are changing. German prosumers report a growing focus on self-consumption optimization and the use of dynamic tariff structures, reinforcing interest in residential energy storage and intelligent energy management. At the same time, installer feedback from the Netherlands points to rising expectations for storage deployment as net-metering schemes approach phase-out, further increasing the relevance of smart control and automated load optimization.

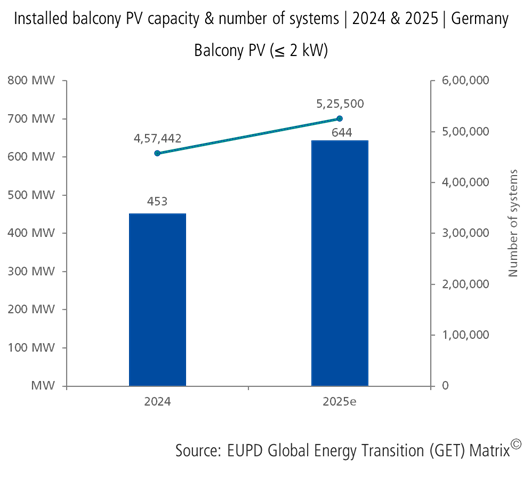

Alongside these developments, balcony PV and balcony storage are emerging as fast-growing residential subsegments, particularly among apartment dwellers and urban households previously excluded from rooftop PV adoption. When asked about primary purchase motives, prosumers most frequently cite reducing electricity costs and expanding existing PV systems to better cover household electricity needs. Ease of installation also ranks among the top motivations, alongside interest in the technology itself. Across the European markets, Germany has established itself as the leading market for balcony PV, supported by simplified registration frameworks for systems below 2 kW. According to the EUPD Global Energy Transition (GET) Matrix©, in Germany the segment recorded year-on-year growth exceeding 42%, while balcony storage attachment rates increased from around 13% in 2024 to approximately 35% in 2025. Similar regulatory easing is now taking place in other European markets, including Belgium and Poland, where new frameworks for small plug-and-play systems below 800 W to 1 kW are expanding access and reinforcing the role of compact, storage-enabled residential configurations.

Taken together, these developments illustrate that while residential PV installation volumes are softening, the residential customer base itself remains highly relevant as demand is redirected toward adjacent energy technologies. Rather than exiting the market, households are continuing to invest through upgrades, add-ons, and system extensions that build on existing PV installations. In an increasingly selective market environment, installer feedback highlights that manufacturers’ ability to support retrofits, ensure cross-brand compatibility, and enable seamless integration across storage, EV charging, and energy management systems is becoming a decisive factor in sustaining residential market relevance and growth.

Innovation Is Already Responding to a More Selective Residential Market

As residential energy technologies continue to diversify, leading brands are already differentiating through targeted product innovation that aligns closely with evolving prosumer and installer expectations. To further support informed decision-making and recognize manufacturers’ advancements, EUPD’s Top Innovation Award (TIA) highlights technologies that demonstrably address real-world prosumer and installer expectations.

Recent TIA-recognized technologies provide concrete examples of how leading manufacturers are responding to these evolving residential system requirements. Zendure’s SolarFlow 2400 AC introduces an AI-enabled, AC-coupled plug-and-play storage solution that simplifies installation while enabling scalable capacity and intelligent charging and discharging across residential setups. EcoFlow’s STREAM Series Plug & Play Solar Plant connects modular batteries, microinverters, and solar generation into an AI-managed home energy network designed to maximize solar utilization and reduce grid reliance, particularly in urban and balcony PV applications. FENECON’s FEMS provides an open, AI-supported energy management platform that integrates PV, storage, EV charging, and controllable loads under dynamic tariff conditions, reflecting growing demand for vendor-independent system intelligence. BYD’s residential energy storage system applies vehicle-grade LFP battery technology in a modular, compact design, emphasizing long-term safety, durability, and easy installation, while supporting flexible system expansion and compatibility with multiple inverter platforms. AIKO’s NAVIGATOR Intelligent Module embeds module-level intelligence directly into PV hardware, enabling real-time monitoring, fault detection, and performance optimization without additional system complexity.

These examples highlight how residential innovation is increasingly focused on intelligence, integration, and reliability, aligning product development with the practical requirements voiced by Europe’s prosumers and installers as the residential PV market becomes more selective.

Residential Demand Is Being Redefined, Not Withdrawn

The developments observed across Europe’s residential solar markets point to a recalibration rather than a retreat. While rooftop PV installation volumes have softened, insights from prosumers and installers show that engagement with residential energy technologies remains active and evolving. Households that adopted PV in earlier growth phases continue to invest, but increasingly through upgrades, extensions, and improvements that build on existing systems.

Survey feedback highlights a growing focus on long-term reliability, and better control over energy use under changing grid and pricing conditions. This is reflected not only in rising interest in home storage and intelligent energy management, but also in the rapid uptake of smaller scale and accessible formats such as balcony PV and balcony storage. This shift shows that residential demand is spreading across a wider set of applications and use cases.

What emerges is a residential energy market that remains highly relevant, even as its growth profile changes. The direction is clear, and leading players are already responding. Innovation-led portfolios built around complementary residential technologies are shaping the next phase of growth in Europe’s residential energy market.

Authors: Saif Islam and Varun Mahankali

Saif Islam is a Senior Consultant at EUPD Research, contributing to the organization’s mission of delivering high-quality market intelligence, strategic insights, and industry research across the global renewable energy and sustainability sectors. With 12 years of experience in energy market analyses, and sustainability-driven strategy, he supports stakeholders in understanding market dynamics, emerging technologies, and evolving policy landscapes. He can be reached at s.islam@eupd-research.com.

Varun Mahankali is a Senior Consultant and the Manager of the Top Innovation Awards at EUPD Research. He has over five years of experience in clean tech research and consulting. His expertise spans market intelligence, innovation analysis and consulting within the renewable energy sector. He can be reached at v.mahankali@eupd-research.com.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.