From ESS News

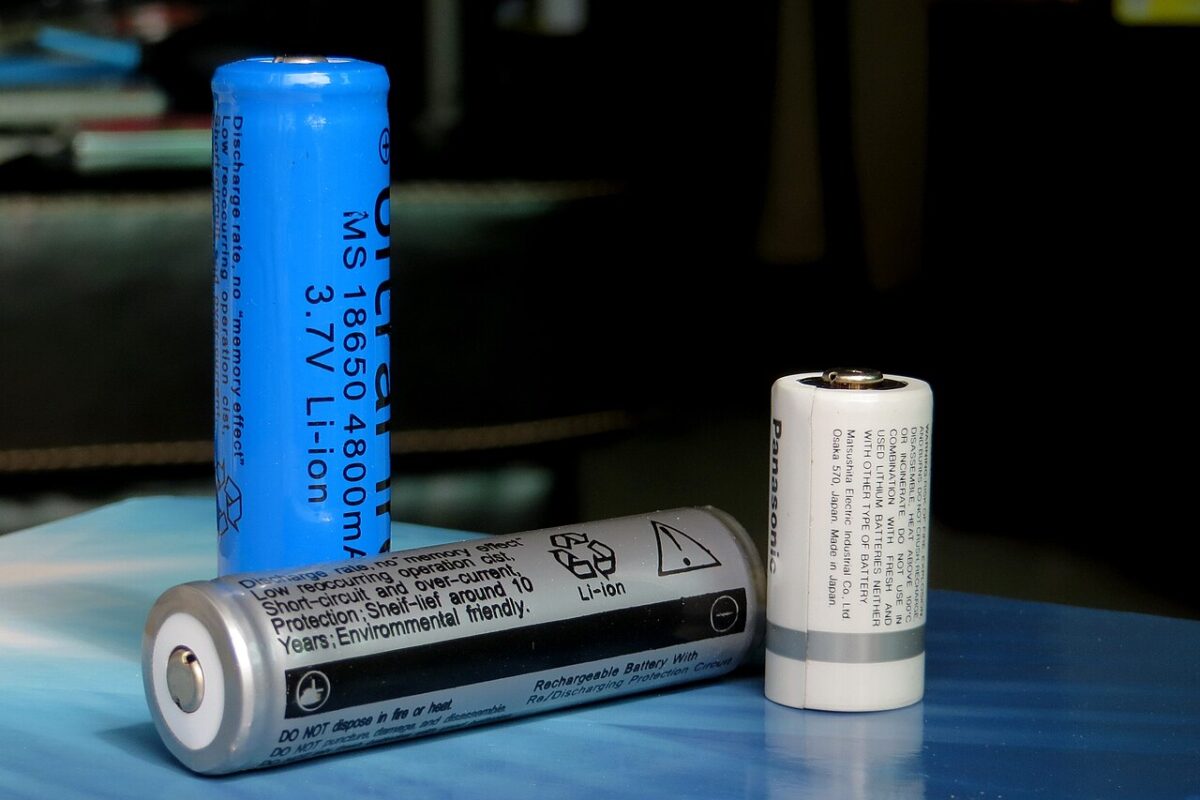

Suncorp, which provides insurance in Australia and New Zealand, reports that lithium-ion battery fires are contributing to higher home insurance costs. The insurer said the higher number of battery-related losses adds to pressures from natural disasters and theft, with home insurance premiums rising 9.4% in 2024-25. April and May 2025 were the months with the highest value of fire claims on record, many connected to lithium-ion incidents.

In its latest financial reporting, Suncorp CEO and Managing Director Steve Johnston noted that the proportion of claims above AUD 500,000 ($325,000) involving lithium-ion ignition sources has doubled over five years, rising from 9% to 18%. Several cases resulted in the total loss of houses or apartments.

To continue reading, please visit our ESS News website.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.