From pv magazine France

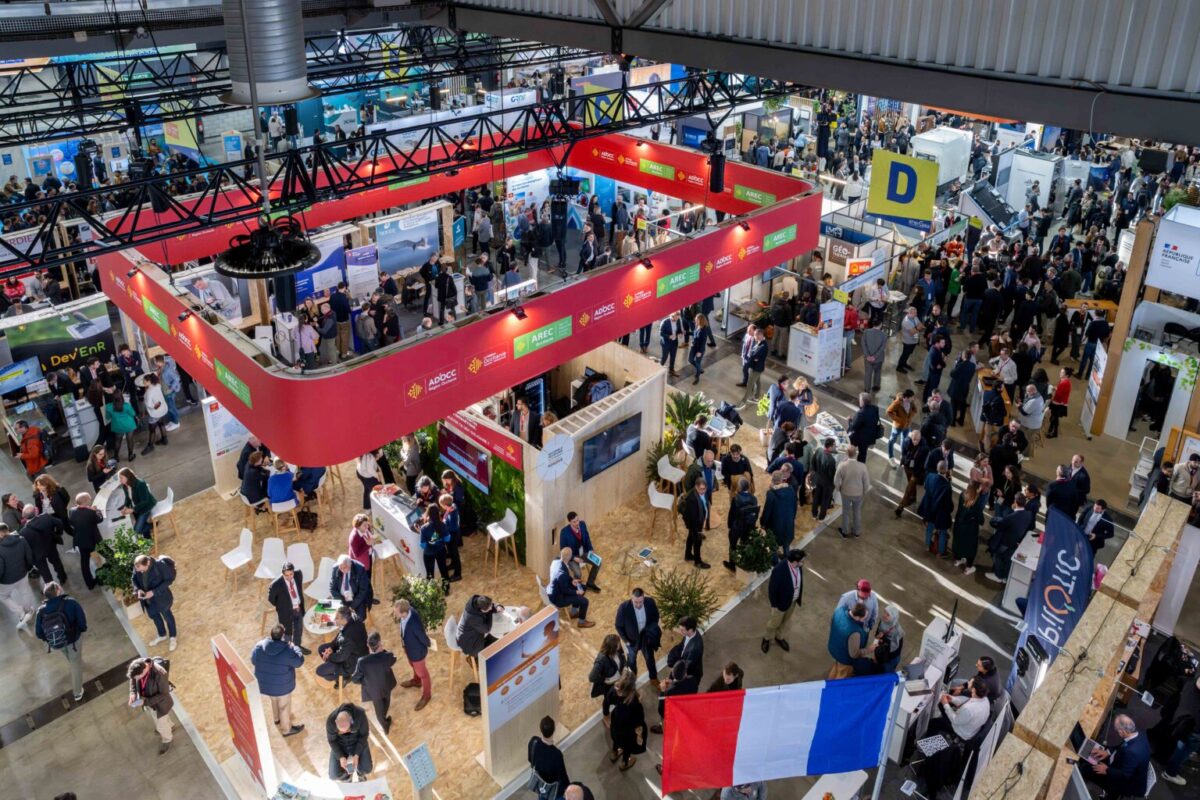

The Energaia renewable energy trade show in Montpellier, France, attracted larger-than-expected crowds last week, defying concerns that political uncertainty around renewable energy policy would dampen participation. Organizers reported 551 exhibitors across seven halls on Dec. 10 and 11, an increase of 50 from the previous year, alongside about 22,500 professional visitors.

“We welcomed precisely 551 exhibitors – 50 more than last year,” Caroline Gignon, head of ENERGAÏA Forum, told pv magazine France.

International participation accounted for 27% of exhibitors, with the remainder based in France, according Gignon. Demand was particularly strong for so-called starter packs, fully equipped booths typically used by first-time exhibitors, reflecting the entry of new companies into the market. Visitor numbers doubled from the prior year as the event expanded into additional halls to accommodate growth.

Industry sentiment at the show, however, was more cautious when looking beyond the near term. Market participants pointed to rising uncertainty for 2026 as the residential solar segment slows and visibility on future tenders remains limited. Grid operator Enedis forecasts around 6 gigawatts of photovoltaic capacity to be connected in 2025, but many of those projects were initiated before current market headwinds emerged, limiting their usefulness as a guide to longer-term momentum.

Policy delays added to the uncertainty. France has yet to approve its 2025-35 Multiannual Energy Program (Programmation pluriannuelle de l’énergie, PPE), the national energy roadmap initially expected before mid-2023. Prime Minister Sébastien Lecornu has again pledged publication before the end of the year.

For its 19th edition, Energaïa placed a strong emphasis on local acceptance of renewable energy projects, a theme sharpened by the proximity of municipal elections. Energy storage also emerged as a dominant feature across the exhibition floor, with solutions spanning utility, commercial and residential scales. Containerized stationary systems were widely on display, including a 20-foot unit from Starcharge with storage capacity of up to 5 MWh.

SolarEdge Technologies presented its 197 kWh CSS-OD commercial system, which can be expanded to 4 MWh. In the residential segment, companies such as Atmoce and Marstek showcased plug-and-play batteries of about 5 kWh. Manufacturers increasingly highlighted lithium iron phosphate (LFP) chemistries, citing safety advantages over conventional lithium-ion batteries.

Despite the more cautious outlook for 2026, the scale of participation and the breadth of new technologies on display reinforced the sector’s resilience, with storage and residential systems standing out as key areas of near-term innovation.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.