Chinese PV Industry Brief: New PV capacity exceeds 10 GW in H1

More than 10 GW of PV capacity was deployed in the world’s largest solar market in the first half, according to several sources. One state-run think tank has even predicted that China could install 40 GW this year.

Chinese PV Industry Brief: Risen plans 13 GW output expansion, Datang reveals tender results

Risen Energy has announced plans to expand its annual cell and module output by 13 GW. Datang, meanwhile, has published the results of the module tender it held for this fiscal year.

Trina reveals 600 W module

The Chinese giant has leapt ahead of rivals who recently announced their intent to work towards the next generation of mega panels by pledging to have its 600 W Vertex product on sale by the end of March.

Chinese PV Industry Brief: TCL acquires Zhonghuan, distributed-generation PV soars

TCL, one of China’s biggest electronics manufacturers, has acquired Zhonghuan Semiconductor. The National Energy Administration, meanwhile, reported record growth for the distributed-generation PV segment in June.

Chinese PV Industry Brief: 10 GW module-inverter tender and 300 MW in Liaoning

JA Solar began work on a 300 MW solar plant in Liaoning province last week, while state-run Huaneng launched a fiscal 2020 tender for 5 GW of inverters and another 5 GW of PV modules.

Chinese PV Industry Brief: Huadian kicks off 2 GW tender

Also, a court in Beijing is now reviewing an application for bankruptcy filed by a unit of Hanergy. In other developments this week, a diverse range of solar industry players launched the 600W+ Photovoltaic Open Innovation Ecological Alliance.

Chinese PV Industry Brief: Longi to grow by 10 GW, China opens world’s largest floating PV project

Plus, equipment manufacturer Shangji Automation is set to enter the silicon ingot making game with plans for an 8 GW fab, while state-owned developer Panda Green says it plans to add 500 MW of annual project capacity over the next three years.

Trina signs 970 MW, 35-plant, multi-nation project contract

The solar manufacturer has landed its biggest engineering, procurement and construction services deal and will work on solar facilities in Europe and Latin America which will come online before 2023.

Canadian Solar joins the 500 W-plus panel club

The Chinese-Canadian company has unveiled a range of high-power modules which are set to go into mass production by early next year. The series includes a commercial and industrial rooftop-dedicated product offering a reported 405 W.

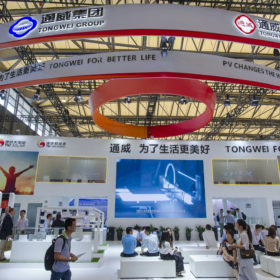

Chinese PV Industry Brief: Tongwei freezes cell prices, state body opens procurement round

Longi has also joined the 500 W-plus module club with its new Hi-Mo5 product, while Sunport has announced to expand production of its MWT module.