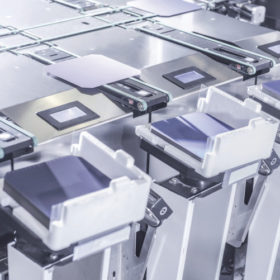

Meyer Burger mulls gigawatt-scale German solar fab

Chief executive Gunter Erfurt told a German radio station a solar factory in North Rhine-Westphalia could supply high-efficiency panels for a 10 GW floating solar project on the vast Hambach open-cast coal mine.

Obligatory temperature testing: How Covid-19 is changing the boardroom

Chinese solar project developer GCL New Energy revealed in its latest update in a drawn-out project sale saga how coronavirus measures will affect corporate gatherings.

Trina secures 105 MW order for its 500 W modules

The Chinese manufacturer will provide Indian developer SunSource Energy with its Vertex panels. Shipments will be made in the fourth quarter.

Indian Railways tenders for 1 GW of solar

Developers have until June 30 to lodge bids to develop plots of solar capacity across the national rail network which offer a maximum INR2.71/kWh ($0.036) for the electricity generated under a 25-year contract.

LCOE from large scale PV fell 4% to $50 per megawatt-hour in six months

Analysts at Bloomberg New Energy Finance say the lowest-cost projects financed in Australia, China, Chile and the UAE in the last six months hit a levelized cost of energy of just $23-29/MWh and the best solar and wind projects will produce electricity for less than $20/MWh by 2030.

Solar, wind and hydro resilient during Covid-19 crisis

A study by the International Energy Agency into the chilling effect of the Covid-19 pandemic on energy demand states renewables will be ‘the only energy source likely to experience demand growth for the rest of 2020’. The slower the economic recovery, the more the fossil fuel industry will suffer.

The 900 MW fifth phase of 5 GW solar park moves forward in Dubai

The $570 million fifth phase of the project will sell power at $0.016953/kWh under a 25-year power purchase agreement. It is scheduled to go online in the second quarter of 2021.

Solar can drive down levelized cost of desalinated water

A study from Finland’s Lappeenranta University of Technology states decarbonization of desalination could help achieve a levelized cost of water of €0.32-1.66 per cubic meter. Solar and storage are expected to play a decisive role.

Covid-19 weekly briefing: Merchant solar developers could seek shelter in return to subsidies and PPAs are being revisited, but at least the Irish are coping with lockdown measures

The unfolding effects of the Covid-19 crisis, and fears of a possible second wave, have split analysts trying to guess how the unsubsidized renewables market will emerge as slumping demand continued to distort power markets. pv magazine rounds up the week’s coronavirus developments.

Covid-19 disruption leaves indebted Chinese manufacturer in limbo

Debt-saddled GCL-Poly’s attempts to renegotiate $809 million of defaulted borrowings have been held up because of the coronavirus crisis unfolding in Europe, where one lender is based. Shareholders are due to vote tomorrow on a project sale which could generate $153 million of benefits.