Chinese PV Industry Brief: Longi unexpectedly raises PV wafer prices

Furthermore, Tongwei secured 104,800,000 wafers from Shuangliang and PV module manufacturer Yingli said its capacity has reached 8GW.

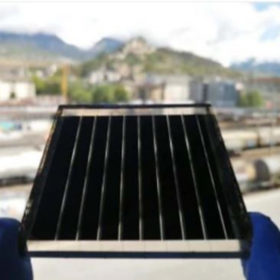

Photovoltaic-thermal noise barrier from South Korea

The Korea Institute of Energy Research has developed a 3kW solar noise barrier to produce electricity and heat. The thermal solar modules reduce the operating temperature of the photovoltaic panels by absorbing excess heat.

Spraying water system for solar module cooling

A British-Indian research group has developed an active cooling technique that is claimed to improve a PV system’s yield by around 0.5%. The system could be used in residential solar arrays and the water heated by the PV modules may be fed into a solar water heating system.

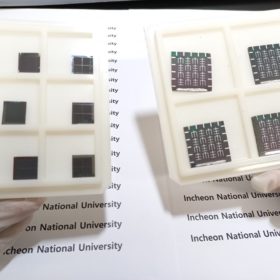

Kesterite solar cell with 11.76% efficiency via aluminum oxide passivation layer

The solar cell was built with Al2O3-incorporated CZTSSe absorbers using aqueous spray pyrolysis in ambient air. It achieved an open-circuit voltage of 0.469 V, a short-circuit current of 36.96 mA cm2, and a fill factor of 67.25%.

Major advances for US, Australian solar window specialists

Australian solar window supplier ClearVue says its products can reduce carbon emissions in buildings by as much as 90%, while California-based BIPV window coating producer Ubiquitous Energy has raised $70 million to scale up its own tech.

Chinese PV Industry Brief: JinkoSolar announces Jiangxi Jinko’s IPO pricing

Jiangxi Jinko plans to issue 2 billion shares at RMB5.00 per share and expects to raise net proceeds of around RMB 10.0 million. Solar manufacturer Solargiga said it expects a 17% revenue growth for 2021.

Perovskite solar module with 21.36% efficiency via new passivation tech

Lithuanian scientists built the panel with 23.9% efficient solar cells with operational stability of over 1000 h. The module has an active area of 26 cm2.

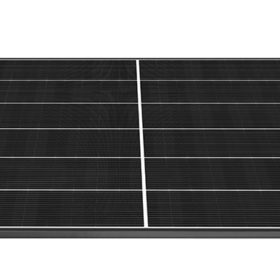

Panasonic unveils 410 W solar panel with 22.2% efficiency

The new heterojunction module series is compatible with Panasonic’s Evervolt battery and has a power output ranging from 400 to 410 W. It also features a temperature coefficient of -0.26% per degree Celsius.

Perovskite ink for flexible solar panels

Developed by a Canadian start-up, Solar Ink can be used to create standalone perovskite solar modules or it can be combined with existing solar modules in a tandem configuration. It can be coated on both flexible and rigid substrates, resulting in translucent solar cells which, in turn, can be used to produce flexible and light modules for application in solar windows and vehicle-integrated photovoltaics.

Modeling method for agrivoltaics in greenhouses

Spanish researchers have developed a new modeling technique to assess the performance of semi-transparent PV systems for greenhouses. Their novel approach considers the broadband and spectral content of the irradiance, the solar cell technology and its performance metrics, and the relationship between the photosynthetic rate and the effective photon flux that falls on the crops.