Finnish solar manufacturer finally starts production in Vilnius

Valoe completed the 15-month purchase process of a 60 MW cell production line from Solitek in the spring and installed interdigitated back-contact production equipment. It hopes to begin deliveries in the next quarter.

Energy Infrastructure Partners invests €530m in Baywa re

The Baywa group will maintain a 51% stake in the German renewable energy company.

Ramping up renewables now could save Europe €363bn by 2050

Delay, and policymakers will see the carbon emission allowance which would enable us to stay well below 2C frittered away so quickly net zero would have to be reached in 2040, rather than ten years later, when the relevant technology costs will be cheaper.

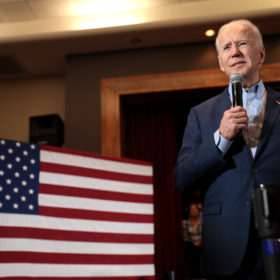

Biden, the EU and China to usher in ‘golden age’ for solar – Jinko

The company shipped a record 5.1 GW of modules in the July-to-September period and expects to hit up to 19 GW for the year, with ‘nearly 100%’ of its products likely to be based on monocrystalline technology in 2020.

GCL shareholders set for a busy festive period as votes loom on $903m worth of solar project sales

Chinese state entities are now behind five phases of two separate sales deals which, if approved, will transfer more than 1.8 GW of solar generation capacity into public ownership.

McKinsey: EU slated for 44 GW annual PV additions in cost-neutral path to net-zero

Business analysts at McKinsey & Company have worked the numbers and found that investments into new infrastructure and technologies necessary to achieve the net-zero target will likely be offset by savings in other sectors. Europe’s PV sector could grow to about three times its current size over the next decade.

The roadmap to the lowest cost grid is paved with distributed solar and storage

We wanted to know what the grid would look like, and cost, if we stopped ignoring the benefits of distributed energy resources and optimized their integration through a better modeling process. We found that when you use better planning models and scale both local solar and storage, as well as utility-scale solar and wind, you maximize cost savings and unlock the path to the lowest cost grid.

EU Commission eyes ‘green trade agenda’ with President-elect Biden

While Donald Trump grapples with the result of the election, Europe’s highest officials have moved on, and demonstrated new optimism for the four years ahead by setting a preliminary agenda for cooperation aimed at president-elect Joe Biden with key topics including work on renewables, battery storage and carbon pricing.

Asian Development Bank provides more than $1bn finance for renewables power lines

The development lender has followed up a $600 million loan for distribution infrastructure in eastern Indonesia with a $430 million credit line for installations in India.

China could drive 4.2 TW of solar capacity by 2050 under decarbonization plan

The solar and wind industries could benefit from a $6.4 trillion boom under the most ambitious of two scenarios described by Bloomberg New Energy Finance, and $2.4 trillion even in the business-as-usual outlook.