From pv magazine 01/2021

The dawning of a new year is a time for commitments, fresh starts, forecasts and projections. One such projection that tends to attract a lot of attention is the estimated costs for future energy technologies – including solar PV. It appears almost certain, though, that all but the best projections concerning PV costs are almost certainly cursed to fail. In fact, with the value of hindsight, this is precisely what we have seen.

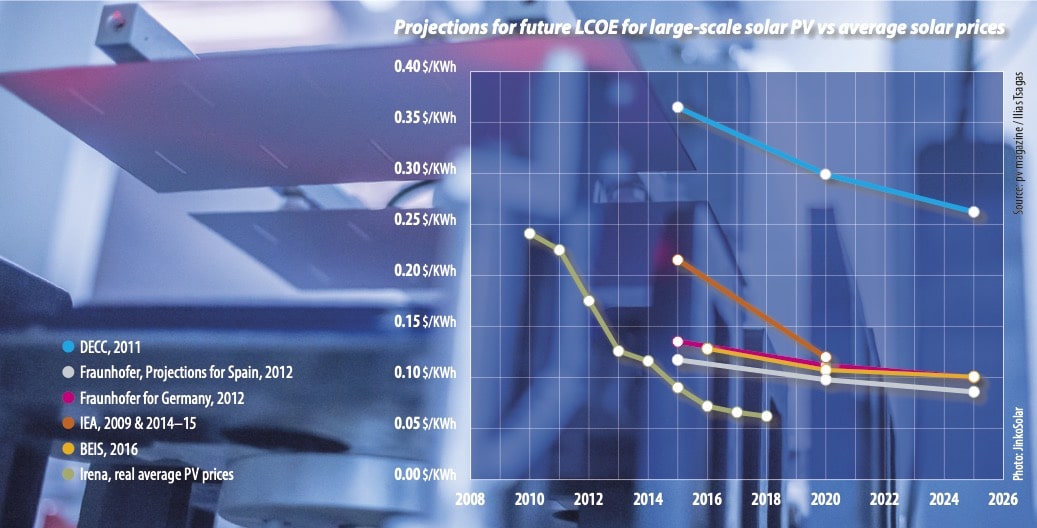

pv magazine has collected data with an aim to showcase how various reputable institutions have historically provided erroneous projections concerning the LCOE of solar PV. Specifically, pv magazine examined reports by Germany’s Fraunhofer Institute for Solar Engery Systems (ISE), the United Kingdom’s Department of Energy and Climate Change, and the International Energy Agency. By then plotting these projections against the global average prices resulting from auctions in the years 2010 to 2018, as reported by the International Renewable Energy Agency (IRENA) in 2019, it is possible to determine the expectation gap.

Fraunhofer data

Fraunhofer ISE projected in 2012 that the LCOE for solar PV in Germany would reach approximately €0.082/kWh ($0.10/kWh) in 2025. By contrast, solar auctions held in October 2019 led to an average solar price of €0.049/kWh – almost half of the Fraunhofer projection for 2025, but a full six years sooner. The Fraunhofer report also includes an LCOE forecast for Spain reflected in the chart above.

DECC projections

Similarly, the United Kingdom’s Department of Energy and Climate Change (DECC) said in 2011 that solar’s LCOE in Britain would hit GBP 0.165/kWh and GBP 0.136/kWh in 2015 and 2020, respectively. The projections were based on low capital cost estimates, using the Arup and EY capital and operating cost profiles for solar PV installations greater than 50 kW, as both Arup and EY are leading global consultancies. Contrasting this with reality, Britain tendered new PV capacity in 2015 at a tariff of GBP 0.079/kWh.

The DECC report also provided projections for medium and high capital cost estimates and these were significantly higher. For example, for medium capital cost estimates, the report forecasts that the LCOE for solar PV in Britain will reach GBP 0.228/kWh in 2015 and GBP 0.187/kWh, in 2020. The pv magazine chart uses the projects based on medium capital cost estimates, as this is the norm when plotting graphs on various estimates.

In 2016, the DECC had become the Department for Business, Energy and Industrial Strategy (BEIS). BEIS published new levelized cost estimates for PV projects to be commissioned in 2016, 2020 and 2025 respectively. The BEIS estimates have also been plotted.

IEA outlook

The International Energy Agency (IEA) reported in 2010 that for solar plants with high lead factors around 25%, the LCOE in 2015 would reach around $0.215/kWh at a 5% discount rate and $0.333/kWh at a 10% discount rate.

Similarly, a separate IEA report published in 2015 forecasted the global average LCOE for PV projects to be commissioned in 2020 to be $0.12/kWh. However, the IRENA data show that in 2018, the global average for solar PV tariffs was already half of the IEA’s projection for 2020.

Popular content

Stark contrast

The compiled figures show how quickly the projections for the solar PV LCOE can become outdated. This failure to forecast the right LCOE for solar become even starker should one consider the lowest prices been reached in tender exercises around the world.

Indeed, competitive tenders during 2019 broke the world’s cheapest solar PV tariff record a few times. Prices struck in Portugal’s ($0.016/kWh), Dubai’s ($0.01653/kWh), and Brazil’s ($0.0175/kWh) solar auctions were the three lowest tariffs awarded that year.

Last year, the world’s record for the lowest solar PV tariff was also outcompeted several times, with Portugal still holding the world’s cheapest tariff of $0.01316/kWh. Meanwhile, Abu Dhabi followed neck and neck, as the authorities awarded a tariff of $0.0135/kWh. Also, Qatar later followed closely with a tariff rate of $0.01567/kWh.

One should note of course that tenders have often grown into complex mechanisms that do not allow for quick and simple comparisons between them to be made. In the case of the Portuguese auction last year, for example, solar PV awards were often combined with solar storage facilities, while there were also rules concerning the grid connection of the projects, tied in the auction’s compensation mechanism.

Nevertheless, despite the nuances in various auction mechanisms in different countries and the difficulty in ranking their results on a global scale, the case remains that PV projects can now be built at record low prices that are not even near the projections made five years ago.

Team effort

A final remark should concern the teamwork behind the solar PV successes. The efficiency of PV technology has improved dramatically throughout the past decade. But all the same, the sector’s success did not follow a radical technology breakthrough, but the same basic technology of crystalline-silicon solar cells.

Cost reductions have mainly been the result of incremental learning across the whole value chain, as well as the development of scale. This is also reflected in the cost variations between countries, which reflect not only the solar resource but the maturity, scale, and the know-how of the local solar PV sector. Having said that, given that many PV companies are now present in various continents, it can be argued that we will experience a dynamic process in which the global average PV cost will continue to drop as PV businesses expand globally.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Predicting PV prices are a science! Based on outstanding model experience my team predicted early 2018 PV prices of 1 ct./kWh in south Europe in 2024, 0.5 ct./ kWh in 2030. The prices achieved in the auctions mentioned in the article are forward prices, the projects will be finalized in 2022/2023 and most probably we will see 1 ct./ kWh in 2024. Not only in peak auctions, it will be the average price in a bulk of auctions.

The prerequisites for reliable predictions are comprehensive knowledge in modelling, preferably in risk modelling and a extremely thorough application of leading model validation standards, e.g. SR 11 – 7 SUPERVISORY GUIDANCE ON MODEL RISK MANAGEMENT.

Don’t forget the fall in the cost of capital. This has been general: OECD governments can ow borrow for long periods at near-zero nominal rates of interest, and prime commercial borrowers like Alphabet and Microsoft pay around 2%. The decline has been even steeper for wind and solar developers, who have moved from high-risk gambles to greater bankability than oil and gas. The WACC of 9.6% still used by Lazards for their reference comparisons is a quaint survival. Capital is cheaper too for gas turbines, but the fuel has to be bought at market prices – currently in a slump, but expected to rise.