Scientists use game theory to monitor renewables auctions

An international team of scientists has assessed different strategies for volume-based and fixed-amount subsidy auctions for large-scale wind and solar projects. They have found that higher subsidy levels in auctions lead to lower final prices.

Weekend Read: Install grid-connected solar, rinse, repeat

Will a redeployable solar and energy storage solution be the answer to unreliable grid electricity across much of Africa, as its developer proposes? Or will it merely be a temporary solution that will see cash-strapped utilities kick the can of universal energy access further down the road?

First Solar delivers on earnings, margins, falls short on revenue

US-based thin-film PV manufacturer First Solar says it has raised its expectations for 2023 as its order backlog continues to grow.

The ‘next big thing’

The PV industry in Southeast Asia has come a long way since guest author Ragna Schmidt-Haupt, partner at Everoze, reported on solar financing innovation in the region more than a decade ago. In this article, she outlines five factors for success, the newest of which has the potential to become a game changer, and not only in Southeast Asia.

Australia announces funding for critical minerals

The Australian government has doubled the amount of federal financing available for critical minerals projects to AUD 4 billion ($2.56 billion) as it looks to shore up supply chains with the United States, deliver on emissions reduction targets, and build clean energy industries.

Co-location, co-location, co-location

Charles Lesser, who leads UK operations at Apricum, and Apricum Project Manager Alexandra Popova explain why the renewables consultancy is predicting a big rise in solar-plus-storage projects in Great Britain.

Merchant PV growing in Spain, Germany

Some see merchant solar as risky, but investors are increasingly snapping up Europe-based merchant PV opportunities for “huge profits,” a researcher from the International Energy Agency Photovoltaic Power Systems Program tells pv magazine.

Qcells fully acquires intellectual property rights for LECO tech

Qcells has acquired full ownership of intellectual property rights for LECO technology with the recent acquisition of Cell Engineering. The technology is known to enhance the efficiency of PERC and TOPCon solar cells.

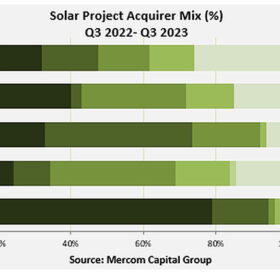

Solar sector corporate financing up 55% so far this year, Mercom says

Despite inflationary challenges and elevated interest rates, financing in the solar industry has remained robust with corporate financing sitting at $28.9 billion – a 55% hike from last year’s $18.7 billion, a new report by Mercom Capital Group states.

Italian agrivoltaics could be a vital plank of the EU’s energy transition

Europe awakened to its energy dependency on Russian gas as the Russia-Ukraine conflict unfolded and the war has pushed the European Union to accelerate its energy transition. Italy could play an important role.