Plan to double size of 20 MW Madagascar solar park

The island nation’s first utility scale solar park is set to double in size and have energy storage added, with work due to start this month.

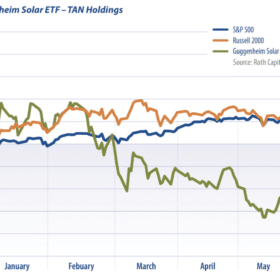

Guggenheim Solar Index: Supply chain cost increases see underperforming solar stocks

In May, cost increases across the supply chain left solar stocks underperforming in the market, writes Jesse Pichel of ROTH Capital Partners. For the U.S., higher prices for shipping and steel have hit particularly hard.

Industrial green hydrogen could become a global commodity but local production is needed for transport uses

Long distance, point-to-point transport of green hydrogen for industrial use can harness the cheap solar electricity available in some parts of the world but distributing the energy-storage gas to individual refueling stations, for vehicle fuel cell use, will likely have to depend on production nearby.

Has China extended solar grid-connection deadlines by a year?

Such a decision, which industry body the CPIA is adamant has already been announced, could make all the difference to investors struggling with a surge in equipment costs fueled by the polysilicon shortage. The all-important National Energy Administration, however, has yet to confirm whether the CPIA’s interpretation is correct.

Phase V of Dubai solar park to take shape before Phase IV

Utility DEWA has announced the first 300 MW of the fifth phase of the Mohammed bin Rashid Al Maktoum Solar Park will be commissioned next month, with the first stage of the fourth phase due to arrive two months later.

Polish developer announces €225m green bond plan

The first batch of five-year investments, offered through German-owned Polish lender Mbank, will raise money to expand a solar portfolio R.Power claims already stretches to more than 4 GWp in its domestic market.

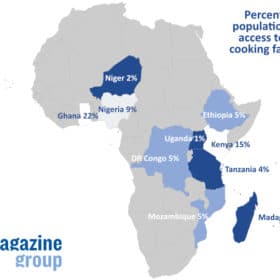

Universal electricity access by 2030 remains a distant dream

Energy efficiency, electrification of heating and transport, and the provision of clean cooking facilities are all going in the wrong direction as the Covid crisis deprived millions in sub-Saharan Africa of electricity use, according to a report by the IEA, IRENA, WHO, World Bank and UN Statistics Division.

pv magazine Roundtables Europe live coverage

Welcome to the first day of the pv magazine Roundtable Europe event! We have a packed two-day schedule planned for you comprising four cornerstone issues that will define the industry as it cements itself as a key pillar of the continent’s energy transition: Quality, Asset Management, Sustainability and Made in Europe, and the Innovation Hub: Hydrogen, battery storage, and e-mobility.

Romania sees first green bonds

World Bank arm the International Finance Corp has now extended almost €76 million of credit into two sustainable lending facilities launched via Raiffeisen Bank.

GCL note holders formally approve debt restructure

The holders of $500 million worth of senior notes which were not settled in late January have accepted the polysilicon manufacturer’s plan to issue fresh three-year investments, after a meeting in Bermuda on Friday.