Renewables power ahead in Australia

Green Energy Markets’ latest analysis shows the National Electricity Market is on track to get 33% renewable electricity by 2020, with individual states performing well beyond that. But the report claims solar jobs will be lost unless the National Energy Guarantee’s 26% emissions reduction target is lifted.

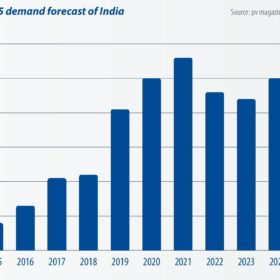

India’s trade war will have global repercussions

India is currently the second largest market in the world for PV module demand. With China’s domestic demand frozen since the 31/5 notification, the country’s total module demand in 2018 will likely only achieve 32-34 GW. This will allow India, which may surpass 10 GW in annual demand, to reach 13% of global PV demand this year. As a result, the future of India’s trade war has become an influential factor in the global PV industry.

The figures for China’s booming PV industry will be seen with a tinge of regret

In what analysts worldwide are sure to look back on as the last golden period for global solar – at least for the immediate future – China saw more impressive figures for PV manufacturing in the first half of the year. Then the government stepped in.

UK green lights fracking days after targeting small-scale renewables

Decision comes just days after business and energy department prepares to end export payments for solar households, and with parliament in its summer recess. The permit has outraged green groups, the opposition Labour Party and nearby residents.

India slashes tax rate for batteries and their raw materials

The 10% reduction in GST is an example to the UK government, which is seeking suggestions on how to drive solar take-up, but manufacturers are already calling for further reductions to fire battery storage in the nation.

Solar is turbocharging Karnataka state to renewables leadership of India

The remarkable 4 GW of solar capacity added last year has seen Karnataka displace Tamil Nadu as the India’s renewables number one. And there is more to come, according to a new report, with PV set to account for a third of rising energy demand over the next decade.

‘UK government knows the answers on solar, it’s just stalling’

Latest consultation exercise has been launched solely to buy time because Brexit is distracting officials from policymaking, according to a spokesman from the National Farmers’ Union.

Indian duties could jeopardize 27 GW of solar projects

Calling for a complete exemption of the 25% safeguard duty on solar equipment, India’s Solar Power Developers Association (SPDA) says, if imposed, it will jeopardize the viability of around 27,000 MW of solar projects involving an investment of more than Rs 1 lakh crore (around US$15 billion). Other key players also speak out against the tariff plans.

UK: Government considers ending solar export tariffs, ‘serious’ policy gaps must be addressed

The U.K. Government is proposing closing both generation and export tariffs for renewables on March 31, 2019. The country’s solar trade association calls for clarity on the policy framework going forward, for both industry and potential investors.

EU MIP decision to have more effect on Indian PV market than safeguard tariffs

The proposed safeguard tariffs on imports from China and Malaysia are expected to generate a number of painful short-term impacts. Overall they are not expected to change much in the market, however, says TrendForce. What will have a bigger effect is the EU’s final MIP decision, due in September.