Great to be made in America

There are both challenges and benefits to boosting solar manufacturing in America. The Inflation Reduction Act of 2022 includes a host of measures to support the production of US renewable energy technologies and could foster a new era for made-in-America solar. pv magazine USA Senior Editor Anne Fischer explores the current status and outlook of US solar manufacturing.

International investments in Indian PV

India is seeing massive investments in PV manufacturing, with manufacturers from Western countries, led by the United States, eager to get in on the act. Chinese companies have yet to make the same call, however.

Interconnection evolution

After a difficult couple of years, things are finally looking brighter for European PV equipment suppliers in 2022, with new projects on the horizon and plenty of space for innovation in the market. Germany’s M10 Solar Equipment is introducing a brand new, flexible approach to cell interconnection that promises big energy yield gains compared to typical half-cut cell multi-busbar modules. And the company is already seeing plenty of interest from producers developing products ranging from conventional modules to building-integrated PV and beyond, as M10 Solar Equipment CEO Philipp Zahn and Business Development Manager Michael Kröffges recently told pv magazine.

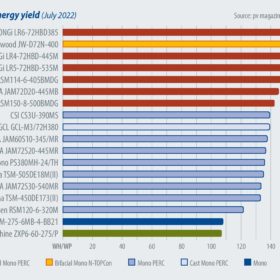

pv magazine test: July 2022 results

We are pleased to present the next batch of energy yield results from the outdoor test field in Xi’an, China. We also look at additional analysis from George Touloupas, the senior director technology and quality at CEA.

Acceleration across the EV value chain

Indonesian efforts to reduce reliance on fossil fuels and develop domestic production of battery energy storage materials and components are picking up pace, despite a slow start. And as Sorta Caroline reports, some of the raw materials are in place for success in Southeast Asia.

Digital finance for direct impact

As finance goes digital, apps and services are helping investors to make easier green investments: solar projects with real carbon savings, cleaner investments, and even direct investment in startups. But can people really make better green investments just from their phone? Tristan Rayner speaks to three different companies looking to make a difference.

From trend to transformation

There are three main drivers behind the continuing growth of solar today: the economics of energy, the energy crisis driven by the war in Ukraine, and a growing global focus on green and net zero initiatives. What matters is that these three drivers change the dynamics of investment – there is a growing body of capital looking to align with low-carbon, net-zero initiatives. Yet as the debate rages about operational versus overall sustainability, what is the future of solar for ESG finance?

Financing plant combinations

Battery business models are evolving, as the technology shows its worth on more of Europe’s grids. Experts from international law firm Osborne Clarke provide an overview of the legal framework for solar energy and battery storage combinations in Germany from a lender’s perspective.

No ordinary lending

ESG investing is growing quickly, including the practice of sustainable lending. Sustainability-linked loans are a part of the green financial wave, and as it breaks, new efforts are codifying the shape that these financial instruments should take for lenders and borrowers alike, writes Climate First Bank

CEO Ken LaRoe.

Loose threads

Material sustainability is fast rising up the solar and energy storage agendas. Increasing amounts of renewables, the electrification of sectors like transport, and a critical supply chain situation are just some of the reasons why. In Q4 2022, the UP Initiative is delving into the world of resources to find out what is being done to address these challenges. Of particular interest are steel, aluminum, glass, and precious metals like silver, copper, and cobalt.