Residential storage in Europe to grow 500% by 2024

A new report from analysts at Wood Mackenzie forecasts 6.6 GWh of residential energy storage to be installed across Europe by 2024. The economics of the technology are at a tipping point, increasingly reaching grid parity in European markets. With rising electricity demand and falling battery system costs, the trend will further spread across the continent and fuel an uptick in demand.

Japanese giants have solar operations on the down-low

Panasonic offloaded some of its PV interests to Chinese HJT cell maker GS-Solar and Kyocera is advertising further savings from its solar operations but neither business unit acted as a significant drag on wider group figures.

Utility scale, rather than behind-the-meter batteries will drive energy storage take-up – Bloomberg u-turn

The analyst has published its latest Energy Storage Outlook report and says large scale deployment will provide the majority of the 1,095 GW/2,850 GWh of battery storage worldwide in 2040, with prices driven down further by grid services demand and EVs.

India’s renewable power generation cost the lowest in Asia Pacific

The cost of solar power generation in India has fallen to half the level seen in many other markets in the region due to extensive solar resource, market scale and competition.

CATL to enter Japan’s residential storage market

Previously known for its automotive activity, CATL is turning to another promising sector to generate demand for its battery cells. With the first few hundred thousand Japanese solar households seeing their 10-year FIT contracts expire, demand for small scale storage is on the rise

Japan’s Toray to manufacture battery components in Europe

Japanese materials company Toray has announced plans to open a facility for manufacturing battery separator films for use in lithium-ion batteries. The factory is expected to begin operations in July 2021 and will increase Toray’s production material for the component by around 20%.

Interview: Fimer CEO Filippo Carzaniga discusses acquisition of ABB inverter business

After the bombshell news this week, the Italian inverter manufacturer’s CEO spoke to pv magazine about the future of ABB’s R&D hubs, manufacturing sites, hundreds of employees and of course Fimer’s outlook.

Toyota shows off solar Prius with 860 W output from 34% efficient cells

The car will be road tested at Toyota City in Japan. Solar charging technology for the vehicle will then be further optimized before the vehicle goes on sale.

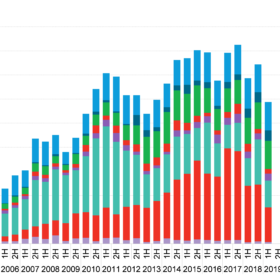

Global renewables investment fell in the first half of this year

While Spain, Sweden, Ukraine and Brazil attracted more funds than last year, China’s transition to an auction-based procurement system and slow performance overall in Europe saw worldwide backing decrease. BloombergNEF does expect investments to ramp up in the second half, however.

Etrion and Jinko turn their gaze on Japanese market

The U.S. project developer and Chinese manufacturing giant have both moved to extend borrowing for Japanese operations as Sumitomo Mitsui has given another lift to its domestic PV market.