Ukraine receives solar panels to power hospitals

Over 5,800 solar panels manufactured by Italy’s Enel have been delivered to Ukraine to help power healthcare facilties.

Feasibility study assesses PV plants for Ukrainian hospitals, water facilities

A new study by the United Nations Development Programme in Ukraine assesses the feasibility of 37 solar projects proposed at hospitals and water supply facilities in 18 Ukrainian cities. It shows the potential to generate around 16 million kWh of clean energy if fully implemented, ensuring uninterrupted power supply.

NREL updates online tool with data for Africa, Eastern Europe, Middle East

The US Department of Energy’s National Renewable Energy Laboratory (NREL) has added a high-resolution solar data set covering Africa, Eastern Europe and the Middle East on its Renewable Energy Data Explorer tool.

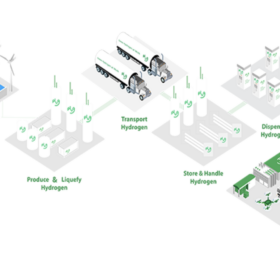

The Hydrogen Stream: Plug Power commissions 1 MW PEM electrolyzer

A number of hydrogen projects are moving forward in the United States, Germany and Denmark. In other developments, the German state of Saxony is teaming up with other partners, including the Czech Republic, to set up a hydrogen network in Eastern Europe.

German company installs PV-powered desalination plant in Ukraine

Germany’s Boreal Light says it has installed a desalination plant in Mykolaiv, Ukraine. It claims that the system – which uses 560 W solar modules to produce 125 cubic meters of clean water per hour – is Europe’s largest PV-powered desalination project.

Conventional grids place power plants in the crosshairs

Warnings about the need to decentralize Ukraine’s electricity grid, made 10 years before the Russian invasion, fell on deaf ears at the time. In the wake of war, nations across Eastern and Central Europe are alive to the risks embodied in traditional energy networks.

Weekend Read: Excluded from Russian vandalism

Built as a symbol of hope amid disaster, the decision to construct a solar site at Chornobyl may have saved it from the destruction that other power generation facilities suffered during early Russian advances in Ukraine.

Weekend Read: ‘Please open your wallets’

Donations of cash and solar equipment have thrown a lifeline to schools, hospitals, and communities in Ukraine but the country needs much more, including long-term backing for the recovery of its industry, reports Ian Skarytovsky.

Weekend Read: Hopes washed away

The Ukrainian solar industry had hoped that a long-anticipated counter-offensive against the Russians would help reclaim PV assets on the eastern bank of the Dnipro River. The brutal reality is that the destruction of the Kakhovka dam has likely severely damaged solar plants in the affected territories, reports Ian Skarytovsky.

A bright spot in the darkest hour

Solar is not only helping to keep the lights on in Ukraine – it also has a vital role as part of Europe’s energy transition and clean energy economy.