The weekend read: Large-format PV modules – is bigger really better?

Large-format PV modules are a key development in solar technology and advocates say their emergence has the potential to be one of the most significant innovations the industry has ever seen. But many people remain unconvinced that bigger is actually better.

The Hydrogen Stream: US port wants to produce 9,000 MT with 260 MW/840 MWh of solar-plus-storage

Aurora Energy Research reports that the size of electrolyzers is increasing. Furthermore, Chile moves forward with its first green hydrogen project and German car manufacturer BMW said it would unveil a hydrogen fuel cell SUV in 2022.

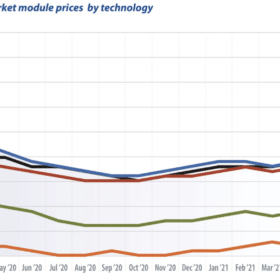

EU spot market module prices: Is sustainable market development possible?

Module manufacturers have once again adjusted their prices upwards. This is already the third or fourth price increase in the last six months, and there is no end in sight, writes Martin Schachinger of pvXchange. But why is it so hard to achieve long-term, sustainable development in the global solar market, at least on the part of manufacturers? Few other industries are so turbulent, with constant swings between excess supply and bottlenecks, between price collapses and price rises – and always to the breaking point of the market. Yet again, planning security is out the window.

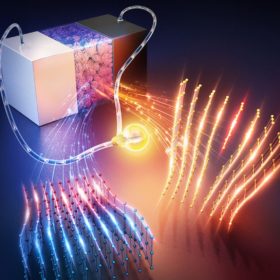

Exploring defects in a solid-state electrolyte

Scientists in the U.S. used sophisticated imaging techniques to observe previously unknown defects in the crystalline structure of a solid-state electrolyte. The scientists theorize that these defects could play an important role in the electrolyte’s performance, and that designing them more carefully into the material could have impressive results.

Tongwei became the largest polysilicon producer in 2020

A new report from Bernreuter Research reveals that Wacker Chemie lost its top spot in the 2020 global polysilicon rankings. It was also the only western company among the “Big Six” that are expected to form a new polysilicon super league in the PV industry. Overall, these six reached a total polysilicon capacity of 470,000 MT last year.

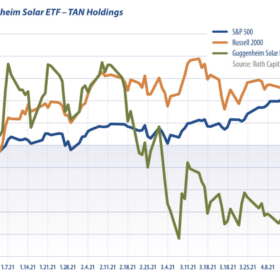

Guggenheim Solar Index: PV stocks slip on short supply

Supply shortages and price increases slowed solar stocks in April, writes Jesse Pichel of ROTH Capital Partners. In the United States, however, new policies promise to foster growth in the second half of the year.

The Hydrogen Stream: Massive hydrogen/green ammonia project in Chile, hydrogen atlas for Germany

Furthermore, Canadian integrated energy company Suncor and Canadian holding company ATCO are looking into a potential “world scale clean hydrogen project” in Alberta, and Japanese energy company Eneos and Japanese multinational automotive manufacturer Toyota Motor, are exploring hydrogen applications at Woven City, a prototype city in Japan.

‘Hydrogen as a universal climate solution might be a bit of false promise’

Hydrogen and hydrogen-based fuels will not be able to move forward fast enough to replace fossil fuels and tackle climate change, according to a German-Swiss research team that claims direct electrification alternatives are cheaper and easier to implement. The scientists cite too-high prices, short-term scarcity and long-term uncertainty, as the main reasons for their skepticism.

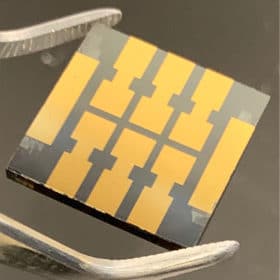

Perovskites stick together for better performance

Scientists in the U.S. demonstrated an additive that acts as a “molecular glue” within a perovskite solar cell. Treating the cells with this self-assembled monolayer material was shown to greatly improve their long-term performance, whilst also providing a boost to conversion efficiency. And the scientists further point out that the treatment relies on simple processing and readily available materials – good signs for its applicability in manufacturing.

The best world regions for compressed air storage

Compressed air energy storage (CAES) may become an interesting solution for countries with weak interconnection with their neighbors, according to scientists from Finland’s Lappeenranta University of Technology (LUT). North America and sub-Saharan Africa were found to have the largest portion of suitable areas for this kind of storage technology, and Western Canada in particular, to have the world’s strongest potential.