From pv magazine 05/2021

Module manufacturers in the 500-watt-plus club are adamant that the high-power solar PV panels provide project developers with an economic edge. They claim that large-format modules produce the best levelized cost of energy (LCOE) and deliver improved balance of system (BOS) costs.

However, there are people such as Dennis She, senior vice president of Chinese solar wafer and module manufacturer Longi Solar, who have gone on the record to say that bigger module sizes aren’t always better.

Longi Solar is among the manufacturers that have pursued the large-format module technology, recently adding a 540 W module to its high-performance Hi-MO series. Longi is a key proponent of the 182 mm cell size, with a few other manufacturers, including Trina Solar, Canadian Solar and Risen, moving up to the larger 210 mm dimension, producing larger modules as well. Longi’s She acknowledges that high-power modules have economic advantages, but he said that this only part of the equation.

“For large-scale PV power stations, increasing the power of PV modules by increasing the wafer area is, to a certain extent, beneficial to the reduction of BOS costs and LCOE,” he said. “That said, the size of the module is not a question of bigger being better. It is necessary to consider in depth the boundary conditions of manufacturing costs, transportation, reliability and manual installation.”

Increasing costs

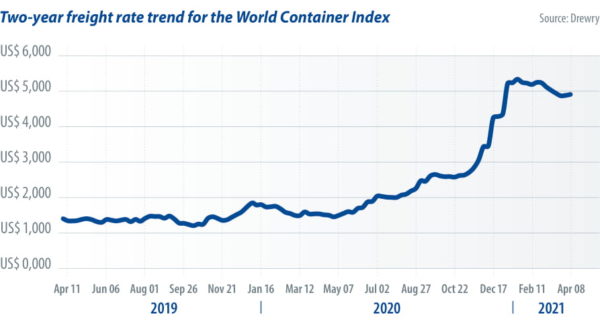

Identifying transportation of large-format modules as a factor to consider is pertinent in today’s climate, when skyrocketing shipping costs have emerged as a major challenge confronting all module manufacturers – even before the recent Suez Canal blockage.

Ocean freight charges have shot up substantially in the wake of the Covid-19 pandemic, triggered in part by a shortage of shipping containers returning to China, which is home to seven of the world’s 10 busiest container ports.

Although containers continue to move from China to elsewhere in Europe, North America and the Asia-Pacific region (APAC), few are making the return journey. Data from the Shanghai International Shipping Institute’s domestic shipping research office indicates that for every 10 containers sent to North America, currently only four are being sent back.

BloombergNEF’s (BNEF) head solar analyst, Jenny Chase, told pv magazine that container shipping costs for shipments to most destinations out of China and Asia had soared in recent months.

“The WCI Shanghai to Rotterdam Freight Index, which is in US dollars to ship a 40-foot container, is now at $7,500. It hit $9,000 in January after rising from $2,250 in October 2020,” she said, adding that costs for the Shanghai-Genoa route looks similar.

“WCI Shanghai to Los Angeles is currently about $4,300, the highest in at least 10 years – it has risen from about $1,500 in H1 2020.”

The Freightos Baltic Global Container Index (FBX) has more than tripled for the China-United States west coast route since March 2020, reaching $5,190 on April 9. Similar increases have been seen to the U.S. east coast, and for ocean freight to the U.K. David Dixon, Rystad Energy’s senior Asia-Pacific analyst, said shipping costs had also climbed to new heights in APAC since the start of the year.

“Shipping rates have gone through the roof,” he said. “We were hearing up to $6,000 or $7,000 at the peak in Australia but it’s now dropped back down to $4,000 to $5,000.” Dixon said he expected the price pressures to continue at least until the middle of the year, and possibly until the end of 2021.

EPC impact

Indian multinational Sterling and Wilson, which has a global solar engineering, procurement and construction (EPC) portfolio of more than 10 GW across 25 countries, said shipping container shortages have been a major issue. It has noted that ocean freight costs have been rising by as much as three times in recent months.

“The availability of shipping containers has been a major challenge throughout the Covid-19 pandemic, with cargo frequently arriving late due to shipments either being delayed or canceled,” a spokesperson for the Australian arm of the company said.

“From India, about 80% of shipments destined for Australia move through Singapore. At one point, Singapore had approximately 2 million containers waiting to be dispatched to Australia, with little certainty as to precisely when those containers would be shipped.”

Dixon said the rise in shipping costs is not a solar-specific issue, but agreed that it is having a marked effect in the industry. The per unit cost of shipping modules has quadrupled from a steady recent average of around $0.005/Wp watt peak to $0.02/Wp in 2021.

“And that has quite a dramatic increase on the capex of projects,” he said. “These [price] movements make the modules, not that they weren’t a significant proportion of capex already, an even more significant proportion of capex. Enough to really eat into the margins or delay the financial close and construction start of these projects.”

While the soaring shipping costs applies to both traditional and large-format modules, the high-power modules are physically much larger and heavier than those found on residential rooftops the world over, and that presents its own set of challenges when it comes to logistics.

A conventional module measures approximately 2,000 mm x 1,000 mm x 35 mm and weighs about 20 kilograms, whereas many of the newer large-format modules measure up to 2,300 mm × 1,200 mm × 35mm and weigh in at more than 30 kg. Even larger modules are on the market, too. Beijing-headquartered manufacturer JA Solar recently announced its new Jumbo module, which the company says has a maximum power output of 800 W. While not yet in mass production, the product sheet indicates the Jumbo measures 2,219 mm × 1,765 mm x 40 mm and weighs in at a hefty 43.5 kg.

The size of the new generation of large-format modules presents a physical challenge at all stages of the logistics supply chain. The size and weight of modules larger than 2 m² don’t allow for single-person handling. And when it comes to shipping, the door height of a standard 40-foot shipping container limits module sizes to widths no greater than 2,343 mm and lengths of 2,280 mm.

This is a challenge for manufacturers looking to make the most of the available capacity in shipping containers.

Packing power

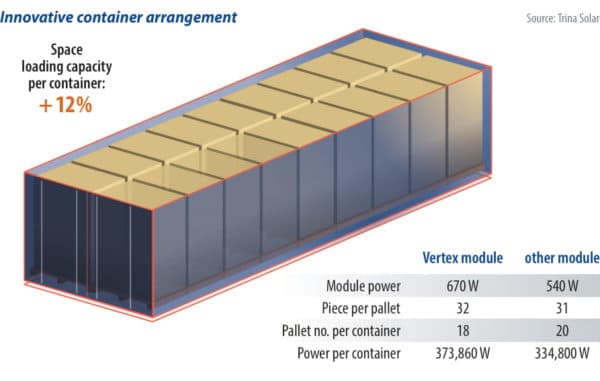

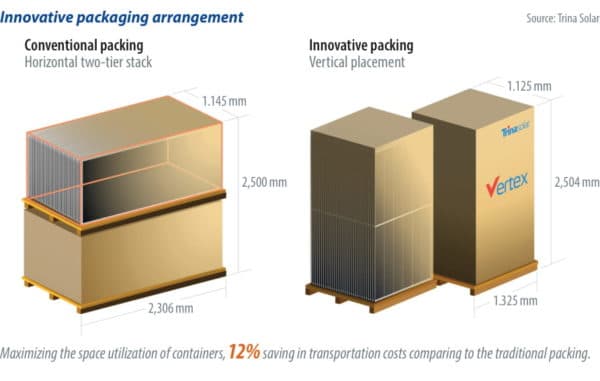

Chinese PV manufacturer Trina Solar, which is at the vanguard of the large-format module movement, has adopted a new approach to packing, claiming it reduces shipping costs by maximizing the space inside the shipping container.

In March, Trina Solar unveiled a new addition to its ultra-high power Vertex series, which the company said will deliver 670 W. Trina Solar has developed a packing method that places the modules vertically inside containers. The company said the new method allows for 558 of its 600 W+ modules, spread across 18 pallets, to be transported in a standard 40-foot container.

Trina Solar said the change equates to a 12% increase in modules shipped inside each container, which in turn reduces shipping costs by 12% for each module.

A “back-of-the-envelope” calculation by BNEF’s Chase illustrated the cost differential between the traditional and newer large-format modules. “Assuming 840 modules per container and 350 W per module, I estimate about 2.5 U.S. cents per watt to Rotterdam,” she said.

Using the figures provided by Trina Solar, the cost to ship a container of 600 W modules to the same destination would equate to $0.022/W. Despite the price differential, Sterling and Wilson said the shipping costs remain a deterrent to the application of large-format modules.

“Economies of scale is a major consideration for higher wattage modules,” the Sterling and Wilson spokesperson said. “To date, large-format modules have not been able to offer greater module efficiency. Even though the number of modules is reduced per project, the increase in tracker pitch – due to high lengths – increases the ground cover ratio and thereby negates the high wattage of the modules. So, unless module manufacturers stop producing certain small-format modules, buyers will generally remain cautious moving to large-format modules.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.