PV demand, changing auctions and price declines – GTM lays out its latest predictions

An uptick in global PV demand will occur in 2020, with China’s 30.5 policy directly affecting 2018’s results by around 18%, says GTM Research. Rapidly falling module prices will benefit predominantly Asian markets, where modules comprise the lion’s share of capex, although regions like Europe will see increased installations. Laying out 10 PV predictions, it anticipates, among others, intensified competition, lower bid prices, more technology neutral auctions and an increasing amount of subsidy free solar.

The weekend read: More strings to the bow

New developments in inverter architecture suggest that string inverters have charged forwards again to take on the challenge and kick central inverters off the throne in the utility-scale market. Hardware design innovations allowing to cut down BoS capex and improve efficiency of the plants might push string inverters further to take more space in the utility-scale market place.

Second-life EV battery market to grow to $4.2 billion by 2025

Circular Energy Storage, a London-based research and consulting group, reports a strong business case for reconstituted electric vehicle batteries for energy storage applications. As the EV and static storage system markets grow rapidly, synergies could be a useful tool for continued cost optimization.

EV charging infrastructure market to reach $18 billion by 2030

EV charging infrastructure is set to become a major market, and actors from different sectors like municipal utilities, inverter companies and storage system providers are getting creative, and collaborative, in order to secure a slice of the cake.

Prices begin to stabilize, though falling revenues and job losses expected among Chinese manufacturers

According to reports from Energy Trend, a 30% decline in PV demand from China this year will likely spell trouble for some of the country’s major module manufacturers, with job losses and factory closures expected, despite China’s determination to open new international markets for its PV industry.

Milestone: Over one trillion watts of wind and solar installed

A BloombergNEF analysis states that global wind and solar PV installations have reached a trillion watts, for the first time. While this milestone took the industry 40 years, the second trillion watts are expected to be installed in five years, in 2023, with the help of storage. The investment costs required to install one trillion watts are also expected to half.

World Overshoot Day comes early this year

World Overshoot Day marks the day the world has used up its annual budget of the resources it could have sustainably consumed. Despite efforts in relevant sectors, the date is creeping forward every year. Twenty years ago, it was in late September.

Chinese shadow over latest IEA world energy report

The International Energy Agency’s latest study of global energy investment paints another rosy picture for solar – even as the authors warn of missed sustainable growth targets – but the report covers last year, and notes China’s policy about-turn could blow a cold wind through PV.

India’s trade war will have global repercussions

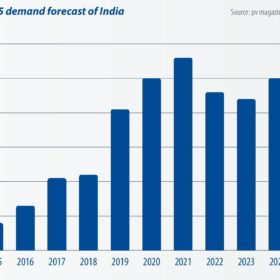

India is currently the second largest market in the world for PV module demand. With China’s domestic demand frozen since the 31/5 notification, the country’s total module demand in 2018 will likely only achieve 32-34 GW. This will allow India, which may surpass 10 GW in annual demand, to reach 13% of global PV demand this year. As a result, the future of India’s trade war has become an influential factor in the global PV industry.

The figures for China’s booming PV industry will be seen with a tinge of regret

In what analysts worldwide are sure to look back on as the last golden period for global solar – at least for the immediate future – China saw more impressive figures for PV manufacturing in the first half of the year. Then the government stepped in.