Bangladesh promoting renewables via green bond policy

The central bank of Bangladesh issued a new policy on green bond financing this week for banks and financial institutions that provide low-cost, long-term loans for renewable energy.

Bangladeshi banks can invest in Islamic green bonds

The nation’s central bank this week said the special funds built up by domestic lenders to maintain stock market liquidity could be used to purchase sharia-compliant ‘sukuk’ green bonds which made their debut last month.

Acme Solar raises $334 million via offshore green bonds

Indian developer Acme Solar’s green bonds were oversubscribed by over three times, and will support it financing twelve projects for a combined 450MW (or 605 MWp) of its operational assets in India.

Universal electricity access by 2030 remains a distant dream

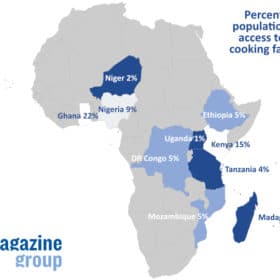

Energy efficiency, electrification of heating and transport, and the provision of clean cooking facilities are all going in the wrong direction as the Covid crisis deprived millions in sub-Saharan Africa of electricity use, according to a report by the IEA, IRENA, WHO, World Bank and UN Statistics Division.

South African bank secures continent’s ‘first green loan’

The private-sector arm of the World Bank says it will lend up to $150 million to Johannesburg-based Absa Bank for green project funding.

Jenny Chase predicts up to 194 GW of solar this year

Falling module prices will help PV post another record year after an estimated 132 GW was installed worldwide in 2020, according to an energy transition investment trends report published by Bloomberg New Energy Finance.

Peeking into 2021: Green bonds to reach US$500 billion per year, solar on track to outrank oil and gas

Global management consulting firm PricewaterhouseCoopers has issued a general economic prediction for 2021. Aside from some general notes on GDP recovery post-Covid, the analysts’ notes were heavily focussed on climate and energy finance and policy.

PV trends of 2020: Part 2

Despite much of the world being on lockdown for a big chunk of 2020, there are few who could say it has been an uneventful year. And while the ongoing Covid-19 pandemic will be what defines 2020 for many, in the solar industry there’s plenty more to shout about, from the rapid rollout of high-powered modules to a drastic increase in carbon-neutral pledges from companies and governments around the world. Across five installments, pv magazine takes a look back at the year in solar. First up were the U.S. election and carbon neutral pledges. Today, we’re talking about auctions and green bonds.

Pension funds and corporates could save the world

The second edition of the clean energy investment report produced by IRENA says the industry needs to unlock the $87 trillion being sat on by the world’s biggest investment houses – ‘greening’ the $100 trillion global bond market would help too.

Tokyo Gas issues green bond to fund acquisition of 694 MW of PV

The Japanese gas provider wants to acquire a 63.2 MW solar plant in Japan and a 631 MW PV facility in the United States. It has issued a JPY 10 billion ($95.9 million) green bond to finance these transactions and support its other operations.