The Hydrogen Stream: Offshore hydrogen pipeline and more electrolysis capacity in Germany

Big German conglomerates such as Siemens, RWE and Vattenfall keep pushing for green hydrogen development through different projects. Germany’s first offshore hydrogen pipeline is being planned by RWE itself, Shell, Gascade and Gasunie, and should be commissioned in 2035. Siemens is planning hydrogen projects in the 5 MW to 50 MW range, for industrial and mobility applications.

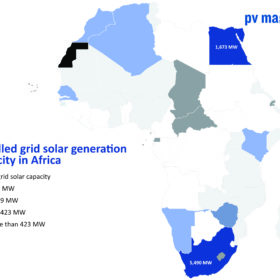

EU to offer expertise to drive renewables-friendly policy across Africa

The oft-heard industry call for more supportive policy for renewables, this time in Africa, has prompted the European Commission to pledge to work with its continental counterpart on improving the clean energy regulatory environment.

The Hydrogen Stream: Alstom moves forward with world’s first hydrogen train, Chile seeks proposal for hydrogen projects

French train manufacturer Alstom said that its Coradia iLint train is now ready for commercial deployment and the Chilean government launched a call for green hydrogen projects. Furthermore, several developments for fuel cell electric vehicles were announced.

Longi crowned king of solar with 24.5 GW of panels shipped in 2020

With production capacity expanded for solar wafers, cells and modules last year, and set to rise again in 2021, the giant is targeting shipments of 40 GW of panels this time around.

Spanish developer plans 1 GW solar plant coupled to 80 MW of storage, 100 MW electrolyzer

Soto Solar has submitted the project proposal to the Ministry of the Ecological Transition and the Demographic Challenge (Miteco). The solar plant could start production in 2023 or 2024 and will have a generation capacity of more than 2,000 GWh/year.

The Hydrogen Stream: 20 MW green hydrogen plant in Finland, two Australian projects move forward

Storegga, Shell and Harbour Energy want to set up a 20 MW blue hydrogen production facility in the U.K. Australia’s Origin Energy wants to build a hydrogen facility at the Port of Townsville, in Queensland. South African company Sasol and Toyota South Africa Motors have announced a partnership to “commence exploration of the development of a green hydrogen mobility ecosystem in South Africa,” starting with zero-emission hydrogen fuel cell (FC) heavy-duty, long-haul trucks.

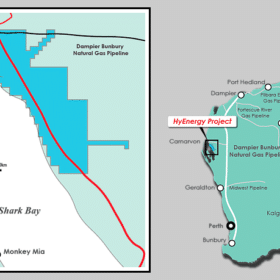

Australian green hydrogen project grows from 1 GW to 8 GW, following commitment from Total Eren

Province Resources has signed a memorandum of understanding with French renewable energy developer Total Eren, which could see the two companies have equal shares in Province’s HyEnergy Zero Carbon Hydrogen project proposed in northwest Western Australia.

Green hydrogen and the cable-pipeline dilemma

New research from Singapore has found that gas pipelines for the onshore transport of green hydrogen and the cables for the transport of electricity to produce it at a distant location have similar costs at a 4000 km transmission distance. For longer distances, gas pipelines were found to be cheaper than cables, although the electric lines are said to benefit from scaling up and higher utilization. For both options, however, a currently too high hydrogen LCOE remains the biggest barrier to overcome.

The Hydrogen Stream: 39,700 km European hydrogen network planned, Germany means business

Several heavyweights in Germany have announced projects to move forward with green hydrogen. RWE, Uniper and Bosch have all announced large-scale projects and the German government has allocated €52 million for hydrogen research. The European Hydrogen Backbone (EHB) initiative is proposing a hydrogen network of 39,700 km by 2040, with further growth expected after 2040.

The Hydrogen Stream: EU launches call for low-carbon hydrogen tech, Netherlands unveils €338m plan

Furthermore, Michelin said it wants to become a world leader in hydrogen fuel cell systems and ScottishPower aims to build a green hydrogen plant at a wind power complex. Moreover, a study led by scientists at the U.S. Department of Energy’s (DOE) Argonne National Laboratory suggested new strategies to design perovskite materials to speed up the oxygen evolution reaction (OER), a process that frees up molecular oxygen from water and is key for hydrogen production.