California-headquartered microinverter specialist, Enphase Energy has announced today a partnership with Japanese electronics giant, Panasonic to deliver AC modules that utilize the latest product iterations from both firms.

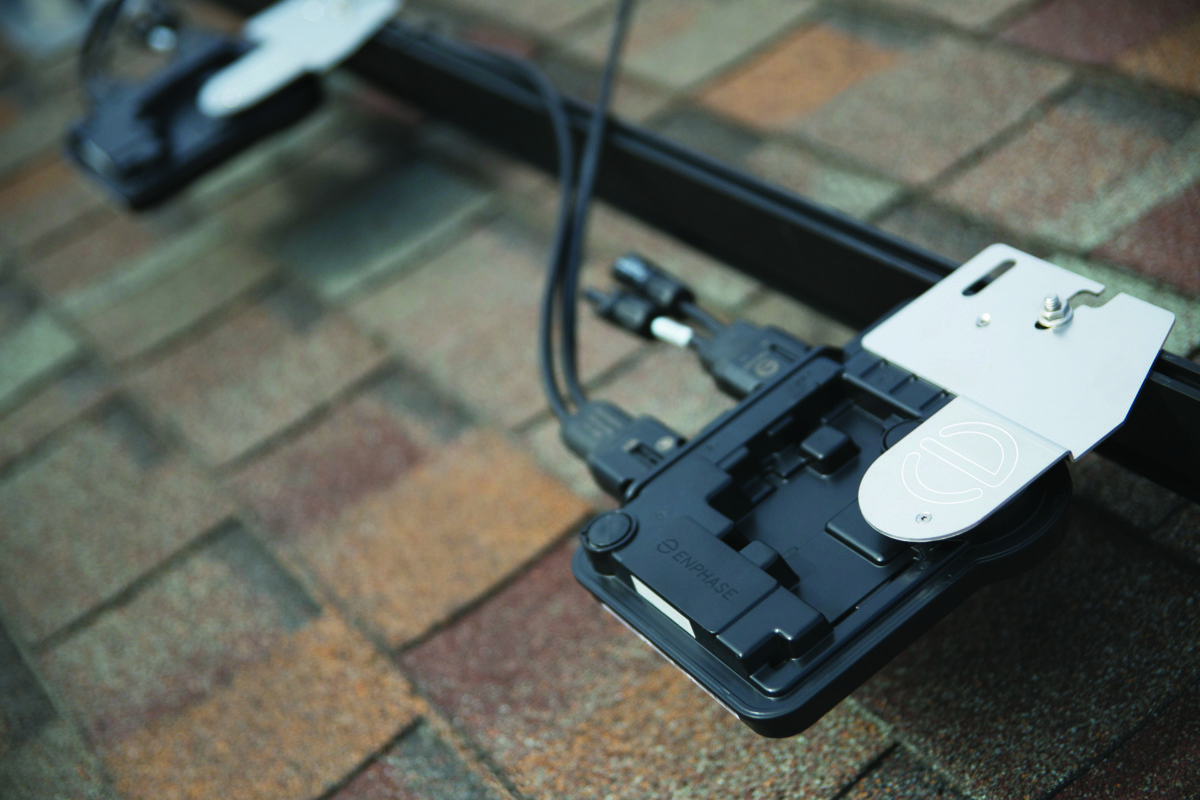

The new microinverter from Enphase – the IQ 7X – is to be fitted to Panasonic’s 96-cell HIT solar modules and made available to distributors and installers in North America. Such a partnership follows on from existing AC module tie-ups between Enphase and Waaree in India, and global collaborations with LG, JinkoSolar and SolarWorld.

The benefits of AC modules include faster installation times thanks to the simplified architecture, and by embedding the microinverter at the fab stage, Enphase also claims that the overall installation quality is higher and at reduced risk of fault. By partnering at the production stage, logistics and overhead costs are also brought down.

According to Panasonic Residential Solar Group manager, Mukesh Sethi, the partnership offers a new production solution for the firm, which also recently rolled out its new “all-black” panel – manufactured with a black backsheet – to the U.S. residential market.

These AC modules will be produced using Panasonic’s N Series HIT modules, the company confirmed. “These modules are an ideal partner for the Enphase IQ 7X microinverter,” said Sethi. “With a unique HJT and advanced bifacial cells, these high-efficiency panels offer homeowners state-of-the-art features and maximum solar production.”

A major route to market for AC modules in the U.S. residential space is their inherent compliance with new NEC 2017 safety regulations, specifically rapid shutdown capability. Enphase’s microinverters are equipped with Enphase Envoy, which is a gateway monitoring software that enables instant shutdown of each module if and when required.

Off-the-shelf AC and smart (modules fitted with DC power optimizers) modules are poised to corner a greater share of the PV panel market as safety regulations (such as rapid shutdown) broaden, and costs tighten.

IHS Markit expects such products to account for around 4 GW of global installs by 2020, up from less than 400 MW in 2017. “Growth will be driven by cost efficiencies gained from manufacturing through to the installation, and by sales channels shifting to module suppliers, which will develop more high-volume buyers,” said IHS Markit senior solar analyst Cormac Gilligan in a recent report on AC and smart modules.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

You wrote, “Enphase’s microinverters are equipped with Enphase Envoy, which is a gateway monitoring software that enables instant shutdown of each module if and when required.”

The gateway MONITORING software in an of itself doesn’t enable the rapid shutdown feature of the microinverter. In fact the Envoy isn’t required in a simple installation of microinverters. However, without the envoy you wouldn’t have panel level monitoring software.

Each microinverter installed in the united states will shut down when the grid is not energized with or without the envoy.

Is there any independent laboratory that confirms Enphase microinverters can withstand 25 years?

I read on their datasheet that they “tested millions of hours”. These americans realy like the word “millions and billions” but these are words.

Where are the independent results?

Sadly they use electrolytic capacitors so its hard to believe that 25 year…. rather 5 year or max 15 in my oppinion.

i was under impression that they stopped using electrolytic caps long time ago.- you might check in to that again

tell us about single company that uses independent lab that will run tests for “millions of hours” – there are methods to run accelerated time testing on electronics (just run internet search) the way they do have billions of hours of data (that is because all online inverters are connected to their servers – online monitoring

looks like they de-rated the caps and they posted the study

https://enphase.com/sites/default/files/EnphaseElectrolyticCapacitorLife.pdf