Half a million: 500,000 homes in a nation of 127 million people. It may not sound like a lot, but those half a million households were bold pioneers back in 2009. As early adopters of rooftop solar power a decade ago, these households were lavished with a feed-in tariff (FIT) that feels preposterously generous in today’s money. At JPY 48/kWh ($0.44), a Japanese residential FIT in 2009 was a fine investment, even if the average solar system cost at the time was equally extortionate in comparison to today.

Those early FITs sowed the seeds for a tremendous period of solar growth in Japan. Accelerated by the nation’s shunning of nuclear power in 2011 in the wake of the Great East Japan Earthquake and Fukushima nuclear disaster, Japan’s annual solar growth regularly reached double-digit gigawatt figures before easing up slightly in 2017. Now that the peak has passed, the industry has begun to settle into a sustainable rhythm. Japan is in the middle of a ‘three year peak,’ in which around 7-9 GW of new solar capacity is expected to be added annually.

Market maturation is now driving diversification. Large-scale ‘mega solar’ projects in Japan may not be as in vogue as they once were, but there remains more than 23 GW of FIT-approved solar plant projects larger than 50 kW in Japan’s pipeline. The FIT available for those projects approved between 2012 and 2014 that will not meet their completion deadline is to be vastly reduced by the government, with the new auction system – introduced in 2017 – intended to nurture and incentivize steady and stable large-scale solar additions to the Japanese grid.

However, it is in the rooftop sectors – both residential and commercial and industrial (C&I) – where greater potential, interest, and indeed challenges lie. From self-consumption utilizing storage to the emergence of an entirely new way of building and buying homes in Japan, solar is angling its way into the hearts and homes of millions of Japanese via new and innovative avenues.

Self-consumption: a tipping point?

With those half a million solar homes set to graduate from their 2009-level FIT from November this year, the question many of those homeowners are now asking themselves is: What do I do with my solar energy after that point?

Although almost all of the power companies in Japan have confirmed that they will continue to buy the solar electricity generated after the FIT comes to an end, the price paid will be below

JPY 10/kWh ($0.09) – which is far lower than the price of electricity from the grid. By way of comparison, homeowners who install a new solar system in 2019 will receive a FIT price of JPY 24/kWh ($0.22), while the average electricity price across Japan over the five year period between 2011 and 2016 was JPY 23.35/kWh, according to the Japanese Agency for Natural Resources and Energy.

It is becoming increasingly clear that the advantages of offering a FIT for residential rooftop solar in Japan are being stripped back. When you consider that the average up-front price of a typical rooftop solar system in Japan is around JPY 1 million (~$9,200), it would be wise to ask: “Who can afford to invest in rooftop PV in Japan?”

At Hanwha Q Cells, our sales strategy used to be quite simple: Customers were advised to take out a loan for the up-front costs of the system, and use the generous FIT payments to pay off that loan while still turning a profit. But with current electricity prices expected to increase in the coming year – coupled with ever-decreasing solar system costs – the message now is one of self-consumption, energy independence, and storage.

Almost uniquely for an advanced economy with a robust electricity grid, homeowners in Japan still have to plan for intermittent power outages. The nation is famously prone to natural disasters that to this day continue to cause blackouts, most recently experienced in Hokkaido last September following the magnitude 6.7 earthquake that struck the island, causing whole cities to go dark.

When concerns over energy security align with lowered solar system costs and a less attractive FIT incentive, as they have begun to do in Japan, talk inevitably turns to self-consumption and storage. This is the transition that we expect to see define rooftop solar in Japan over the coming years – more so in the residential space than the C&I space in the near term, although both segments will transition towards this model significantly in the future.

Battery storage’s role in this transition will grow incrementally. The Japanese government hopes to generate up to 24% of its electricity from renewable sources in 2030, and achieving that target is reliant upon the support of smart and flexible energy storage systems cooperating with the grid.

In preparation for this inflection point, Kyushu Electric Power – one of the leading utilities in Japan – has begun a pilot program that allows residential solar+storage owners to participate in a virtual power plant (VPP) via their home batteries.

Hanwha Q Cells Japan has also been involved in such a scheme – we were in fact the first non-domestic solar company to offer Japanese customers the chance for solar providers to act as an energy supplier. The aim of such schemes is to further democratize Japan’s electricity market, injecting greater flexibility into the grid and offering a larger degree of independence for the homeowner.

From the ground up

Nuclear power, for obvious reasons, remains a sensitive topic across Japan. In 2011, the year of the Fukushima disaster, nuclear power accounted for 25% of Japan’s energy mix. That percentage plummeted to just 2% by 2016, as nuclear power plants were shuttered.

But fears about nuclear’s safety are waning: Indeed, the government is planning to bring nuclear’s share back up to around 20% of the energy mix by 2030.

By government decree, nuclear is the preferred base load capacity. In Kyushu in western Japan, for example, there have been instances of third-party solar power supply having grid access restricted as the nuclear base load grows due to the restarting of nuclear plants. Such a trend is expected to expand across Japan, which will, as it turns out, help to nurture more solar self-consumption in regions with high PV penetration.

Zero Energy Homes

Transcending all pro and con arguments concerning nuclear power, however, is a growing awareness of the need for greater energy efficiency and lower emissions. And while it is the government-led Zero Energy House (ZEH) program that is shaping this conversation, it is increasingly being driven by the people’s own desire to take better care of the environment.

The ZEH program is a great opportunity for solar in Japan. All of the house builders that are registered as ZEH builders are making long-term plans to ensure that they meet a commitment of building 50% of their housing stock as ZEHs by 2020, and this means working with solar component suppliers such as module manufacturers to ensure that these new homes are fitted with appropriately sized PV systems.

For the average Japanese consumer, this is a win-win situation. Although a ZEH will likely cost more than a ‘normal,’ non-ZEH new build, the longer-term financial and environmental benefits are becoming clearer with every passing day. The fact that these homes are being built from scratch also means that considerations around adequate, unshaded roof space for a solar installation are being taken into account from the start – and this plays into the hands of suppliers of high-efficiency and high powered modules that are ideal for such conditions.

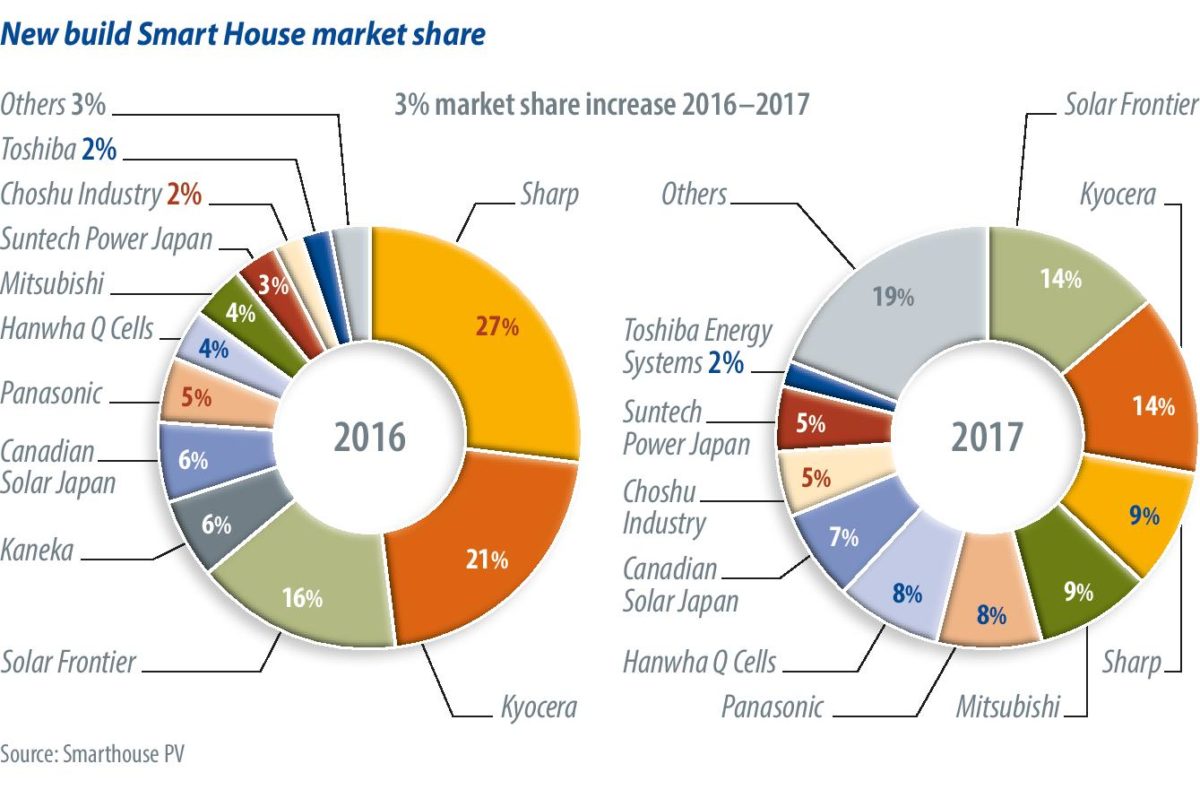

Consumers in Japan are also broadening their purchasing habits. For too long, Japanese consumers only really trusted Japanese manufactured appliances, goods and products – they were seen as a mark of guaranteed quality, whereas foreign competitors were often viewed with mistrust, if viewed at all. That mind set is changing. In fact, Hanwha Q Cells was the market leader in Japan’s module sector in 2017, shipping 770 MW to claim 12% market share.

We expect a similar share in 2018, and are heartened by this fact, not purely because of the way it looks on our balance sheet – but because it reflects a wider, national maturation of Japanese consumer culture: with solar firmly at the heart of the transition.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.