Rystad Energy today described as “blistering”, the uptick in renewables added to its database of energy assets proposed in January and February, with battery storage showing the greatest surge. The first two months of 2019 saw the intention to hook up 2.4 GW of new utility-scale battery storage — an increase of 25% on the existing storage pipeline.

“This is unprecedented,” said David Dixon, Senior Analyst with Rystad Energy APAC. “Half of 2018’s total storage capacity was added in just two months. We believe this is an indication of how attractive the long-term growth is for renewables in Australia.”

Dixon says the key growth has been in the addition of batteries to renewable-energy projects, with 16 of the new assets slated for hybrid solar-plus-battery, wind-plus-battery or three-way combinations.

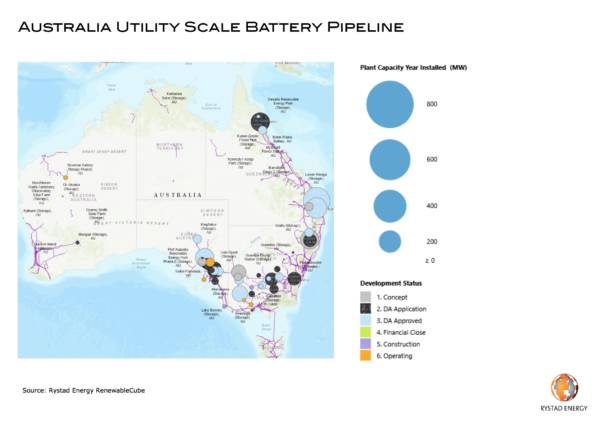

The most significant contributors to this year’s renewable-energy storage boom have been the 500 MW (AC) battery planned as part of Queensland’s $1.5 billion, 1.5 GW solar PV Sunshine Energy Project, due for connection to the grid in 2019; the Desailly Renewable Energy Park (250 MW solar PV and 300 MW of onshore wind), also in Queensland; and South Australia’s January proposal for 500 MW of solar PV plus 250 MW of battery storage at Robertstown solar farm.

Dixon says although the cost of batteries has declined a little on 2018 prices, the main impetus behind the increase in designing renewable energy projects that include batteries is the access that hybrid configurations give developers to participate in markets not available to unsupported wind and solar generation.

Suitably sized battery storage can offer access to participate in the Frequency Control Ancillary Service (FCAS) market, says Dixon, and to store energy for participation in the wholesale market during the late evening when demand, and spot prices, are higher.

Integrating batteries will also assist these projects in providing grid support services, which is becoming increasingly relevant as standards for connecting to the grid become stricter and transmission becomes constrained.

Popular content

Of the 2.4 GW of storage added in January/February, pumped hydro projects made up 490 MW (AC), which represents an 8% increase on the existing pumped hydro pipeline.

On the back of its latest analysis, Rystad predicts that Australia is likely to achieve a “symbolic renewables milestone before the polling stations open”. In a statement made today it forecast that the country’s renewable energy pipeline will reach 100 GW (AC) by the time of the Federal Election in May.

In total 62 new assets were added to the Rystad Energy database in January, which is double the capacity recorded during the same period in 2018.

“This clearly shows the confidence investors have in Australia’s renewable future and possibly where the renewables sector sees the election outcome going,” says Dixon.

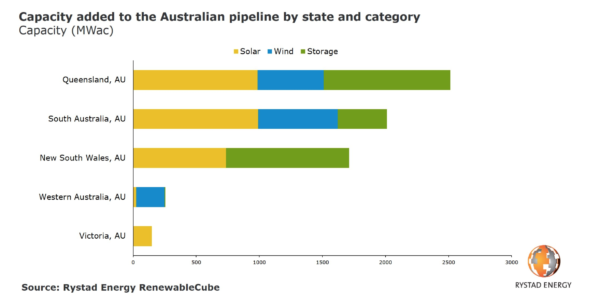

Solar PV installations also continued their powerful upward trajectory, adding 2.9 GW (AC), an increase of 7% on the solar pipeline as at 31 December 2018. And planned wind generation was up 4%, having added 1.4 GW (AC) in the new year. This brings the total pipeline as at 18 March 2019 to 96 GW according to Rystad Energy’s RenewableCube.

One hundred gigawatts by May hardly seems a battery too far.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.