If the communications staff at British energy company BP were exasperated by media reports yesterday which led on the historic cut in the dividend paid by a company beloved of pension fund investors, they can at least console themselves that reports unfolded to include commitments to invest in more “low-carbon energy.”

Media coverage splashed on the decision by BP to halve the dividend to $0.0525/share for the first time since the Deepwater Horizon oil spill ten years ago, with few, if any, outlets following the lead of the explanation behind the “dividend reset” and the “resilient dividend” given on the company website.

There was, at least, also a mention of the company’s commitment to ramp up annual low-carbon investment from its current $500 million to $5 billion by 2030 – and up to $4 billion in the next five years; to ramp up the business’ renewables generation portfolio from 2.5 GW today to around 50 GW over the decade, and to reduce oil and gas production by 40% from last year’s level.

Natural gas

It should be noted, “low-carbon energy” investment by BP apparently includes an element of natural gas, as the footnotes to the press release issued on the company website indicate the 10% of the global hydrogen market being targeted as part of that headline commitment include gas-fired ‘blue’ as well as clean energy-powered ‘green’ forms of the fuel. In fact, noted BP, it would be “building out a customer gas portfolio to complement those low-carbon energies.”

The low-carbon commitment also encompasses bioenergy and carbon capture, usage and storage (CCUS), with the former targeting production rising from around 22,000 barrels per day to more than 100,000 b/d by 2030. In e-mobility terms, BP pledged to expand its 7,500 electric vehicle charging point network to more than 70,000 by 2030.

Popular content

Fossil fuels

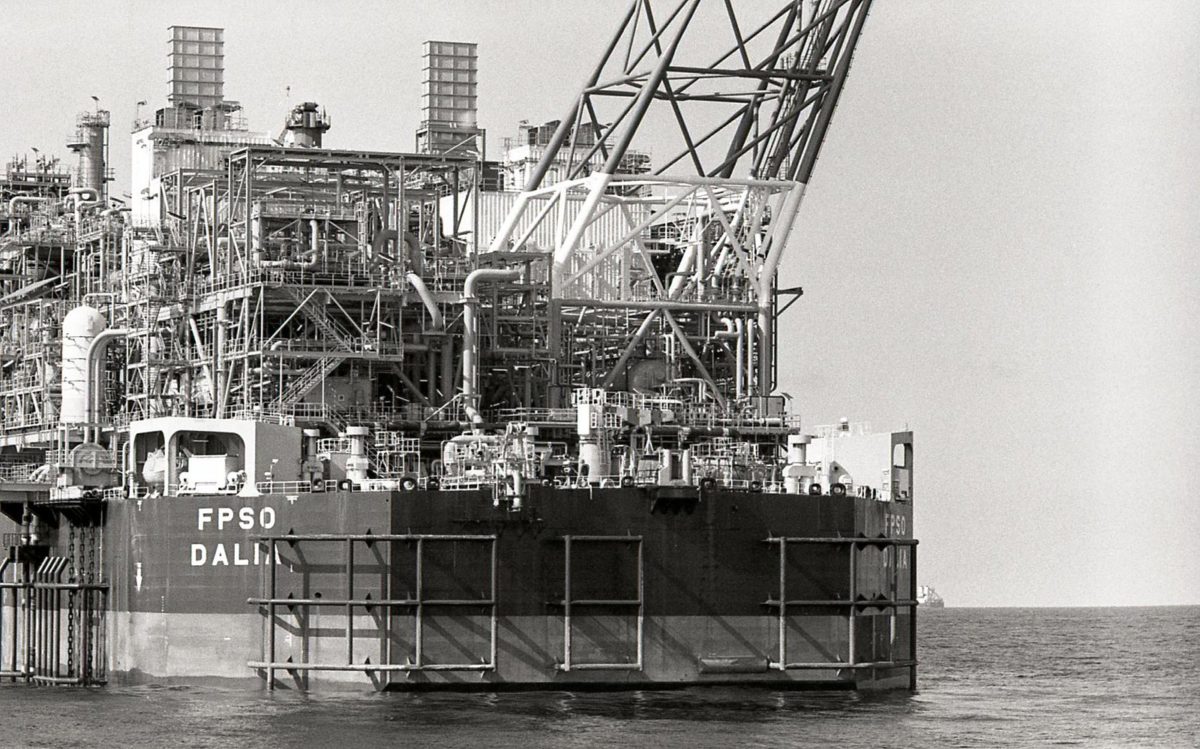

The more cynical observers will have noted, a commitment to reduce oil and gas production 40% over the next ten years will leave 60% of BP’s current fossil fuel portfolio still in operation. In fact, though the company will significantly shed its fossil fuel footprint, it is unclear what net benefit there will be for the planet, as the company explained it is “targeting $25 billion of divestment proceeds between the second half of 2020 and 2025.”

The prediction the remaining, still-fossil-fuel-focused portfolio of 2030 will be “more cost and carbon resilient” – there’s that new buzz word again – hints at deployment of CCUS technology but, far from planning to further wind down the assets, the company said it would be “investing in BP’s resilient hydrocarbons assets to maximize value and cashflow.” Furthermore, added the company, it would be “scaling BP’s presence and fuel sales in growth markets.”

The company’s commitment to reducing its fossil fuel portfolio is to be welcomed, even if it remains to be seen how much of the heralded investment ends up being invested in genuinely clean-energy projects. As ever with BP announcements, the devil is in the detail.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.