Solar module costs in the coming years will continue to fall, but at a much slower rate than in the past decade, according to research group Wood Mackenzie.

In its latest Solar PV Module Technology Market Report 2020, the company forecast that improvement in module efficiency and power class would instead propel the declining capex trend forward and ultimately lower the levelized cost of energy (LCOE) for solar.

Wood Mackenzie examined three technologies that have the potential to improve solar module power class and performance: large wafer, n-type cells and cell and module-level techniques.

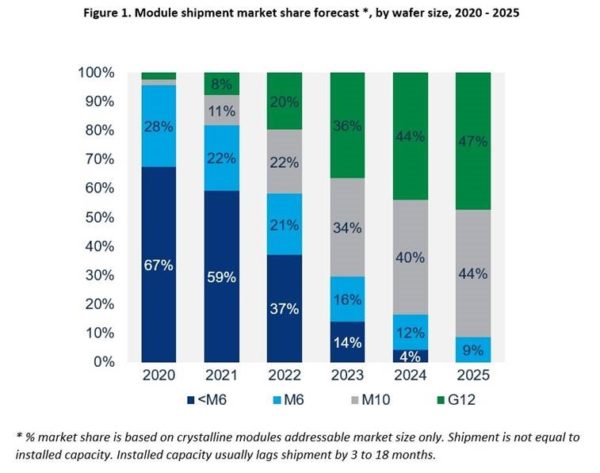

“We found that PV modules made of large wafers, such as the M6, M10, or G12 format, could reduce the capex of a utility scale solar project by 3% to 9%,” said Xiaojing Sun, the report's author.

Sun said the cost savings would appeal to solar developers and installers, which in turn would drive market adoption.

A majority of the major silicon module manufacturers have announced large module products, with many of them on track to commercially produce large modules between the fourth quarter of 2020 and the fourth quarter of 2021, she added.

The total module manufacturing capacity of M6, M10 and G12 wafer-based modules will reach 28 GW, 63 GW and 59 GW, respectively, by the end of 2021, according to the report. By 2025, the production capacity of modules using M10 and G12 wafers is forecast to exceed 90 GW, making them the dominant technologies by manufacturing capacity.

Popular content

“It is important to point out that the market adoption of large modules is dependent on the co-evolution of balance-of-system components such as inverters and trackers to accommodate the higher current and the larger size,” Sun pointed out.

“Multiple industry alliances have been formed since early 2020 to ensure the entire solar ecosystem evolves to support the adoption of large modules,” she added. “If the industry’s efforts bear fruit, we forecast that large module shipments in 2021 will account for approximately 40% of the total shipment of crystalline silicon modules. By the end of 2025, modules made with wafer sizes smaller than M6 will phase out of the market.”

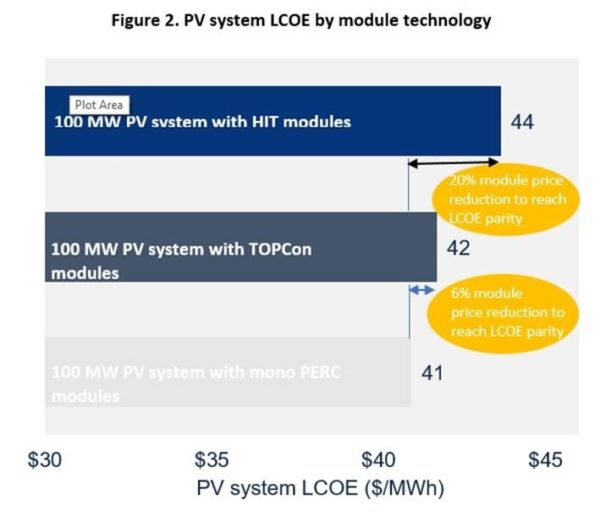

The report also examined n-type modules, such as HIT and TOPCon, that could generate more power per panel due to higher cell efficiencies and have lower degradation rates. “Unlike large modules, n-type modules do not currently yield system capex and LCOE savings in utility scale solar projects,” the study found, adding that the high product costs of n-type modules offset the system-level non-module cost savings.

“Our analysis shows that TOPCon and HIT modules will need a power class premium of at least 40 W and 90 W, respectively, or a 6% and 20% price cut in order to be competitive with mono PERC,” Sun said. “Admittedly, these are tall orders. Nevertheless, significant efficiency improvement and production cost reduction are n-type modules’ must-take path to succeed mono PERC as the next generation solar module of choice.”

The research suggests that the 2020s will see rapid solar module technology innovations, leading to significant increases in module power class, better performance and more versatile applications.

“Module technology innovations, in addition to hardware cost reduction, will be the quintessential driving force that propels the continuous reduction of solar LCOE in the new decade,” Sun added.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.