From pv magazine 09/2021

The United States maintained its position as the largest tracker market in 2020, with Brazil, Chile, China, and Spain making up the top five, and each recording significant year-on-year growth.

Growth of solar trackers is driven by the increasing demand from global economies for renewable energy, and the resulting rapid deployment of solar. Trackers further enable project developers in some markets to reduce the levelized cost of electricity (LCOE), enabling increased revenue potential while supporting success in competitive auctions and tenders.

The supplier landscape continued to be extremely competitive last year, with several suppliers shifting position, such as previously unranked FTC Solar entering the top 10. The top two suppliers, Nextracker and Array Technologies, maintained their ranking positions, but several other major players – including PVH, STI Norland and Gamechange Solar and – moved up the rankings as they gained market share in key solar tracker markets.

The United States saw the largest year-on-year increase for tracker shipments in 2020, boosted by trackers procured to meet safe harbor requirements prior to the expected step down of the Investment Tax Credit (ITC). As the expected ITC step down in 2021 has been extended to 2023, suppliers with a strong U.S. presence, such as Nextracker, Array Technologies, Gamechange Solar, FTC Solar and PVH, will continue to benefit from this policy.

Latin American markets such as Brazil, Chile and Mexico grew in 2020, with STI Norland taking the largest share of the Brazilian market, supporting its climb in this year’s ranking. Soltec increased its market share significantly in Chile, while the European market was dominated by PVH, supported by having the largest share of the Spanish market, which made up the majority of European tracker shipments. Middle Eastern markets were dominated by suppliers to large-scale solar PV projects, such as an 800 MW installation in Qatar awarded to Ideematec. African markets remain modest, but with significant growth expected over the coming years.

The Asia-Pacific market is split in two. Australia represents a strong market for U.S.-based suppliers, while other regions, such as China and India, remain heavily influenced by Chinese and other local suppliers, namely Arctech Solar. However, Western suppliers have made inroads into India and suppliers such as Gamechange Solar had a strong presence in the Indian market in 2020.

Despite these gains, multiple suppliers have dropped down the rankings, in large part due to loss of market share in key markets and a continued competitive landscape. Other suppliers, such as Solar Steel and Convert Italia, have been relegated from the 2020 rankings, but have made recent announcements that indicate strong potential for resurgence in 2021 and onwards.

Revenues rising

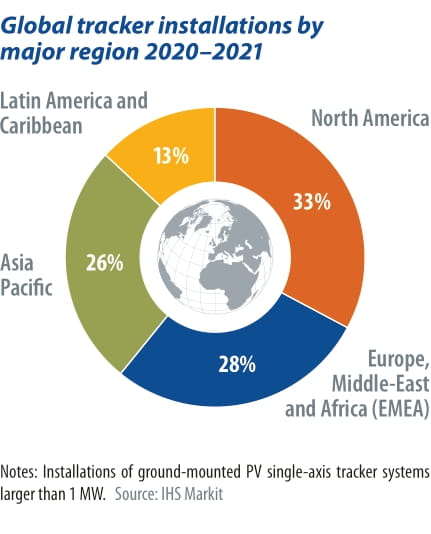

North America, mainly the United States, will remain the largest tracker region globally in the forecast period, but the Asia-Pacific region will move up to second for tracker installations, driven by the huge growth of PV installations in China and India over the forecast period. This growth is driven by significant government renewable energy targets, supported by increasingly competitive auction processes, which will push developers to seek lower LCOE.

Additional growth potential exists for global suppliers in both mainland China and India, as these markets are currently dominated by Arctech Solar. Other local suppliers exist in both markets, with Trinatracker and Nengyao (formerly Kingsun Solar) representing strong challengers in the Chinese market. Gamechange Solar recently announced an office in India, cementing itself as one of the only global suppliers present in the region and a definite contender in India.

Popular content

Steady tracker installation gains are expected across European, Middle Eastern and African markets through to 2025, driven by increasing solar PV installations, but installations in Latin America are expected to plateau toward the latter part of the forecast. Modest uptake of trackers will occur in European markets such as Greece, Italy, and Portugal, while significant growth is expected in South Africa, Saudi Arabia, and the United Arab Emirates. Other growth regions include North Africa, Oman, Qatar, Jordan, and Israel.

Product innovation

Despite these clear opportunities over the coming years, the top suppliers will be challenged to hold their positions as smaller suppliers continue to grow in emerging markets and increasingly compete in established markets. This shifting landscape is aided by ever changing PV developer demands and requirements, such as the need to push into regions with harsher terrain and climatic conditions.

While cost and performance will always remain key requirements for PV developers, tracker product reliability and adaptability are becoming increasingly important for developers as flat open land becomes increasingly scarce and costly. Tracker products will be chosen based on proven ability to operate under harsh weather conditions, such as high wind and snow loads, and suitability for installation on rugged or sloped terrain.

This effectively creates a window of opportunity for innovative suppliers to promote their specific product strengths against competitors, utilizing emerging tracker technologies such as two-in-portrait configurations, dual-row configurations, advanced control software, and features which increase stability under high winds, thus enabling them to gain a foothold across global markets over the coming years.

The development of artificial intelligence-based software, which enables increased energy yields through optimization of tracker operations, is proving to be a priority among tracker suppliers as a means to achieve a competitive advantage. Many suppliers, including Nextracker, Array Technologies, PV Hardware and Soltec, have been promoting the use of software to distinguish themselves from competitors and help developers and grid operators make solar a more predictable and reliable source of energy.

Jason Sheridan

| Top 10 global PV tracker supplier rankings in 2020 | ||

| Shipments (MWdc) 2020 | Company Name | Ranking change 2019-20 |

| 1 | NEXTracker | – |

| 2 | Array Technologies | – |

| 3 | PVH | h |

| 4 | Arctech Solar | – |

| 5 | STI Norland | h |

| 6 | Gamechange Solar | h |

| 7 | Soltec | i |

| 8 | Trinatracker | i |

| 9 | FTC Solar | h |

| 10 | Ideematec | i |

| Source: IHS Markit © 2021 IHS Markit | ||

About the author

Jason Sheridan is a senior research analyst in clean energy technology at IHS Markit. He focuses his research across both the wind and solar markets. Prior to joining IHS Markit, he gained multiple years of experience in the public and private energy sector while based in London. He has worked on topics ranging from residential solar energy and storage development to electricity network distribution policy and wholesale energy market abuse investigations. Sheridan holds a bachelor of science in environmental science and health from Dublin City University and a master of science in sustainable energy and green technology from University College Dublin.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.