From pv magazine 10/2021

China’s residential PV market has experienced a major boom since 2019, when a specific budget and fixed feed-in tariff incentive was announced, which also facilitated access to grid connection. In the last three years, a clear and strong financial model has triggered the emergence of an increasing number of prosumers who benefit from the program.

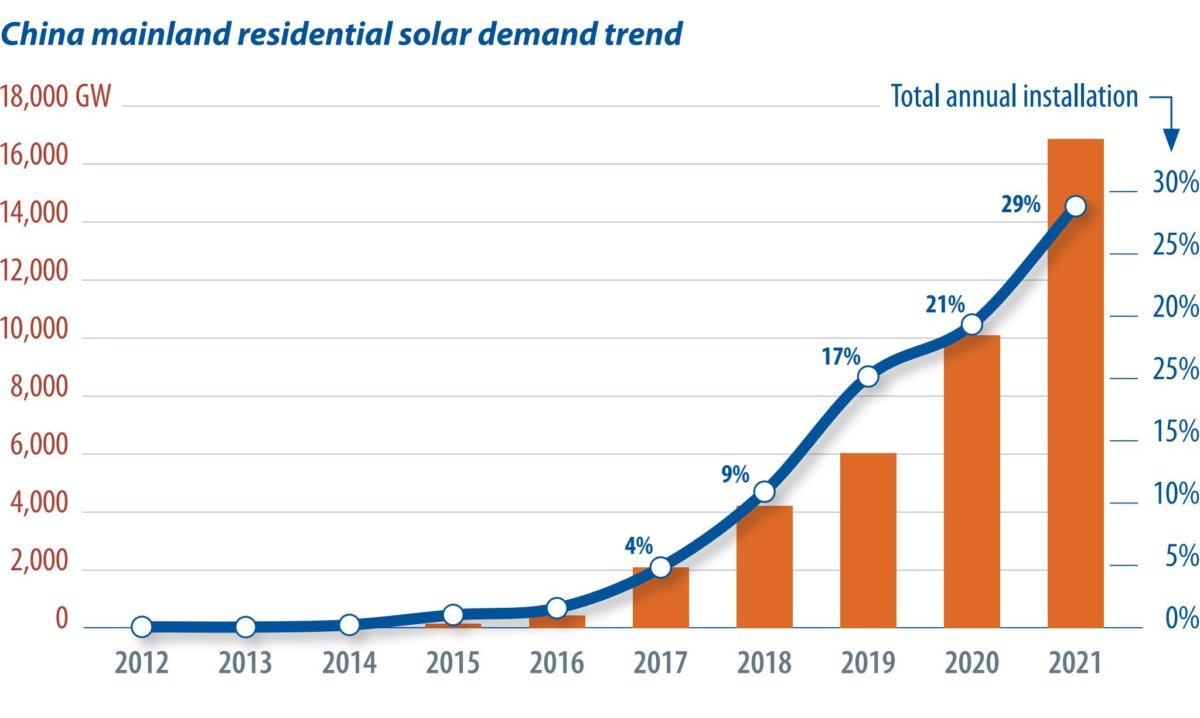

Residential demand was weak until 2016, but in 2017 several programs promoting distributed PV were announced, including a lack of quota limitations for residential installations and fixed budgets, awakening this sleeping giant.

In the first seven-months of 2021, China installed 7.66 GW of residential solar, with close to 1.8 GW installed in July alone. The market is taking advantage of the relatively generous and fixed budget of CNY 0.5 billion ($77.5 million) and a subsidy of CNY 0.03/kWh. Indeed, the residential market is the only segment that remains under any type of national-level subsidy program.

In this favorable environment, IHS Markit estimates residential demand will reach another record year, with nearly 17 GW installed in China by the end of this year and close to one-third of the total installations in China in 2021. The market share for residential installations has never been larger, as shown in the chart (bottom left).

Important differences

Compared to other regions, China’s residential segment has some unique attributes. The average size of residential installations is far greater than in other regions. The increase in the average size of residential installations is a global trend also present in other markets (e.g., the United States) but no other country gets close to the trend in China. The national average for residential installations grew from 10 kW/system in 2018 to 21 kW/system in 2020 to get the most of separated budget assignation and standalone subsidies. Higher module power that moved from an average of 350 W to more than 400 W in the same period has also helped to consolidate this trend and optimize rooftop space.

Installations are not evenly distributed across the country, but highly concentrated within three provinces. According to IHS Markit’s latest report, Shandong, Hebei, and Henan have accounted for nearly 75% of residential installs since 2019. The main drivers for the concentration of installations in these provinces are (i) higher solar resources than other provinces, with average solar irradiation around 1,250 hours/year; (ii) large rooftop space availability in rural areas and high density of rural residences, and (iii) local financial institutions supporting residential PV programs in these provinces, and (iv) relatively higher residential electricity prices.

Popular content

Finally, there are three major types of financing model in this segment, especially in the largest province, Shandong province. The first includes financial leasing, which is not the main model in Shandong, but quite favorable in Zhejiang and other eastern provinces. The latter includes 100% payment of the installation by the residential owner, which is the easiest and safest source of finance. However, the total capex of the system is the most important factor to consider. The third and preferred option, “mortgage loan,” is the most used in Shandong province, where local banks and residential developers will give service, with less (initial) downpayment from residents.

Residential outlook

The growth of the residential segment has been exponential since 2012. However, there is increasing uncertainty in the market about the future of residential solar in China once the current program is phased out next year, which means that the residential segment will also be included in the grid-parity umbrella, as is the current status of commercial and utility installations. Despite the elimination of the direct subsidy, IHS Markit forecasts this segment will continue having an important market share throughout the 14th five-year plan (2021-25) period. The main driver will be a new policy program to stimulate rooftop development in pilot counties, that was announced at the end of June.

The program states that at least 50% of party and government buildings in the pilot counties must have rooftop PV installations, as well as a minimum of 40% for other public buildings like hospitals, more than 30% for C&I buildings, and 20% for rural residences. In early September, the applied cities/countries list was announced by the National Energy Administration, with 676 places to develop residential and C&I segment solar systems on their roofs. With this policy scenario, IHS Markit projects residential installations will fall year on year in 2022 to quickly resume growth from 2023, with an increasingly diverse installation base across China.

About the author

Holly Hu, senior analyst at IHS Markit, is responsible for tracking and analyzing solar policies and markets in Asia, particularly China and Japan. She also provides in-depth coverage of the polysilicon-to-photovoltaic-module supply chain, with a focus on Chinese manufacturers. Before joining IHS Markit, Hu was the manager of the business development department at Trina Solar, where she provided market intelligence and analysis of industry rivals.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.