The latest statistics from Portugal's Directorate General for Energy and Geology (DGEG) show that the country added just 118 MW of new solar capacity in the first four months of 2023.

Despite a sluggish start to the year, new solar installations in Portugal may have gained momentum in May and June, mirroring the trend from the previous year. From January to April 2022, Portugal added only 111 MW, but in May, it saw an increase of 262 MW, bringing the total to 373 MW. In June, an additional 173 MW was installed, reaching a cumulative total of 546 MW. However, the second half of the year experienced slower growth, with only 344 MW of new additions.

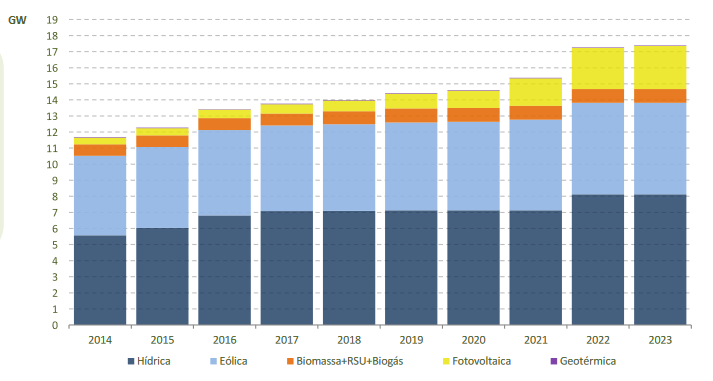

BloombergNEF predicts that Portugal's solar installations will reach 1,363 MW by the end of 2023, a substantial increase compared to last year's 890 MW and the current 118 MW of new capacity. The research provider estimates that Portugal will add 1,632 MW in 2024, 1,749 MW in 2025, and 1,741 MW in 2026. From 2030 onwards, BNEF projects relatively stable annual installations of around 1,745 MW.

The 2026 cut-off for increasing yearly installations is noteworthy: it is the commissioning deadline for the winners of the record-breaking Portuguese solar auctions from 2019 and 2020. That is if the deadline doesn’t get pushed back again. In February this year, Portugal introduced longer deadlines for several stages of these projects’ commissioning process. The country’s energy secretary Ana Fontoura Gouveia identified the global instability caused by Russia’s invasion of Ukraine as the culprit and warned further extensions could not be ruled out if the war continues.

The slow progress of the record-breaking solar auction projects, on the other hand, is likely a key culprit for Portugal’s lagging new capacity additions. From the 2019 auction, only seven out of 25 PV plants are in operation. No project from the 2020 auction has been commissioned so far. The 2019 auction allocated 1,150 MW of grid capacity, with the 2020 auction allocating 670 MW, totaling 1,820 MW across both auctions.

The French developer Akuo won a project with a solar tariff of €0.0147 ($0.014)/kWh at the 2019 auction. This marked a new world record at the time. In 2020, the record was broken again, with a winning bid of $0.0132/kWh.

In October 2022, the Portuguese government offered a remuneration boost to winners of these auctions, which had proved non-bankable amid rising inflation and equipment prices. The new law also introduced a 12-month extension of the period in which selected projects can sell electricity at spot market prices, instead of the awarded tariff.

It seems that these measures weren’t sufficient to convince auction winners to bring their projects online. Only 5% of the nominal power awarded at the 2019 and 2020 auctions was online by mid-March, according to data from Portugal’s Ministry of Environmental and Climate Action analyzed the by financial newspaper O Jornal Económico. Of these 92 MW being injected into the grid, Prodigy Orbit, owned by the Spanish Solaria, developed four projects with 49 MW of capacity. Iberdrola has two PV plants in operation, with 20 MW and 10 MW of capacity. Finally, Made Better, a subsidiary of the Portuguese Grupo Lusiaves, has a 13 MW installation connected to the grid.

The new deadlines for commissioning the projects from the 2019 auction are April 2024 and April 2025, depending on whether the projects require environmental approval. Solar projects that occupy surfaces of less than 100 hectares are exempt from environmental approval, excluding projects in protected areas. The deadlines for the 2020 auction projects are June 2025 and 2026.

The largest solar plants in the 2019 auction belong to the French of Akuo, with lots of 150 MW, 120 MW, and 100 MW. There are another three projects over 100 MW in size. In the 2020 auction, the largest plant went to Qcells with 109 MW. Spain’s Endesa and Iberdrola have projects with 99 MW and 69 MW, respectively.

If the country is to install 1,363 MW by the end of the year, as predicted by BNEF, a considerable share of the record-winning auction projects will have to go online, quickly.

The picture might look brighter in the years to come, with large-scale PPA and merchant projects scheduled to come online from 2024. Iberdrola and Prosalia, for example, have already secured an environmental permit from the Portuguese authorities to build a 1.2 GW solar plant in the municipality of Santiago de Cacém. It is expected to start commercial operations in 2025 and is set to become Europe's largest PV project.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.