Groningen-based Corre Energy has signed an agreement with Dutch energy supplier Eneco for offtake, co-development, and co-investment of a compressed air energy storage project in Ahaus, Germany.

The project is based on four salt caverns in the German state of North Rhine-Westphalia with a potential to host a 500 MW storage system. Eneco will operate, co-develop, and finance the project through its German subsidiary LichtBlick, one of Germany’s largest green energy suppliers. Cavern construction is already underway, with handover of the first two expected in early 2027.

Phase one of the Ahaus project will use two of the site’s existing salt caverns to deploy Corre Energy’s multiday CAES solution to deliver 220 MW of compression capacity and 320 MW of generation capacity. The project is expected to use equipment by Siemens Energy. “Our first phase scheme at Ahaus is targeting 320 MW of generating capacity and a duration of over three days,” Corre Energy's spokesperson tells pv magazine, adding that the company is not ready to “give a MWh figure at this stage.”

The agreement will see Eneco acquire a 50% interest in the project, at economics to be agreed, comprising both development capital and construction equity. “The agreement, which is subject to respective board approvals, significantly de-risks Corre Energy’s pathway to both commercial close and FID [final investment decision],” Corre Energy said.

“This landmark agreement combines offtake, development, and co-investment arrangements to propel our first German project while showcasing the latest demand for our CAES solution,” said Keith McGrane, CEO of Corre Energy.

The transaction represents Eneco’s second agreement with Corre Energy following its 15-year offtake agreement for the ZW1 project in the Netherlands, announced in December 2022.

“By locking in long-term investment partnerships such as in Germany, we are accelerating the commercial development of our portfolio underpinned by long-term offtake arrangements. These arrangements are repeatable across the portfolio and for each project can capture c€1bn of net revenue over the duration of a 15-year offtake agreement.” said McGrane.

Popular content

The partnership will enable Eneco to use the full capacity of the first phase of the project in Ahaus once delivered in 2027. At the moment, chemical company Solvay is still extracting salt from the caverns.

“We see a bright future for these storage solutions, and this second project with Corre Energy brings us closer to achieving the goals set out in our One Planet Plan: to be climate neutral in 2035, together with our customers,” said Kees-Jan Rameau, COO – Integrated Energy at Eneco.

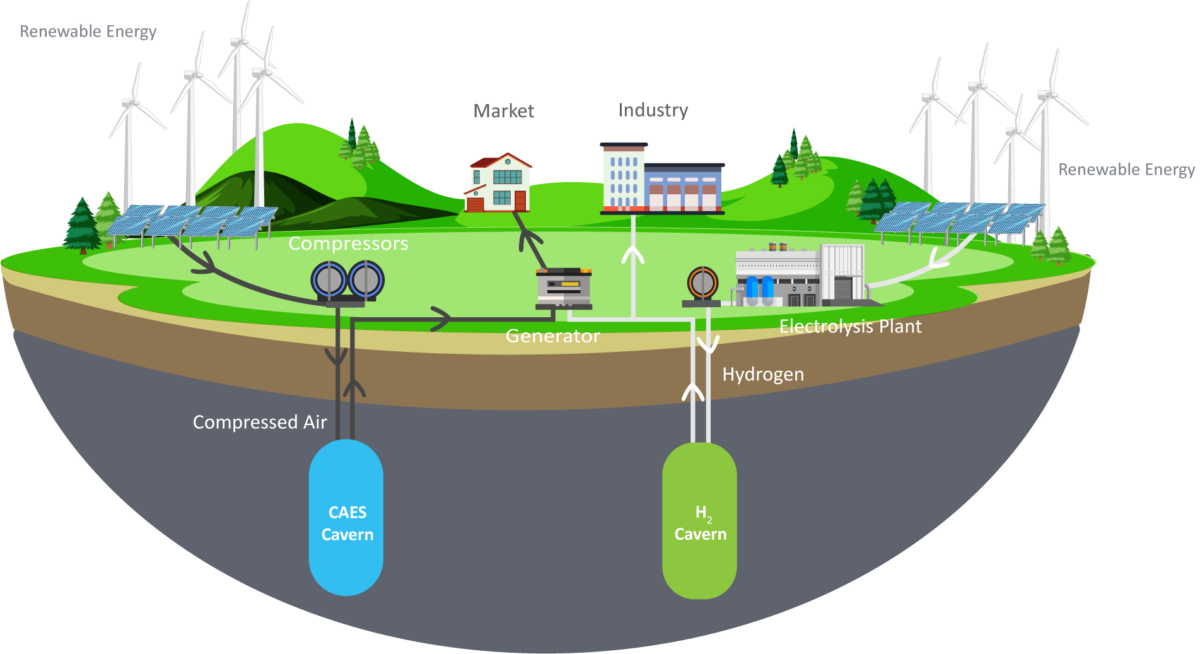

According to the project partners, the CAES site in Ahaus is well located between increasing offshore wind power production in the north and the significant power consumption regions to the south. It is close to the future national hydrogen backbone grid (H2-Startnetz) and will complement the regional establishment of an industrial scale renewables-based green hydrogen value chain.

The project represents the first CAES facility to be developed, constructed, and operated in Germany since 1978 when the 321 MW Huntorf plant was commissioned as the world's first CAES plant. In recent years alone, several large-scale projects have been announced in the United States, Israel, Canada, Australia and China.

However, there has been a significant limit to the adoption rate of CAES due to its reliance on underground formations for storage.

This article was amended on Jan. 31 to include the Corre spokesperson's comment.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.