In December 2023, the head of the Cyprus Energy Regulatory Authority (CERA), Andreas Poullikkas, presented an overview of the country’s energy mix at a local conference. The island’s electricity generation fleet comprised 1.5 GW of conventional facilities (mainly diesel and gas) and 776 MW of renewable energy plants. The country’s state-owned utility, the Electricity Authority of Cyprus (EAC), owns all conventional power stations while independent investors dominate renewables generation. Solar projects are by far the most widespread renewable energy technology in the country, with 606 MW of generation capacity. Wind and biomass sites come in at 157 MW and 13 MW, respectively.

Cyprus does not have a liberalized energy marketplace. In the retail market, the EAC enjoys an absolute monopoly. The wholesale electricity sector has opened up to independent power suppliers although they can only sell electricity to large consumers.

To date, there are six independent power suppliers on the island. All six operate solar plants, with portfolios that correspond to about 8% of electricity generated in the country. Interestingly, private suppliers sell electricity to large consumers about 10% cheaper than the EAC does.

Incentives

Installed solar capacity on the island is remunerated via various schemes including net metering (which credits household generators to the retail value of the electricity they export to the grid), net billing (which credits at the wholesale electricity rate), and feed-in tariffs (FITs). There is also a fleet of subsidy-free projects, first developed in 2017, when the government allowed 102 MW of new solar capacity to operate under an “avoidance cost” regime. The avoidance cost paid to such generators equals the amount of money the EAC saves by not paying fossil fuel power plants to generate because the electricity has been covered by renewables.

Today, most of the solar parks developed under the cost avoidance regime have abandoned those payments and instead sell electricity independently on the market. That is because, since May 2023, CERA has capped the amount of avoidance cost payments at €0.11 ($0.12)/kWh. Generators can sell their electricity at higher prices via private suppliers.

Apart from the avoidance cost regime, the government has also allowed an additional number of PV projects to be built under private power purchase agreements (PPAs), leading to a separate portfolio of around 150 MW of installed solar capacity. In total, Cyprus has around 250 MW of installed solar operating under PPAs.

Solar plan

In October 2023, CERA issued permission for the EAC to build 600 MW of new solar capacity by 2032. This allows for the incumbent utility to build a fixed amount of PV each year, starting from 30 MW in 2023 and reaching the 600 MW total in 2032.

CERA has also communicated the EAC’s plan to the European Commission for approval and while that has not yet been granted, the utility has published an open call to landowners to propose land for renewable energy projects until a deadline June 1, 2024.

Solar installations in Cyprus by support mechanism

| Support scheme | Capacity in MW, Dec. 2023 |

|---|---|

| Net metering and net billing | 244 |

| FIT (set by government) | 77 |

| FIT (set via tender) | 35 |

| Avoidance cost | 101.5 |

| PPA | 148.5 |

Fanos Karantonis, chairman of the Association of Renewable Enterprises Cyprus and a leading solar investor, told pv magazine that the renewables association opposes CERA’s decision. Karantonis is of the opinion that the EAC’s plan will kill competition in the energy market right at a time when the Cypriot wholesale market is attempting to liberalize.

Karantonis notes that, in May 2022, CERA published a preliminary decision arguing that it could not allow the EAC to enter renewables because the country’s energy market was very concentrated. The situation is no different today, said Karantonis, and the EAC continues to dominate the energy market.

The rationale behind CERA’s decision, published in October 2023, was that it has granted licenses to around 1.9 GW of renewable energy plants and there will, therefore, be sufficient competition in the market by the time the EAC’s portfolio of 600 MW becomes operational.

Karantonis rejects this argument. “The way the regulator presents the case is misleading,” he said. “The network is highly congested and it is clear to anyone that not even 10% of the 1.9 GW of licensed projects can be built by 2032. Moreover, there is no guarantee that all of the projects licensed by the regulator will receive environmental permits.”

Karantonis rejects this argument. “The way the regulator presents the case is misleading,” he said. “The network is highly congested and it is clear to anyone that not even 10% of the 1.9 GW of licensed projects can be built by 2032. Moreover, there is no guarantee that all of the projects licensed by the regulator will receive environmental permits.”

The renewables industry representative said that independent investors have “fought hard” over the past six years to license projects, find suitable land, and connect their 250 MW of projects, either developed under PPA or via the avoidance cost mechanism. “It is utter imagination that Cyprus can add 500 MW to 1,000 MW in the following five years,” he said.

An argument often circulating in public discourse is that allowing the EAC to own a renewable energy portfolio would reduce wholesale electricity prices. Karantonis counters that the best way to reduce wholesale prices is by boosting competition and tackling the nation’s pressing curtailment issue.

“The EAC has, already, access to about 500 MW of renewable energy generation in the country, including solar, wind, and biomass projects,” he said. That is because all renewable energy generation sites, apart from the PPA projects, sell electricity to the EAC.

Popular content

“Consider, for example, the FIT projects,” added Karantonis. “Renewable power investors sell electricity to the EAC but the EAC only pays one part of the feed-in tariff, which equals the avoidance cost. The remaining amount of the tariff is paid by the country’s renewable energies fund, which is in turn funded by electricity consumers.”

Karantonis crunched the numbers. With the avoidance cost set at €0.11/kWh, the EAC pays only that amount. It sells the electricity on the wholesale market at €0.21/kWh.

Curtailment crisis

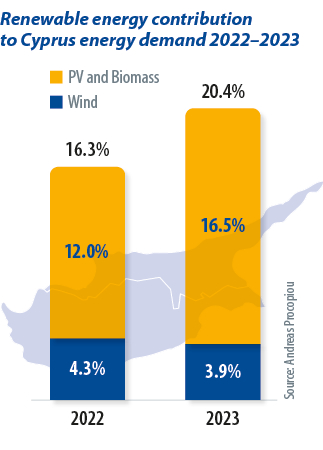

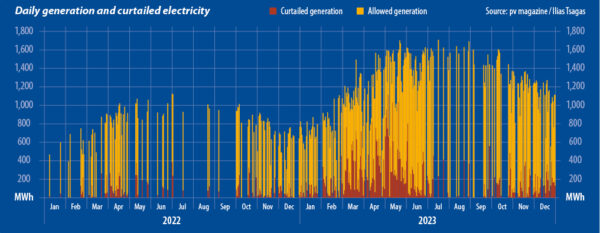

Private solar generators say that curtailment of renewable electricity remains a major problem. Cypriot renewable energy expert Andreas Procopiou noted the island’s PV generation capacity grew by an impressive 51% in 2023. However, the full value of that capacity increase was not echoed by a significant rise in the technology’s contribution to the island’s energy consumption.

According to Procopiou’s data, PV power contributed 16.5% of Cyprus’s total demand in 2023, only 4.5% more than in the previous year. “The discrepancy in the growth rate of installed capacity versus the increase in PV energy contribution underscores a critical issue: curtailments impacting renewable energy production,” said the analyst. “The average daily curtailment, which was at 3.3% in 2022, sharply escalated to 13.4% in 2023. Particularly concerning was April, which recorded the highest average daily curtailment, of 32.23%.”

Such a sharp increase in energy curtailment is affecting wholesale prices too, added Karantonis. Generators are not compensated for curtailed power and are therefore unwilling to sell the electricity they produce to private power suppliers at lower prices.

Energy storage

Cyprus is in urgent need of energy storage. In mid-2023, the nation’s Ministry of Energy, Commerce and Industry published a draft plan presenting policies to support the installation of household and business, “behind-the-meter” energy storage facilities.

The draft calls for the remuneration of clean energy and energy storage sites – and hybrid projects, featuring both – in two main ways. Firstly, existing renewables plants will be offered a capital expenditure (capex) subsidy for the purchase and installation of energy storage units. Secondly, new hybrid plants will be able to claim both capex and contract-for-difference (CfD) support. Under CfD regimes, renewable energy generators receive a fixed power export rate minus the day-ahead hourly wholesale price of electricity as a bonus on top of any payments they receive separately from the commercial sale of the power they generate. When the wholesale price is higher than the power export rate, generators refund the difference.

Both the capex support and power export rate would be set using competitive bidding among generators. The ministry’s proposal, though, came with limited detail: only new hybrid plants that are willing to export power to the EAC would be allowed to claim the subsidies. In other words, the government would offer state aid only to projects that collaborate with the incumbent utility and would neglect private wholesale electricity suppliers.

Karantonis claims this is a breach of European state-aid laws. He said that the Association of Renewable Enterprises Cyprus presented this opinion to the European Commission’s directorate-general for competition in November 2023. The government’s attempt to undermine competition in the electricity market, and to exclude independent project owners, does not stop there, he added.

Other measures, according to Karantonis, include efforts to allow Cypriot transmission and distribution electricity operators to own grid-side, “front-of-meter” energy storage assets, in breach of European Union regulations.

“We believe both the government’s draft plan for behind-the-meter energy storage as well as the recent European decision on the Cypriot network operators owning front-of-meter storage will kill competition in our country’s wholesale electricity [market],” said Karantonis.

All European Union member states have committed to reforming their domestic electricity markets in line with the bloc’s Target Model in an effort to align national marketplaces in preparation for incorporation into a single market. Cyprus has also committed to adopting the Target Model with the Cypriot transmission system operator (TSO) assigned to perform the role of market operator.

Yet, a decade after its initial commitment, Cyprus has not independently staffed its TSO, which is reportedly filled mainly by EAC personnel. Under European law, the TSO and the distribution system operator (DSO) should be separate entities, independent from the national utility. Critics say that in Cyprus, the line separating the incumbent energy company’s power supply business from the DSO is blurred.

Island economies have often been trailblazers in the adoption of renewable energy, changing perceptions about how electricity systems and marketplaces can operate with high penetration levels of clean energy. Cyprus has much to gain from the accelerated adoption of solar, energy storage, and market liberalization. The fact that incumbents retain considerable power, however, is proving effective in delaying adoption.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.