Both hydrogen batteries and lithium-ion batteries have been identified as promising stationary energy storage solutions for integration with rooftop solar systems. However, while lithium-ion batteries have been widely installed by both homes and businesses, hydrogen batteries only started to take off in 2021 with the world's first commercial deployments by Australia-based startup LAVO.

Both technologies have their pros and cons. Hydrogen batteries have around 40% lower roundtrip efficiencies than lithium-ion ones, translating into more energy losses that could impact grid imports and cost of electricity in meeting energy demand. On the other hand, hydrogen batteries have less capacity degradation and higher energy density than lithium-ion ones. This allows them to store more energy for a longer duration, which could have an impact on the self-sufficiency and payback periods of the rooftop solar systems.

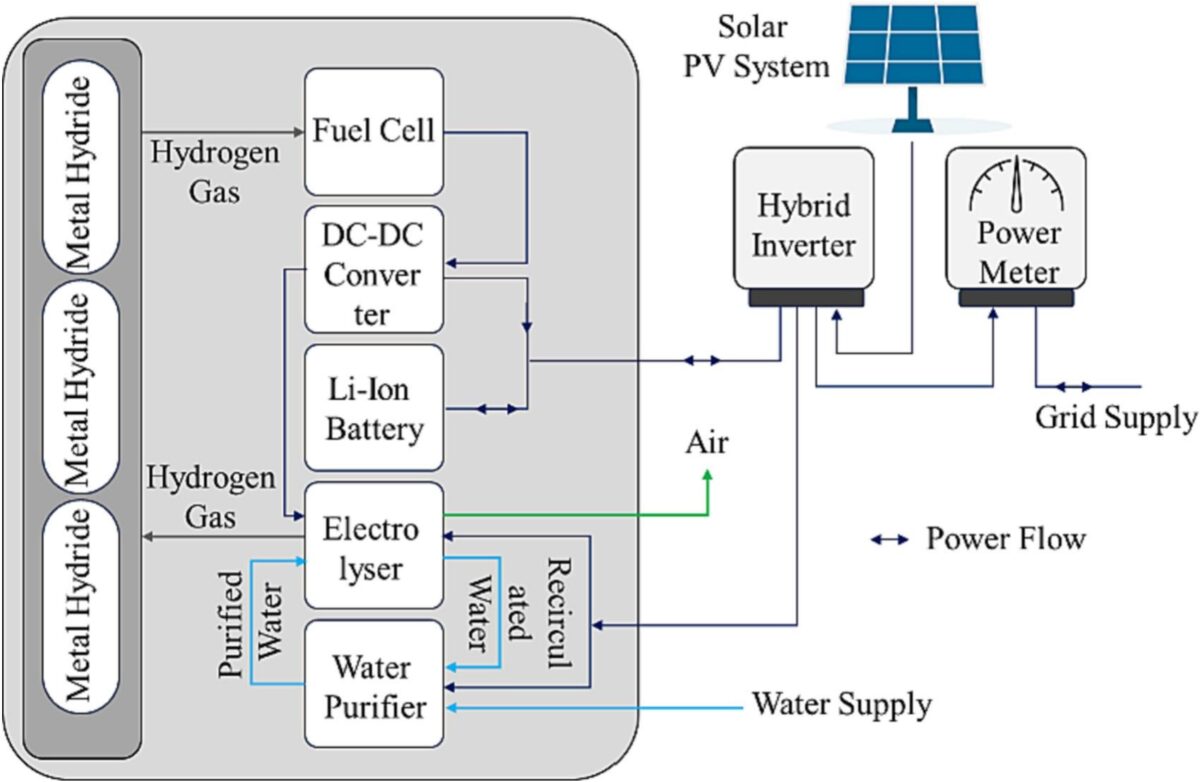

Addressing a knowledge gap on the technical and financial performance of hydrogen batteries, researchers at the University of New South Wales (UNSW) in Australia have modeled the operation of a commercial hydrogen battery coupled with a rooftop PV system, using Time of Use (ToU) and solar feed-in tariffs, and compared the performance with a commercial lithium-ion battery under a solar and arbitrage scheme.

They evaluated the performances of the 13.5 kWh commercially available batteries – LAVO and Tesla Powerwall 2 – and an operational 4.5 kW rooftop PV system under six different scenarios. Their model considered battery aging and performance degradation, with results suggesting that both hydrogen and lithium-ion batteries can reduce grid dependency and lower electricity costs by minimizing grid imports.

The researchers found that the lithium-ion battery outperforms the hydrogen battery in better capacity utilization due to lower roundtrip energy losses. “The lithium-ion battery generates higher net income, achieving a payback period 9 years earlier in the arbitrage scheme and 1 year in the solar scheme compared to the hydrogen battery,” the researchers reported, explaining that, under the solar scheme, the batteries are charged and discharged following the electricity demand and availability of the rooftop PV generation.

The hydrogen battery consumed more energy than the lithium-ion battery in arbitrage and under the solar scheme, which resulted in consumers paying more to energy retailers to operate hydrogen batteries in rooftop solar PV systems. Furthermore, less income was generated under the ToU and solar feed-in tariffs using a hydrogen battery as compared to a lithium-ion battery, which contributed toward a longer payback period for the hydrogen battery.

However, the researchers also found that the hydrogen battery demonstrates a longer lifespan, enduring 18% more charge-discharge cycles than the lithium-ion battery. “This makes the hydrogen battery suitable for remote applications requiring extended duration of energy storage,” the researchers said. However, with water required to generate hydrogen, hydrogen batteries are not suitable for areas that experience water shortages.

“Therefore, the choice of optimal battery system for rooftop PV system depends on the availability of water resource, weather extremes and the trade-off between the preference for greater financial profit or extended battery cycle life,” the researchers say, noting that the solar scheme is the best choice for both types of batteries in a residential setting to generate maximum financial profit.

Their results were discussed in the paper “Assessment of hydrogen and lithium-ion batteries in rooftop solar PV systems,” published in the Journal of Energy Storage.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Hydrogen batteries are better for renewability and impact on environment. Batteries are more expensive to renew than mining and availability of Lithium is limited. Hydrogen is virtually unlimited.