From pv magazine print edition 3/24

In a disused mine-site cavern in the Australian outback, a 200 MW/1,600 MWh compressed air energy storage project is being developed by Canadian company Hydrostor. The facility came about after a deal struck with local electricity network operator Transgrid, which had gone to market looking for storage solutions to improve reliability in the famed frontier town of Broken Hill.

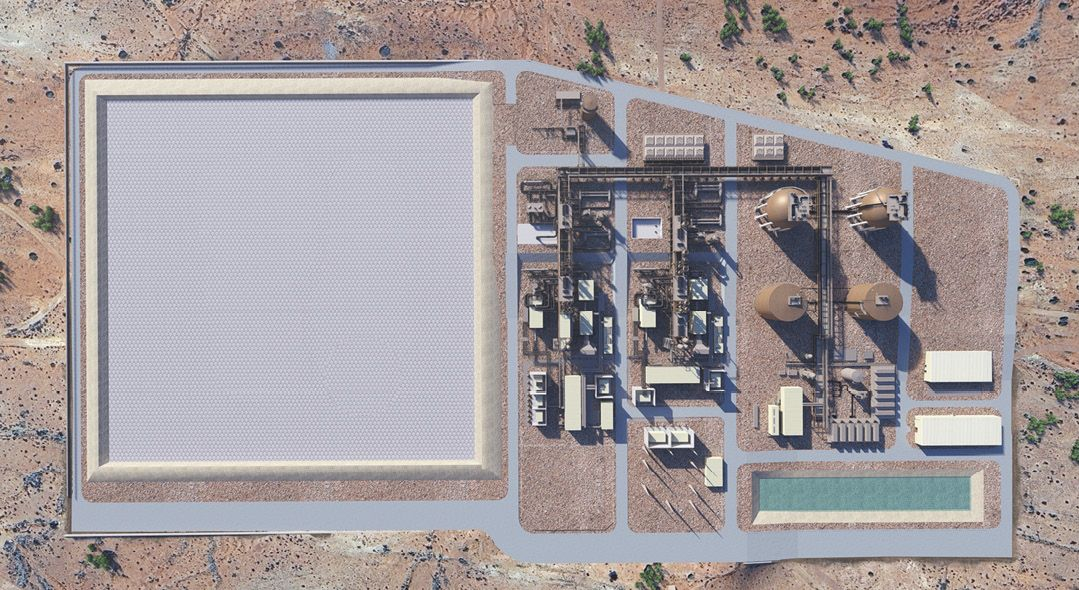

Dubbed the Silver City Energy Storage Centre, it will be Hydrostor’s first large-scale compressed air plant and will be one of the first “adiabatic” systems in the Western world, if successfully brought online by its expected 2027 date. Adiabatic CAES systems involve a thermal energy, or heat, storage component, in effect meaning they do not require the fossil fuels which have historically been used in such systems.

Silver City’s compressed air will be stored 600 metres below ground, with a project area of less than 40 hectares and a life expectancy of 50 years, as Hydrostor Australia vice president of origination and development, Martin Becker, told pv magazine.

Since compressed air batteries use turbines, the plant will also provide system strength and inertia to the electricity grid. Its grid services will be far more consistent than the synthetic inertia offered by big batteries, Becker added, since lithium batteries degrade with cycling and therefore can only act as virtual synchronous machines for a few hours per day. Hydrostor expects to reach a final investment decision on Silver City this year.

Proven technology

CAES today sits at a curious nexus. On the one hand, the technological components and individual systems that go into these large infrastructure projects are proven and have been used in industry for decades, sometimes centuries.

Only a handful of compressed air plants have ever made it into commercial operation, however. A 321 MW plant has been running in Huntorf, Germany, since 1978 and, since 1991, a 110 MW plant has operated in McIntosh, Alabama, in the United States. Both of those projects are diabatic – meaning they do not store heat and so use fossil fuels in their processes. Adiabatic compressed air systems are a far more recent phenomenon. Hydrostor opened the first commercial adiabatic plant in 2019, in Goderich, Ontario, in Canada, but the project has a peak power output of just 1.75 MW.

In the years since, China has gone big on CAES, bringing multiple systems online, including a 100 MW plant in Hebei province in 2022. Work began in the same year on a 350 MW/1.4 GWh plant in Shandong and many more projects are in the works.

For Australian agency the Commonwealth Scientific and Industrial Research Organisation (CSIRO), compressed air is one of the most promising deep storage technologies, largely because of its comparatively low cost, long asset life, and relative flexibility. While costs are highly project dependent, a 2021 paper by David Evans et al., published in Applied Sciences noted CAES costs could be as low as $3/kWh to $6/kWh.

“The per-unit cost goes down the bigger it gets, which isn’t true for batteries,” said Ben Clennell, a senior principal research scientist at CSIRO. CAES, said Clennell, “is cost competitive and if it’s also competitive in terms of being able to get projects up and running, and the geological locations are suitable … it could play a large role [in energy storage]. We’re one gigaproject away from having a project that is actually demonstrating this technology in the Western world.”

Compressed air

Compressed air batteries pressurize atmospheric air, storing energy in the form of potential energy, like a spring. To discharge, the air is released via an expander, to spin a turbine. Systems have two core components: the above-ground plant, with its turbomachinery, and the below ground storage void – which can take numerous forms.

There are three different types of compressed air storage systems: diabatic, adiabatic, and isothermal. An isothermal process is a thermodynamic process in which the temperature of a system remains constant, typically when a system is in contact with an outside thermal reservoir. A change in the system occurs slowly enough to enable the system to be continuously adjusted to the temperature of the reservoir, through heat exchange. Such designs reduce energy loss but there is a dearth of operational projects. Adiabatic systems are becoming the industry focus, although Corre Energy and others are now pursuing hydrogen-ready diabatic systems.

Efficiencies between the types differ, with diabatic systems generally offering 50% to 55%, and potentially 60%. CSIRO’s Clennell says round-trip efficiency for adiabatic CAES systems with top-tier technology is somewhere around 70%. “It’s pretty well established what those numbers are,” he said. “There are no bits we don’t understand, it’s just an engineering problem to get the best efficiency possible, really, without having an enormous amount of overbuild on the expense of the components. It’s unrealistic to go above around 75%, I think.”

Options

There are many ways for adiabatic systems to store the heat resulting from the compression of air and companies are pursuing a range of techniques.

“We’ve tried different approaches but we’ve actually landed on the simplest approach because it’s so bankable,” said Hydrostor President and Chief Operating Officer Jon Norman.

The company has opted to simply store heat in the form of pressurized water within insulated spherical tanks. That and every other aspect of Hydrostor’s system is designed around existing industrial kit.

Popular content

“We are more a systems integrator with IP [intellectual property] on how we are integrating the system, rather than a new technology provider,” said Norman.

That approach also holds true for another burgeoning player in the European market, Corre Energy.

“There’s dozens of examples of failures in compressed air but it’s always associated with this issue of letting the perfect be the enemy of the good,” said Norman, noting the failed CAES pilots and projects that have dotted recent decades have tended to involve re-engineered supply chains and project locations that overlooked grid demand and constraints. Funding has also been a factor.

Hydrostatic compensation

Gleaned from the hydrocarbon storage industry, Hydrostor’s systems also involve hydrostatic compensation, a water component to help them overcome air pressure anomalies within caverns – a key stumbling block for CAES.

This water reservoir sits above ground and is connected to the underground air storage cavern via two shafts. When the compressed air battery is “empty,” the cavern is filled with water. As the system charges, the compressed air moves into the cavern displacing the water.

“When you want to generate, you release the valve on the surface, the water rushes down the shaft and pushes the air back out,” Becker said. “It’s like a piston.”

The amount of water required in Hydrostor’s systems is 1/20th that needed by a pumped hydro plant of similar capacity, according to Becker. For the Silver City project in Broken Hill, he expects around 350,000 megaliters will be needed. Water is a touchy subject in Australia, so Becker is quick to note the process of air compression itself creates condensation – water that will then be captured and fed back into Silver City’s reservoir in a cycle.

The hydrostatic compensation component, Norman said, is what enables Hydrostor’s projects to remain “bankable” even when they don’t rely on pre-existing caverns. While its Broken Hill project will repurpose an existing mine cavern, the company is also developing a much larger, 500 MW/4 GWh project in California. Willow Rock, as it is known, will involve digging out a greenfield cavity. “At the 500 MW scale, building out that subsurface cavity is about a third of the capital cost,” Norman said.

Geology

The fact that CAES relies on underground caverns, making it geology dependent, has been another major hurdle to widespread development. A 2022 Thermo paper by Rabi, Radulovic, and Buick, of the University of Portsmouth, in the United Kingdom, noted several projects have failed “as a result of geologic constraints.” The drama surrounding Australia’s largest pumped hydro scheme, Snowy 2.0, illustrates marrying engineering machinery and geology can prove deceptively tricky.

Hydrostor is trying to get around this by opting for hard rock as its preferred medium, largely because of its abundance. Hard rock is not the only material suitable for storing compressed air, with salt caverns and other porous rock also holding potential. For instance, projects could also be located in spent gas fields or greenfield aquifers, said CSIRO’s Clennell.

Salt caverns are more abundant in Europe than Australia and are the preferred medium for Netherlands-based Corre Energy. It is exclusively pursuing brownfield sites and is now developing two 320 MW projects, in Germany and the Netherlands. Both will have 84-hour energy storage duration – around 26 GWh, according to Patrick McClughan, Corre Energy’s chief strategy officer. “Salt caverns being the chosen medium at the majority of our sites to store at scale, of course, gives a huge range of optionality because of the duration they offer,” said McClughan.

Corre Energy is collaborating with German engineering giant Siemens, designing systems around the latter’s equipment. “We’ve been working with Siemens a long time,” said McClughan. “It gives Corre Energy this framework to supply a standardized and scalable multi-day solution … [and] it really optimizes our delivery time frame.”

Due to Siemens’ involvement with the operational CAES plant in Huntorf, among others, McClughan said there is no need for Corre Energy to pilot its project designs. In January, the company signed an agreement with Dutch utility Eneco – co-owned by Mitsubishi – for the offtake, co-development, and co-investment of its German project. The deal will see Eneco acquire a 50% stake. “This is the first time a major European utility has provided such a deep commitment,” McClughan said, highlighting the confidence the contract illustrates for CAES.

Corre Energy wants both projects shovel-ready by 2025. It is anticipating 18-month construction periods and hopes to have the plants operational by 2027.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I need to get access to this technology owner of CAES… how it’s be possible