From pv magazine India

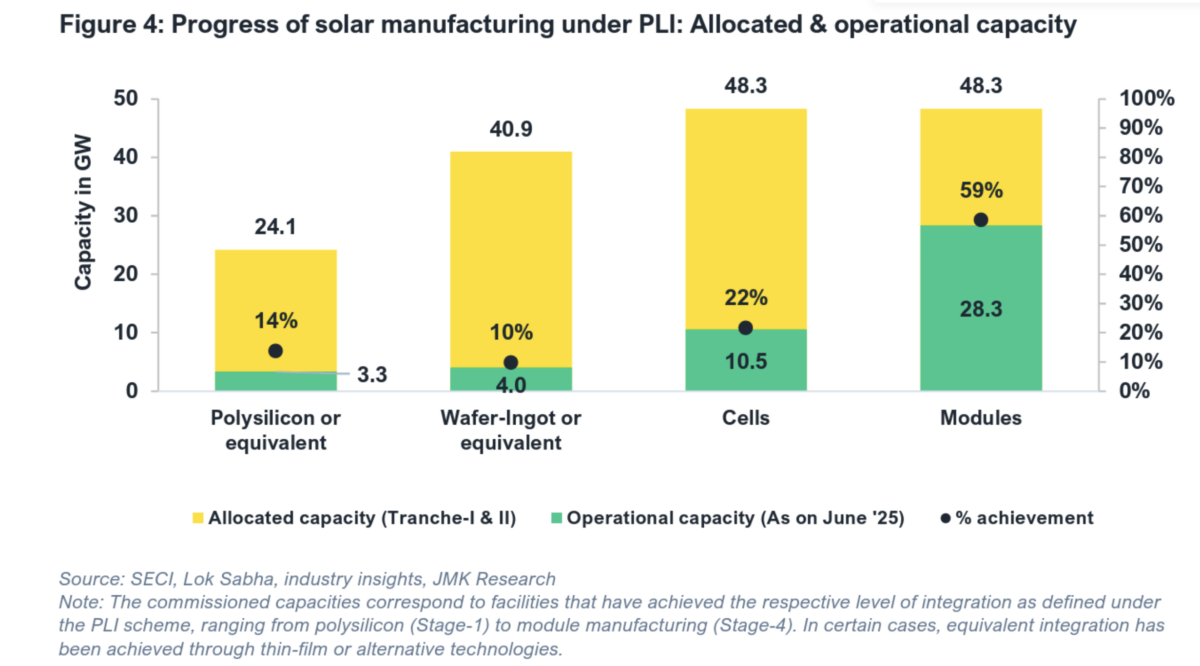

The solar PLI scheme continues to draw strong interest from India’s PV manufacturers, but delivery remains uneven as operational capacity lags awarded commitments. The overall achievement rate stood at roughly 29% of awarded capacity as of June 2025, with only 59% of module capacity and 14% of polysilicon capacity realized.

A report from JMK Research and the Institute for Energy Economics and Financial Analysis says the PLI framework has laid the foundations for domestic PV manufacturing but still faces significant operational and policy constraints.

“The scheme channels government support towards measurable industrial output, helping build durable, long-term manufacturing capacity,” said Vibhuti Garg, director for IEEFA South Asia and a contributing author.

India’s PV manufacturing base reached 3.3 GW polysilicon, 5.3 GW wafer, 29 GW cell, and 120 GW module capacity as of June 2025. The PLI scheme contributed all installed polysilicon or equivalent output, about 75% of wafer capacity, 36% of cell capacity, and 24% of module capacity, underscoring stronger progress upstream than downstream.

Implementation challenges continue to weigh on developers.

“However, the PLI scheme for solar PV manufacturing faces implementation challenges like high capital intensity of upstream integration, inadequate incentives, inconsistencies in trade policy, import dependency, and global raw material price volatility,” said Prabhakar Sharma, senior consultant at JMK Research and one of the report’s authors.

Policy asymmetries have added uncertainty for manufacturers. Unrestricted imports of polysilicon and wafers alongside module restrictions under the Approved List of Models and Manufacturers, as well as frequent ALMM revisions, have complicated investment planning. The requirement for fully integrated wafer-to-module lines increases upfront capital needs, while incentives cover only a fraction of production costs.

“India’s reliance on imported machinery, components, and Chinese technical expertise has further slowed capacity ramp-up, a situation worsened by visa restrictions and limited equipment availability,” said Chirag H. Tewani, senior research associate at JMK Research and a co-author.

Global price volatility – particularly in polysilicon and wafers – and China’s upstream dominance continue to expose Indian manufacturers to cost instability. Limited domestic polysilicon scale also constrains cost competitiveness and slows progress toward a resilient, integrated supply chain.

PLI non-compliance carries significant financial risk for awardees. JMK Research estimates that across both tranches, companies face up to INR 41,834 crore ($4.80 billion) in combined exposure from bank-guarantee encashment, lost incentives, and unrealized revenue.

The report argues that the scheme’s trajectory depends on structural reforms rather than deadline extensions. “Future PLI iterations should focus on improving cost competitiveness, upstream integration and market resilience,” said Aman Gupta, research associate at JMK Research and an author of the report. Recommended measures include tax credits, lower-cost financing, buffers against global price swings, layered incentives, longer policy horizons to support full value-chain participation, and targeted support for critical components.

The emerging 50% U.S. tariff on Indian solar exports adds to the pressure, creating a more complex environment that will require coordinated policy execution and alignment of incentives with manufacturing timelines to maintain momentum in domestic PV manufacturing.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.