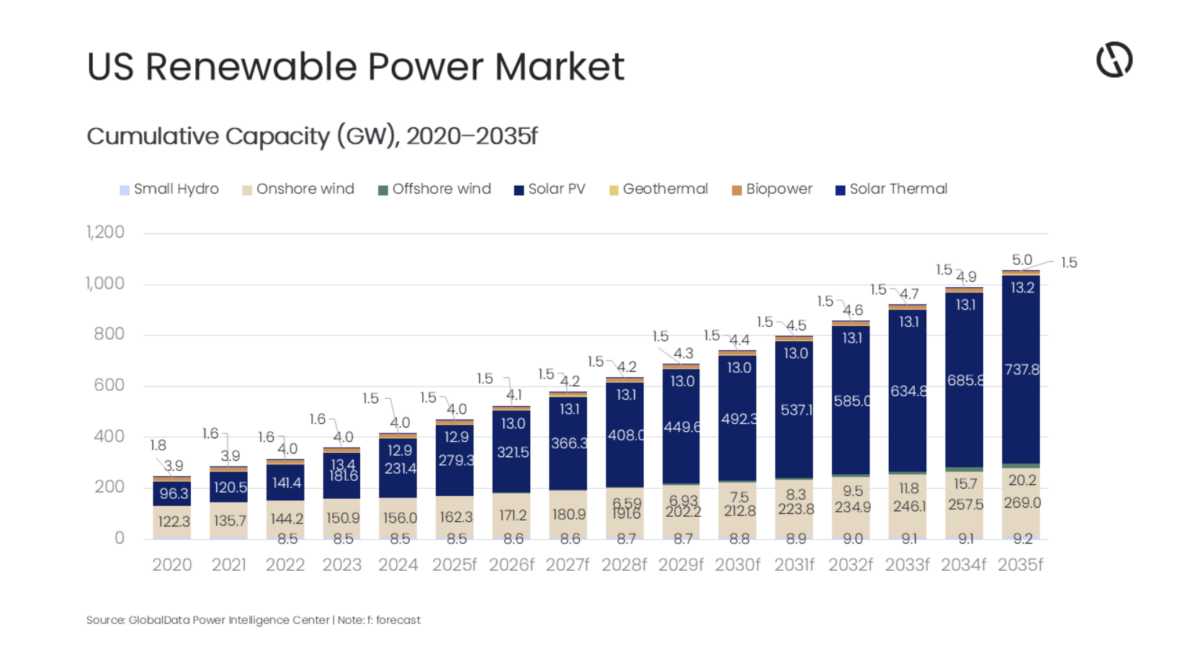

The U.S. is on track to deploy 737.8 GW of solar by the end of 2035, according to analysis by London-based consultancy firm GlobalData.

GlobalData says the U.S will add 47.9 GW of solar in 2025, slightly below the record 49 GW deployed in 2024.

The annual deployment rate is then expected to slow, with GlobalData projecting 42.2 GW of added solar in 2026, 44.8 GW in 2027, 41.7 GW in 2028 and 41.6 GW in 2029. At the end of the decade, the U.S. cumulative solar capacity is on course to stand at 449.6 GW.

Annual deployments are forecast to begin increasing in the early 2030s, with GlobalData projecting 42.7 GW of new solar in 2030, 44.8 GW in 2031, 47.9 GW in 2032 and 49.8 GW in 2033. The U.S. is then expected to surpass the 50 GW threshold in 2034 and 2035, with annual deployments of 51 GW and 52 GW, leading to 737.8 GW by the end of 2035.

Total renewables capacity in the U.S. is set to reach 1.06 TW by 2035, GlobalData’s analysis adds, more than doubling from the 414.5 GW recorded at the end of 2024.

The consultancy’s analysis says solar deployment over the next ten years will be driven by state procurement targets, distributed generation policies, net billing and net metering frameworks, and large-scale utility contracting across key markets such as Texas, California and the Midwest.

However, trade and tariff measures introduced in 2025 have added cost pressure and uncertainty for renewables reliant on imported components, while higher input costs have slowed project timelines, increased capital requirements and contributed to delays and cancellations.

Mohammed Ziauddin, power analyst at GlobalData, said despite policy shifts and tariff-related cost pressures, renewable energy remains the primary driver of capacity growth in the U.S. power sector through to 2035.

Ziauddin added that between 2025 and 2030, renewable investment is expected to reach around $442.2 billion, which he said reflects the scale of ongoing solar and wind development across key regional markets.

“Solar and wind continue to expand at scale, supported by state policies and private sector demand, while gas and nuclear investments address capacity adequacy and longer-term system needs,” Ziauddin concluded. “Together, these trends are reshaping the U.S. electricity system into a more diversified and resilient market over the long term.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.