Africa installed approximately 4.5 GW of solar last year, according to the Global Solar Council’s (GSC) “Africa Market Outlook 2026-2029.”

The report says 2025 saw the continent’s fastest year for solar growth to date, outperforming GSC’s medium-term deployment forecast set last year. Growth was driven by rising electricity demand, grid constraints, higher tariffs and falling electricity costs, the report adds, with deployments increasing in both utility-scale projects funded mainly by public and development finance and rapidly-expanding privately financed rooftop and distributed systems.

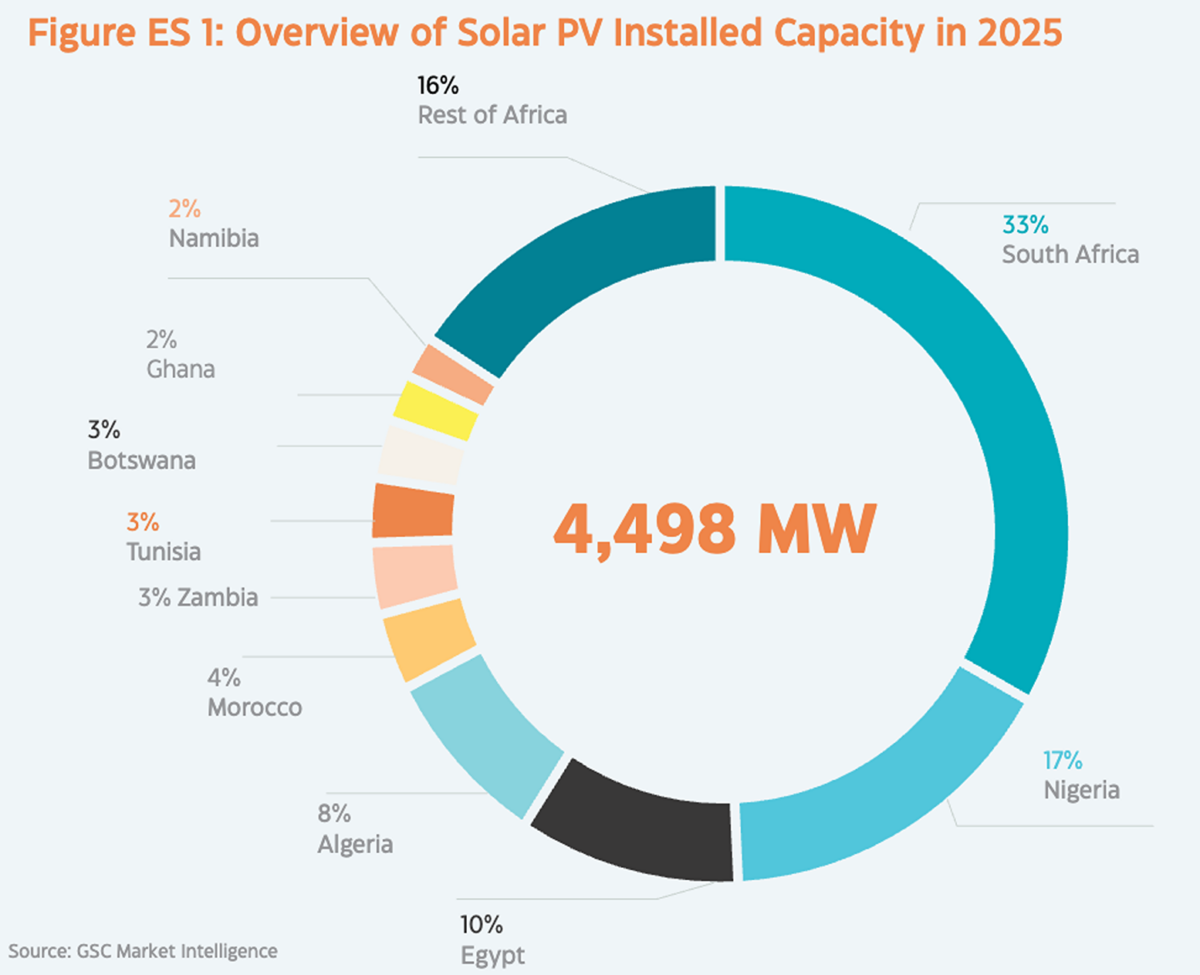

Data from the report says Africa’s top ten solar markets accounted for around 90% of new solar last year, led by South Africa, with 1.6 GW, and followed by Nigeria (803 MW), Egypt (500 MW) and Algeria (400 MW).

Morocco, Zambia, Tunisia and Botswana also added more than 100 MW of solar each in 2025, meaning four more countries added over 100 MW of solar last year than in 2024. Ghana and Chad round out the top ten for added solar last year, with 92 MW and 86 MW respectively.

Utility-scale solar accounted for 56% of installed capacity in 2025 but GSC’s report says the remaining 44% from distributed sources is “clearly underestimated.” It explains that the quantity of solar panels imported to the continent far exceeds that which can be absorbed by utility-scale projects alone.

“Utility-scale projects, on average, in the past years have covered 15 % of these imports, thus largely exceeding what can be explained by these projects alone, pointing to rapid and less accurately reported growth in distributed, commercial, and rooftop solar,” the report says. The analysis follows the Africa Solar Industry Association’s solar market outlook, published last month, which said Africa’s cumulative solar capacity could be over 63 GW due to the number of solar module imports from China.

GSC’s medium-term outlook forecasts Africa could install over 31.5 GW of solar capacity by 2029, with distributed and utility-scale markets expected to continue their expansion in parallel across an increase number of countries.

But the report also warns that finance has become “the binding constraint of scaling solar” in Africa, with access to capital remaining fragmented and misaligned with distributed markets, with public and development finance remaining the dominant financier of green energy projects on the continent. GSC says that while private clean energy investment in Africa is increasing, it remains poorly suited to distributed solar which requires smaller ticket sizes, shorter tenors, and local currency financing.

“While the opportunity is clear, financing costs in Africa remain three to five times higher than in developed markets, suppressing otherwise viable projects,” the report says. “Financing both grid-scale and distributed solar in parallel is therefore critical to accelerating access, improving resilience, and anchoring solar in Africa’s economic transformation.”

Reducing the cost of capital through risk recalibration and regulatory stability is one of GSC’s key policy recommendations for Africa’s solar market. The report says governments and development partners should work with credit agencies to better assess sector-specific risks and implement stable and transparent regulations. It adds that clear rules for licensing, tariffs and contracts will lower investor risk, rescue financing costs and make projects more bankable.

Other recommendations include streamlining of permitting and licensing, particularly for C&I and distributed solar, improving grid planning transparency, stabilizing tariff frameworks and strengthening skills development and local manufacturing.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The very significant portion of real growth for solar in Africa is likely to be on the scale of balcony solar or “balckonkraftwerk” . The true capacity and production of electrical power data may not be captured accurately going forward in the next few years..