From pv magazine 03/2022

PV veterans will remember with a heavy heart the relatively recent decimation of the continent’s manufacturing landscape, after Asian competitors outpriced and out supplied their European peers at eyewatering speed. However, as Europe remains one of the largest solar markets globally, deployment levels continue to ramp up, and sustainability issues come to the fore, calls for meaningful domestic manufacturing capacity to be re-erected have become increasingly loud over the past few years, and it appears that in 2022 they may begin to be answered.

The SolarPower Europe (SPE) trade group is one of many organizations determined to re-establish a homegrown solar manufacturing landscape. In a recent op-ed on pv-magazine.com, CEO Walburga Hemetsberger stated that the association envisions 20GW of PV production in Europe by 2025, covering the entire value chain, from polysilicon to modules. “This is the objective we set for the European Solar Initiative, an industrial alliance we launched in February this year [2021], which facilitates the redevelopment of industrial projects in Europe,” she wrote. As she pointed out, however, manufacturers must establish gigawatt-scale fabs to be cost competitive.

State of play

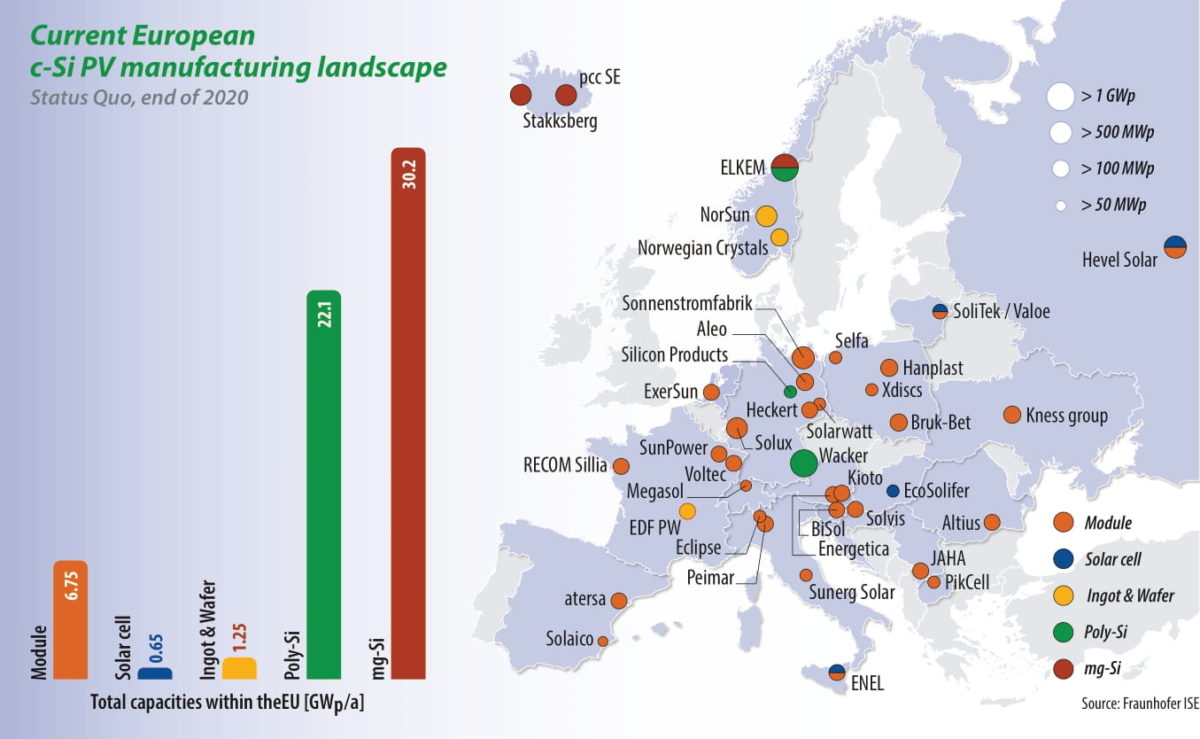

In July 2021, German research body the Fraunhofer Institute of Solar Energy Systems (ISE) released its “Photovoltaics Report,” which details the current state of European crystalline silicon PV manufacturing, as of the end of 2020. Looking at the map, while solar-grade polysilicon production capacity is relatively well established, the rest of the supply chain has a way to go if it is to achieve a meaningful share.

Indeed, according to the chart, Europe had 22.1GW of polysilicon production capacity in operation, but just 1.25GW of solar wafer production capacity, 650MW of solar cell capacity, and 6.75GW of solar module production capacity.

Last April, the European Solar Manufacturing Council (ESMC), an association of European manufacturers and research institutes, said that at least 75% of PV demand in Europe should be covered by domestic production, while two-thirds of PV products produced in Europe should be exported.

This would mean building up 60GW of manufacturing capacity on the continent by 2026 – three times what SPE is calling for. The current trade deficit of €10.5 billion ($11.8 billion) in solar cells and modules could be converted into around €50 billion of PV production on the continent, said the council, which would create around 178,000 new jobs in Europe.

Decarbonize Europe - Green light to new avenues for solar and storage

Of the €723.8 billion the European Union wants to provide through its post-pandemic reconstruction program – the Recovery and Resilience Facility (RRF) – the ESMC says that €20 billion should be used to shore up the European PV industry. In a report issued in late December, it wrote that “to benefit from the support of the RRF, EU member states must submit recovery and resilience plans (RRPs), with the reforms and investments to be implemented by the end of 2026 … In ESMCs RRP evaluation effort, a total of €477 million have been identified as direct support for PV manufacturing. They consist of both loans and grants to establish or strengthen the PV value chain in Italy, Romania, and Croatia.”

Italy is said to hold the largest direct RRP support for solar PV manufacturing, with €400 million dedicated to help reach the national target of 2GW annual manufacturing capacity by December 2025, said ESMC, while in Romania, €50 million has been allocated to develop 200MW of PV production capacity, and in Croatia, €26.5 million has been dedicated to the development of environmentally friendly production processes, including PV manufacturing.

Ramping up

Some significant steps were made in 2021 to ramp volumes up, predominantly in Germany, with Switzerland-based Meyer Burger Technology AG opening a 400MW module and a 400MW cell factory at two separate locations in Germany last March for its heterojunction products. Following financing in July 2021 to accelerate its production capacities, this year is expected to be a “ramp-up year” with plans to increase its annual European cell production to 1.4GW and module production to 1GW by the end of 2022.

The UK’s Oxford PV also completed the build-out of its 100MW Brandenburg fab for its crystalline silicon heterojunction/perovskite tandem PV cells last July. It too expects the line to start full production in 2022 and CEO Frank P. Averdung told pv magazine at the time that it is in the “final stages” of a funding round that will allow the company to expand beyond the initial 100MW line up to gigawatt scale. “We hope we will be able to communicate the closure of the funding very soon,” he said.

Meanwhile, in a recently announced partnership, Sonnenstromfabrik (CS Wismar GmbH) is expanding its 200MW module manufacturing operations in Wismar with the addition of a new 300MW line. The German company will use REC Group’s award-winning and patented half-cut cell and twin module and junction box design for the manufacture of two new PERC module products utlizing large format wafers.

And on the wafer front, another German company, Fraunhofer ISE spinoff NexWafe GmbH – which manufactures high-efficiency monocrystalline silicon kerfless wafers – is gearing up to start commercial production this year, following an injection of €32 million in 2021, €25 million of which came from Indian conglomerate Reliance Industries Limited. In addition to manufacturing in Germany, Reliance will be granted access to NexWafe’s patented technology to utilize in its planned gigawatt manufacturing facility in India.

While there are many plans taking place in Germany, Italy is also a hot spot for PV manufacturing, as the EMSC mentioned. Last November, renewable energy company and PV module manufacturer Enel Green Power (EGP), a unit of Italian power utility Enel, secured an undisclosed sum from the European Union to scale up its 200MW heterojunction cell and module factory in Catania to 3GW.

Speaking to pv magazine this January, new EGP CEO Salvatore Bernabei said the company is “planning to start the works for the enlargement of the factory soon. We will add a new building close to the existing one.” The factory is expected to begin manufacturing activities by the end of 2023 and to reach full capacity by mid-2024.

A month later, Enel announced that Italian engineering company Comal is planning a 1GW solar tracker manufacturing fab in the power company’s Montalto di Castro power plant in Italy. The new factory – “Tracker Sun Hunter” – will see Comal manufacture trackers across an area of over 30,000 square meters inside Enel’s plant which is no longer used for energy generation.

In France, REC Group said in November 2020 that it is planning to build a 4GW PV module factory in the northwestern region of Moselle. Work was expected to commence this year; however, delays have seen this pushed back. In a statement released in June 2021, the company said, “REC Solar France teams and partners remain mobilized and are working hand in hand to bring the project to a successful conclusion as soon as possible.”

According to the initial announcement, everything will be done on-site including the production of cells, assembly of modules, quality control, receipt of raw materials and shipment of finished products.

Sustainable path

As mentioned in the February edition of pv magazine (pp.74-77), Europe is also on a mission to establish itself as a key manufacturing base for batteries to support both the growth of electric vehicles and stationary storage projects. Over the past six years, ambitious plans have been announced to achieve this goal, with the latest predictions suggesting that 35 gigafactories will be operational by 2035.

One of the key priorities is to build a sustainable manufacturing industry. This is also vital for the solar value chain and something that is being taken seriously. As pv magazine said in the third quarter of 2020, as part of the UP Initiative’s Circular Manufacturing quarterly theme, the creation of a circular PV economy is an EU priority under its proposed Green Deal.

For example, the Circusol project, which stands for Circular Business Models, is an Innovation Action project funded by the European Commission’s Horizon 2020 program. It seeks not only to unearth new business opportunities, like solar as a service, but also to look at the redesign and recyclability of solar products, among other issues. A part of this consortium has seen Lithuanian module maker SoliTek investigate barriers and opportunities related to solar module circularity, to propose alternative design options. pv magazine will publish the results of this investigation during the second quarter.

Stating that now is the time to reinvest in the European manufacturing industry and take advantage of the TW-scale opportunities ahead, Germany’s Fraunhofer ISE established the Green Manufacturing Consortium in 2019. It is a German publicly funded project, comprising 20 industrial partners, four institutes and two industry associations, including First Solar, Meyer Burger, Total, Wacker, VDMA, Oxford PV, and Von Ardenne.

The objective is to develop an “economic-ecological evaluation methodology for a sustainable future factory for the production of innovative PV modules,” Jochen Rentsch, said head of the department production technology division photovoltaics at Fraunhofer ISE, in 2020.

The overarching goal of the project is to develop an economic-ecological evaluation methodology for a sustainable future factory – 10GW in size and easily scalable beyond that – to produce innovative PV modules. “Via a comprehensive energy and material flow model of scaled and vertically integrated PV fabs we will simulate changes in production capacity, factory layout, supply systems, production facilities and processes as well as recycling of materials through recycling processes and other value-added stages,” explained Rentsch.

At the time, Fraunhofer ISE Director Andreas Bett said reestablishing a European PV manufacturing market represents a “big opportunity” to ensure energy security by reducing dependency on imports, lowering costs, and addressing sustainability. “Why transport large and heavy PV modules the long distance from Asia and cause CO2 emissions and added cost? For example, module costs of €0.20/W can be soon realized, and transport costs from China to Europe can be up to €0.025/W,” he wrote.

Sustainability is also a key priority for both REC Group and Sonnenstromfabrik. Indeed, talking about the recently announced partnership, managing director of the latter, Bernhard Weilharter, said that producing low-carbon products is a central aim for the company. The journey started in 2016 when Sonnenstromfabrik began supplying the French market with certified low carbon modules. It now completes life cycle assessments for all its products, and in some markets it also secures an Eco Passport to back its environmental credentials.

Meanwhile, REC Group not only produces its wafers in Norway using hydro energy, but it also focuses on upcycling kerf via a “unique new kerf processing technology” – during the standard wafer slicing process, around 30% of the silicon remains as waste, or kerf – to reuse it in cells and modules, said Agnieszka Schulze head of global PR at REC Solar EMEA GmbH. It further produces “polysilicon with the lowest carbon footprint,” she added.

Decarbonization plans

After a period of stagnation, the European PV industry is again stepping onto the world manufacturing stage. Thus, pv magazine will spend the second quarter looking at the companies acting to establish PV fabs, particularly those which are doing so in a sustainable manner.

In addition to revisiting the circular manufacturing projects highlighted in the third quarter of 2020, we will be looking at the challenges European manufacturers face, the advantages of producing Made in Europe solar products, and what needs to be done to convince political leaders and other decision-makers to jump on board.

pv magazine sees this transition as being crucial if Europe is to achieve its decarbonization plans in a sustainable way. This will therefore be a topic that will be addressed via the UP Initiative, but also at its virtual Roundtables Europe event on June 28 and 29. For more information, contact up@pv-magazine.com.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.