US proposes 10% tariffs on inverters, AC modules, non-lithium batteries from China

As the trade war escalates, PV inverters, solar panels with attached microinverters and battery storage products other than those which utilize lithium-ion chemistry, may be the latest victims.

EPFL Scientists develop 25.2% efficient perovskite/silicon tandem cell

Researchers from the École Polytechnique Fédérale de Lausanne (EPFL) in Switzerland have developed a process for depositing a perovskite layer onto a silicon solar cell, which it says has already resulted in the creation of a 25.2% efficient tandem cell.

China’s Chint investigates US solar manufacturing

The company is planning pilot U.S. inverter assembly in Texas, while it scouts for manufacturing locations in the U.S. Midwest.

JA Solar secures $68 million loan for equipment at 1.5 GW Vietnam wafer fab

Chinese manufacturer, JA Solar has secured a long-term buyer credit loan facility worth US$68.4 million for the procurement of equipment for its 1.5 GW wafer facility in Vietnam.

Solar corporate funding rises 15% YoY with $5.3 billion in H1 2018 – Mercom

Despite the uncertainty caused by U.S. solar panel import tariffs, deteriorating trade relations between the U.S. and China, and the looming consequences of China’s PV policy change, the solar industry saw a 15% YoY increase in corporate funding in the first half of 2018, on the back of a Q2 rebound, finds the latest Mercom Capital report.

Q4 could be a ‘hot market’ for solar contract negotiations following China’s changes – BNEF Q&A

In a Q&A with Bloomberg NEF (BNEF), two solar analysts tell pv magazine they see no PV module price rebound, continuing oversupply, and falling utilization rates. They expect Q4 could be a “hot market” for contract negotiations, while Chinese developers will start overseas construction earlier than planned for two key reasons.

China’s CATL to invest €240 million in Europe’s first battery cell fab

The Chinese battery manufacturer has said it will establish a fab in Germany’s Thüringen with an annual capacity of 14 GWh. The battery cells will be primarily produced for the electric vehicle (EV) industry. Up to 600 jobs are expected to be created. In related news, BMW has entered a €4 billion long-term partnership with CATL.

Global EV market growing sturdily despite trade dispute setbacks

EnergyTrend recognizes recent tariffs developments will hit the electric vehicle (EV) industry. Despite this, environmental regulations, as well as costs and technological advancement, will prevail and continue to drive EV sales globally.

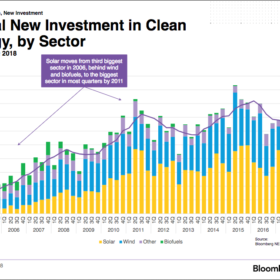

Global solar investment drops due to low project costs, China policy change

While overall global investment in clean energy saw a decrease of just 1% YoY in the first half of 2018, solar’s share dropped 19% following changes to China’s PV policy and lower project costs, says Bloomberg NEF (BNEF). It forecasts this trend to continue throughout the year.

Lower module pricing will bolster PV deployment in India

More than 80% of India’s solar equipment requirements are met through imports from China. Against this backdrop, industry analysts see the predicted 30% lower module pricing, following China’s revised policy, as a good news for Indian PV projects.