India to replace thermal power with renewables under existing PPAs

Indian generators and distribution companies will evenly split the gains achieved by bundling cheaper renewable energy with high-cost thermal sources.

The Hydrogen Stream: Toyota and Kawasaki want to develop hydrogen engine

Kawasaki Heavy Industries and Yamaha Motor revealed plans to develop hydrogen engines for two-wheeled and other vehicles. Meanwhile, France-based Hyvia has announced two new prototypes of hydrogen-powered light commercial vehicles, Germany’s ThyssenKrupp is considering listing its hydrogen business in an initial public offering (IPO), and Potruguese utility EDP said it wants to invest in 1.5 GW of renewable hydrogen by 2030.

Solar module prices will stay high until 2023, IHS Markit says

IHS Markit predicts that global installed solar PV capacity will grow by 20% to over 200 GW in 2022, despite a difficult cost environment. PV system costs are expected to resume their downward trend from 2023, when more polysilicon capacities will come into operation.

Giant floating solar under development in Laos

EDF is planning to build a 240 MW floating PV project at Laos’ largest hydropower dam. French engineering company Innosea has joined the ambitious project as a provider of support for wave and anchoring studies.

Indian government expands budget for PV manufacturing scheme

The Indian authorities have announced plans to provide more funding to help more manufacturers under its production-linked incentives scheme, which is designed to support gigawatt-scale manufacturing of high-efficiency solar modules.

France’s tender for utility scale solar concludes with final average price of $0.06475/kWh

The procurement exercise’s final average price is 3% lower than that of the previous tender of the same kind. Around 636 MW of PV capacity was allocated by the French authorities.

US solar market in flux

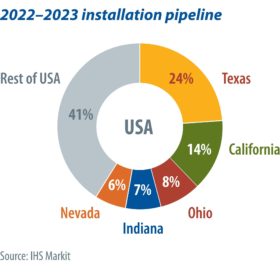

Next year will set new records for the U.S. solar market, with 30.4 GW of installations expected. The utility-scale PV pipeline in 2022 is nearly 50% greater than 2021 and 2023, due to the combined effects of pandemic-related supply chain impacts, the solar Investment Tax Credit schedule, and other module procurement challenges. Over the next two years, solar installations will be concentrated in Texas, California, Ohio, Indiana, and Nevada, with large portions of the pipeline being developed by a few key players in each state. IHS Markit’s Eric Wright takes a closer look.

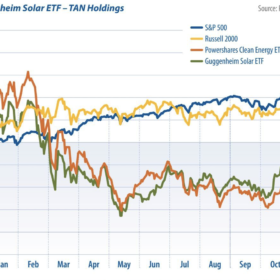

Guggenheim Solar Index: Solar pricing throughout the whole upstream chain is rising

As of October 22, 2021, the overall solar stock market posted strong performance, with the Invesco Solar ETF leading the pack.

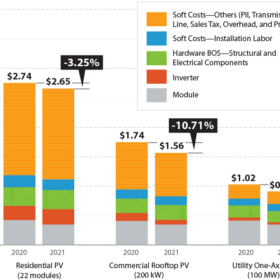

Costs falling for all PV systems in US market, says NREL

The U.S. National Renewable Energy Laboratory says in a new report that costs for all types of PV systems continue to fall, although it notes that balance-of-systems costs have increased or remained flat across sectors this year.

Planned $54m float could drive first slice of Philippines mega solar project

Developer Solar Philippines is preparing to issue up to 2.7 billion shares, for an estimated $0.02 per share, in the project company which will develop its 500 MW-plus Peñaranda project on Luzon.